Palantir: Buybacks And Billings Acceleration Power Upside Potential

Sep. 18, 2023 11:41 PM ETPalantir Technologies Inc. (PLTR)2 Comments

Summary

- Palantir's stock has seen significant growth in 2023, driven by fundamental improvements and a reset in valuation. Its board recently approved a $1 billion buyback.

- Commercial revenue growth in the US started to outstrip government revenue growth, showcasing Palantir's potential in the enterprise space.

- The company also remains committed to GAAP profitability, which will assuage investors in a more risk-averse market.

- Palantir also enjoys an ironclad balance sheet with >$3 billion in net cash, enabling buybacks and potential acquisitions.

Michael Vi

Even amid recent market volatility, 2023 has so far been quite kind of mid-cap growth stocks, including and especially companies that are part of the AI trend. Palantir (NYSE:PLTR), one of the core enterprise software companies leveraging AI and machine learning technology, got a long-needed respite this year after falling sharply in 2022.

Year to date, Palantir's stock is up more than 2x, but in my view, this isn't just AI hype alone. On top of resetting valuation from last year's bargain-basement levels, Palantir has also achieved significant fundamental improvements including strong commercial revenue and customer growth, alongside a continued streak of profitability.

Since then, a number of bullish drivers have materialized. The company has done a fantastic job at chasing growth despite both executing a small layoff as well as wading through a tough macro environment that has severely dented deal momentum for large, complex software vendors (which is certainly the case for a company like Palantir). Billings growth accelerated in Q2, which was incredibly reassuring after several quarters of revenue deceleration. It's worth noting as well that Palantir is now leveraging its cash-rich balance sheet to pursue its first-ever buyback program, with an authorization of up to $1 billion - which, at current share prices, would cover roughly 3% of the company's outstanding market cap.

In light of recent strength, I'm recommending holding onto the stock and I am increasing my price target to $18 (~16% upside from current levels, detailed valuation later).

And as a reminder to investors who are relatively newer to the Palantir story, here is my updated long-term bull case for this company:

- Palantir's AI/big data applications have tremendous variety in use cases. Palantir isn't a software company that serves only one or a limited set of use cases. Data and inferences that can be made from data are prevalent in just about everything: which explains why Palantir is such a powerful tool for both public and private sector clients. Big data is also the feeder to AI, as the two work hand in hand.

- Stepping up go-to-market momentum, especially in the commercial segment. Palantir is chasing growth across a wide variety of channels. The company has stepped up its sales hiring, a nod at the broad market opportunity it has and the need for more territory coverage. Palantir also has deepened relationships with ISVs (integrated service vendors) that can resell Palantir's products without its involvement and offer additional coverage that Palantir's direct sales force can't handle. The company's growing base of commercial revenue also proves out that there is plenty of untapped market opportunity even in the small/midsize business space.

- One foot in the public sector, one foot in private. Palantir made its name on being a large federal government contractor, but its products are just as compelling to an enterprise segment that is growing ever more obsessed with the value of big data. Most software companies start off as primarily dealing with enterprise buyers, and then hopefully getting FedRAMP certification to sell into public sector clients later. Palantir did the reverse: but now, its momentum with Fortune 100 companies is continuing to grow, and customer adds are continuing to trend at an impressive pace. The latest product rollouts like AI are being sold simultaneously to both government and private sector clients.

- Free cash flow and GAAP profitability. Palantir has maintained GAAP profitability for several quarters and continues to generate healthy free cash flow, which means the business is self-financing (a departure from many other rapid-growth software companies that continue to need to raise capital to finance their losses).

- Strong balance sheet. Palantir has over $3 billion of net cash on its balance sheet, which gives it plenty of financial flexibility to pursue buybacks and acquisitions for growth if it so chooses.

Q2 download

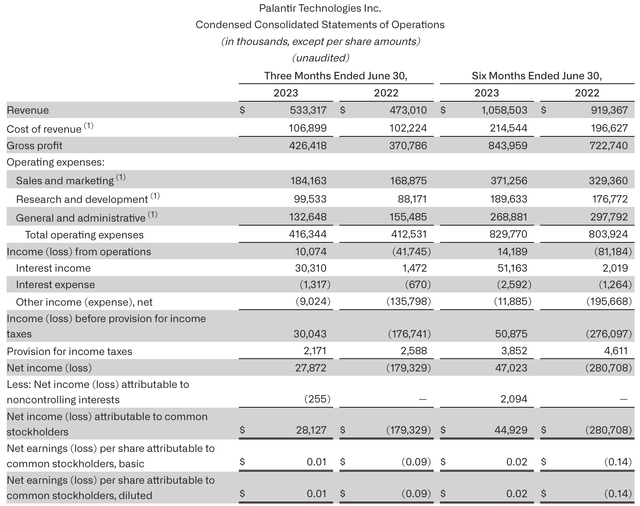

Let's now go through Palantir's latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Palantir Q2 results (Palantir Q2 earnings release)

Palantir's revenue grew 13% y/y to $533.3 million, decelerating versus 18% y/y growth in Q1. In spite of the revenue deceleration, however, we note that billings is up 52% y/y to $603 million. This indicates that, timing in revenue recognition aside, the company continues to sign on a tremendous amount of new deals that will materialize as revenue in future quarters, paving the way for potential revenue acceleration ahead. It's worth knowing as well that billings accelerated versus 25% y/y growth in Q1, despite the revenue deceleration.

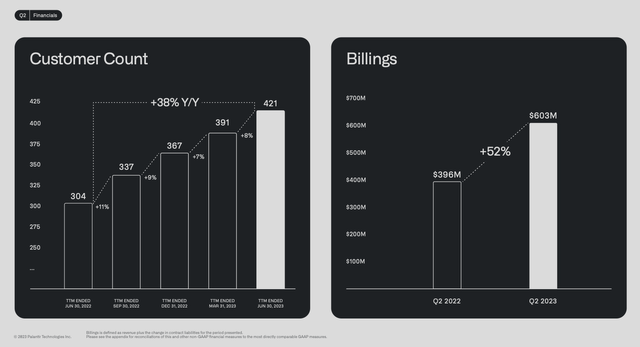

Palantir customer metrics (Palantir Q2 earnings release)

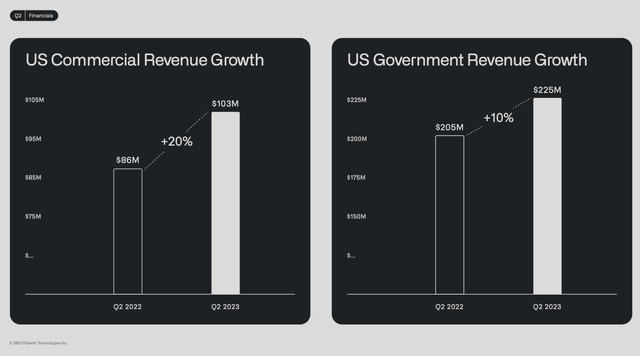

It's also worth noting that in the U.S. business, which accounts for just over half of Palantir's overall revenue, commercial revenue growth of +20% y/y outstripped government revenue of +10% y/y: which is a telling indicator of Palantir's vast opportunity in enterprise software and the fact that so few blue-chip companies are currently Palantir clients.

Palantir US business spotlight (Palantir Q2 earnings release)

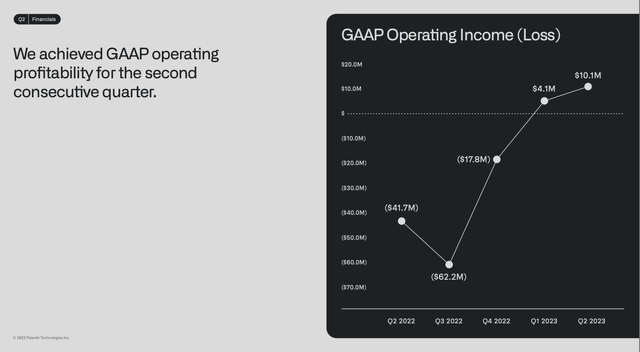

Palantir profitability trends (Palantir Q2 earnings release)

The company also cited an ongoing commitment to GAAP profitability, which is reassuring for a company whose leadership, much like Tesla's (TSLA), is considered to be more future-oriented and product-driven, and not overly concerned with market sentiment. Per CEO Alex Karp's remarks on the Q&A portion of the Q2 earnings call:

Why do we care about profitability? We care about profitability because we power some of the most important enterprises in the world. They care that we’re on steady footing. We care about it because it shows people that we are serious. We care about it because it positions us to be on indexes like the S&P that show that we are one of the leading industries in the world.

We believe in ourselves, which is why we’ve authorized a buyback to align with this belief in ourselves, our belief of profitability aligns with our desire to be on the S&P.

- We are going to invest in ourselves and not at a small scale in the lot $1 billion range. And so, profitability, stability, move to S&P, move to a company that is reflects what we will be, which we believe is the most important enterprise software company in the world and these are all very much linked."

Valuation and key takeaways

Meanwhile, for next fiscal year FY24, Wall Street analysts are expecting Palantir to generate $2.63 billion in revenue, representing 19% y/y growth (data from Yahoo Finance). Taking these estimates at face value (noting that billings growth over the past two quarters have exceeded 19% growth), Palantir's current valuation stands at 11.5x EV/FY24 revenue.

Given recent strength and billings acceleration for Palantir in a tough macro climate, I'm extending my prior $17 price target on the company to $18, representing a ~13x FY24 revenue multiple and ~16% upside from current levels (which I think is achievable in a 9-month timeframe through the first half of 2024).

Though not a cheap stock, Palantir has routinely proven its potential as a technology powerhouse playing in a massive market, and its ability to generate GAAP profits at its current scale is indicative of tremendous upside ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

.jfif)

No comments:

Post a Comment