Boeing Will Pay $8.1M to Resolve Alleged False Claims Act Violations

Boeing BA –2.57% will pay $8.1 million to resolve allegations it submitted false claims and made false statements related to its contracts ...

___________________________________________________________________________________

Boeing Co (BA): An Underestimated Powerhouse in Aerospace and Defense?

A Glimpse into Boeing Co (NYSE:BA)

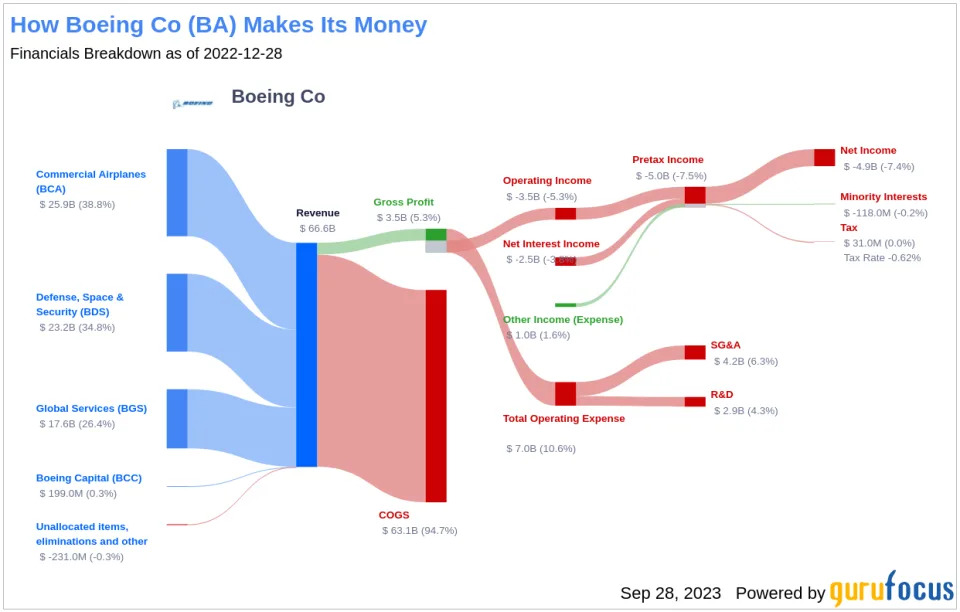

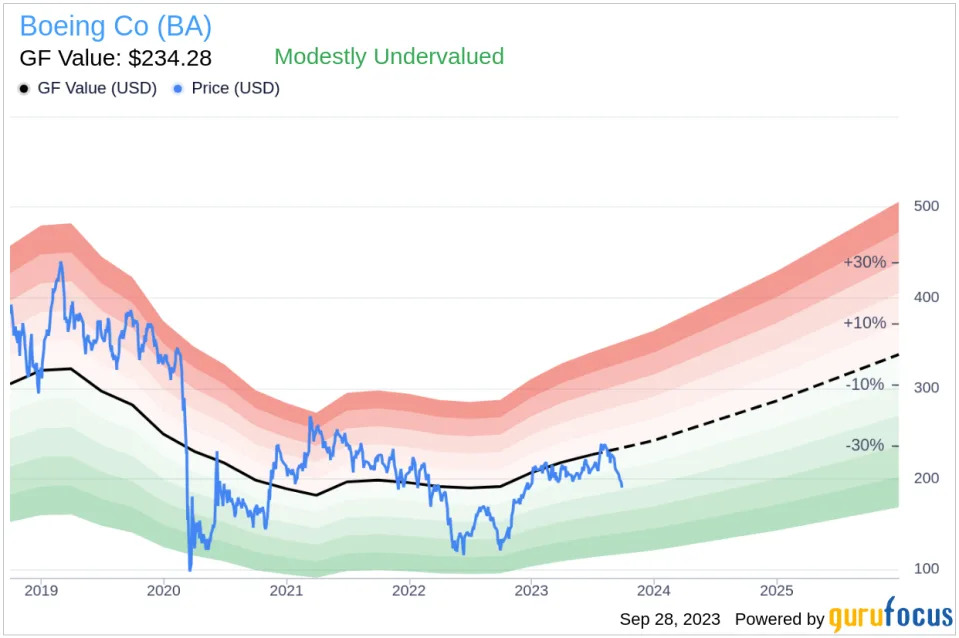

Boeing Co operates in four segments: commercial airplanes; defense, space, and security; Global services; and Boeing capital. Competing with Airbus in the production of aircraft and with Lockheed, Northrop, and several others in the creation of military aircraft and weaponry, Boeing Co has established itself as a significant force in the industry. With a stock price of $190.43 and a market cap of $114.90 billion, the company's value is a topic of interest for investors. The GF Value, a proprietary measure of a stock's intrinsic value, for Boeing Co is $234.28.

Deciphering the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

For Boeing Co (NYSE:BA), the GF Value suggests that the stock is modestly undervalued. Consequently, the long-term return of its stock is likely to be higher than its business growth.

Assessing Boeing Co's Financial Strength

Companies with poor financial strength pose a high risk of permanent capital loss to investors. To avoid such a loss, it's crucial to evaluate a company's financial strength before purchasing shares. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. With a cash-to-debt ratio of 0.26, Boeing Co ranks worse than 68.38% of 291 companies in the Aerospace & Defense industry.

This statistic indicates that the financial strength of Boeing Co is relatively poor...

___________________________________________________________________________

Boeing to settle US claim over Osprey production issues

A Boeing logo is seen at the 54th International Paris Airshow at Le Bourget Airport near Paris, France, June 18, 2023. REUTERS/Benoit Tessier/File Photo

WASHINGTON, Sept 28 (Reuters) - Boeing (BA.N) has agreed to pay $8.1 million to resolve allegations it violated U.S. law by failing to comply with contractual obligations in its production of V-22 Osprey aircraft, the U.S. Justice Department said Thursday.

A Boeing spokesperson said the company "entered a settlement agreement with the U.S. Department of Justice and the U.S. Navy to resolve certain False Claims Act allegations, without admission of liability."

- The settlement related to allegations Boeing violated the False Claims Act from about 2007 through 2018 because of its failure to meet certain specifications for fabricating composite components for the tiltroter aircraft at its facility in Ridley Park, Pennsylvania, the Justice Department said.

- The Osprey is a military aircraft that takes off like a helicopter and then rotates its propellers to fly like a plane.

- The government contended Boeing failed to perform monthly testing on autoclaves used to cure composite parts required under the terms of its contract with the U.S. Navy and was not in compliance with additional requirements related to the testing, the department said in a statement.

No comments:

Post a Comment