28 Aug, 2023 12:17

Eurozone recession likely as business activity slows – S&P

- HCOB’s flash Composite Purchasing Managers’ Index (PMI) for the bloc, a measure reflecting manufacturing and services activity, slumped to its lowest level since November 2020 to 47.0, from 48.6 in July.

Both manufacturing and services reported falling output and new orders.

- Activity in the EU’s key services industry slumped for the first time this year and plunged to a 30-month low, data shows.

- Output in the Eurozone has been shrinking for three consecutive months, led by a fifth successive monthly decline in manufacturing, data shows.

- New orders for goods continued to fall at one of the sharpest rates since the global financial crisis, accompanied by a second month of deteriorating demand for services,” S&P said.

Concerns are mounting that GDP in the euro area will be falling in the third quarter as the bloc’s economy slipped deeper into decline in August.

“Another weak PMI for the Eurozone confirms a sluggish economy with recession as a downside risk. Inflation pressures for services remain stubborn as wage pressures continue to be a concern,” Bert Colijn, senior economist at ING, said.

Hiring nearly stalled in the bloc as companies grew reluctant to expand capacity in the face of deteriorating demand and gloomier prospects for the year ahead, the report said.

For more stories on economy & finance visit RT's business section

__________________________________________________________________

NEWS RELEASE

MARKET SENSITIVE INFORMATION

Embargoed until 1000 CEST (0800 UTC) 23 August 2023

HCOB Flash Eurozone PMI® Flash

PMI signals steepening downturn in August, price gauges tick higher

Key findings: HCOB Flash Eurozone Composite PMI Output Index(1) at 47.0 (July: 48.6). 33-month low. HCOB Flash Eurozone Services PMI Business Activity Index(2) at 48.3 (July: 50.9). 30-month low. HCOB Flash Eurozone Manufacturing PMI Output Index(4) at 43.7 (July: 42.7). 2-month high. HCOB Flash Eurozone Manufacturing PMI(3) at 43.7 (July: 42.7). 3-month high.

- Data were collected 10-21 August Eurozone business activity contracted at an accelerating pace in August as the region’s downturn spread further from manufacturing to services.

- Both sectors reported falling output and new orders, albeit with the goods-producing sector registering by far the sharper rates of decline.

- Hiring came close to stalling as companies grew more reluctant to expand capacity in the face of deteriorating demand and gloomier prospects for the year ahead, the latter sliding to the lowest seen so far this year.

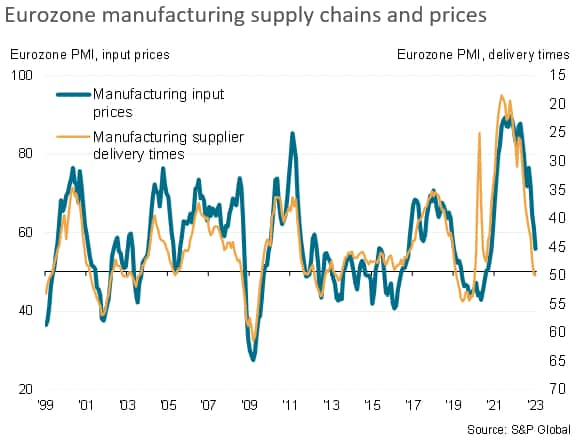

- While inflationary pressures continued to run far lower than seen over much of the past two-and-a-half years, led by falling manufacturing prices, August saw headline rates of input cost and selling price inflation tick higher due in part to upward wage pressures.

Output and demand At 47.0, down from 48.6 in July, the seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses, fell in August to its lowest since November 2020.

If pandemic months are excluded, the latest reading was the lowest since April 2013.

- Output has now fallen for three consecutive months, led by a fifth successive monthly decline in manufacturing output.

- Although the rate of decline of factory output eased slightly in August, it remained the second-strongest recorded by the survey over the past 11 years barring only the initial COVID-19 lockdowns.

- The eurozone service sector meanwhile also fell into decline in August, with activity contracting for the first time since last December, albeit at a much softer rate compared to the goods-producing sector.

- Demand conditions continued to worsen across both sectors.

- New business inflows fell overall for a third straight month, with the rate of decline accelerating to the fastest since November 2020.

- Excluding the pandemic, the drop in new business was the steepest since October 2012.

- New orders for goods continued to fall at the one of the sharpest rates since the global financial crisis, accompanied by a second month of deteriorating demand for services.

- The latter contracted in August at a pace not seen since May 2013 if COVID-19 lockdown months are excluded.

Employment, operating capacity and optimism

- Employment came close to stalling, with the August flash PMI survey registering the smallest rate of job creation since headcounts began rising after the pandemic lockdowns in February 2021.

- A marginal loss of manufacturing jobs was recorded for a third successive month, while hiring in the larger service sector continued to slow from April’s recent peak to register only a marginal rise, signaling the smallest net job gain in the sector since February 2021

National trends

Looking at growth across the euro area, the steepest downturn was recorded in Germany, where output across both goods and services fell for a second month and at a rate not seen since May 2020 (and since June 2009 if the pandemic is excluded).

- A severe and steepening decline in manufacturing output was accompanied by the first fall in German service sector activity since last December.

- France reported a third successive monthly drop in output, the rate of decline unchanged on July, which had seen the sharpest decline since May 2013 barring only four months of pandemic lockdowns. The rate of contraction moderated in manufacturing, though remained sharp, and meanwhile accelerated in services.

- The rest of the region suffered a moderate decline in output compared to France and Germany, yet the reduction was notable in being the first recorded since December amid an ongoing loss of manufacturing output alongside a near stagnation of activity in the service sector.

Comment

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said: “The service sector of the eurozone is unfortunately showing signs of turning down to match the poor performance of manufacturing.

- Indeed, service companies reported shrinking activity for the first time since the end of last year, while output in manufacturing dropped again.

- Considering the PMI figures in our GDP nowcast leads us to the conclusion that the eurozone will shrink by 0.2% in the third quarter.”

- “ECB president Christine Lagarde sounded the alarm that the economy may be faced with higher wages and lower productivity, leading to higher inflation.

- It seems like those worries are about to turn into reality, at least for the vast service sector. For, in this sector input prices and thus wages increased at an accelerated pace in August.

- Meanwhile, stagnating employment combines with decreasing production and results therefore in lower output per head. As a result, the ECB may be more reluctant to pause the hiking cycle in September.”

No comments:

Post a Comment