Looking Forward: Areas To Watch

Business Outcomes

Smallsat ventures continue efforts to prove their business models and generate revenue, with increasing attention on communications

megaconstellations. Macroeconomic factors may have outsized impact on early-stage ventures and influence long-term smallsat market

Communications Megaconstellations

Smallsat telecommunications operators dominated smallsat activity in 2022 and are continuing deployments in 2023. Launch of these large

constellations will influence smallsat activity in the next few years as initial deployments finish and expanded constellations are authorized

Smallsat Launch Options

Smallsats continue to primarily deploy on medium to heavy launch vehicles. Smallsat operators have other launch options including small

launch and rideshare. In addition, dozens of companies continue to develop new small launch vehicles (many <500kg capacity)

Government Use of Smallsats

2023 will likely see first deployments of U.S. national security proliferated architectures. Governments are increasingly seeking to leverage

smallsats or include them in architecture planning to augment existing capabilities

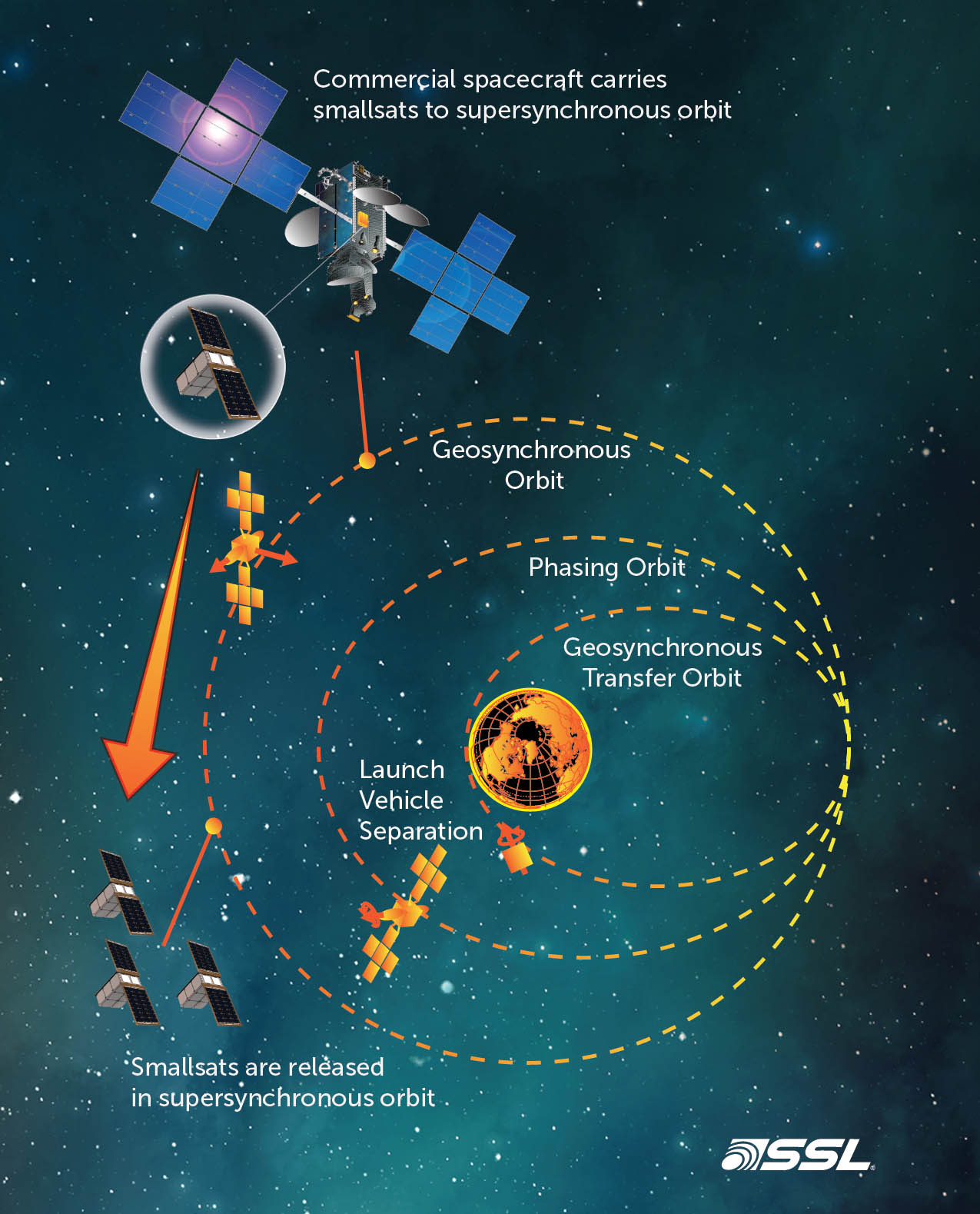

Smallsat Driven GEO/NGSO Integration

Organizations are likely to continue and expand GEO/NGSO integration, possibly through additional merger and acquisition activity, for

optimal routing of traffic based on consumer speed, coverage needs, and unique remote sensing observations/data fusion

__________________________________________________________________________________

___

_________________________________________________________________________________

No comments:

Post a Comment