China’s thirsty data centres, AI industy could use more water than size of South Korea’s population by 2030: report warns

- Hong Kong think tank says annual water use by Chinese data facilities – almost half of which are in dry regions – could more than double by 2030

- It takes 20 times more water to have a ChatGPT conversation than to run a Google search, according to the non-profit group’s report

Published: 10:00am, 17 Apr 2024

The team projected that by the end of the decade, China would have more than 11 million data centre racks, which house servers, cables and other equipment.

- That is nearly triple the number it had in 2020 of around 4 million.

- The boom in generative AI technology is also expected to add to water demands from the information and communication technology (ICT) industry.

- It pointed to a preprint study – meaning it has not yet been peer-reviewed – from last year by researchers in the United States that showed the large language model GPT-3 consumed 500 millilitres (16.9 fluid ounces) of water for every 10 to 50 responses it generates.

- That is 20 times more than it takes to produce 50 Google searches.

The report said that if 100 million users had a conversation with ChatGPT, the chatbot “would consume 50,000 cubic metres of water – the same as 20 Olympic-sized swimming pools – whereas the equivalent in Google searches would only consume one swimming pool”.

CT Low, co-author of the report and geospatial risk lead at China Water Risk, said the accelerated development of generative AI would add pressure to the country’s already stressed water resources.

- “We recommend corporates and the financial sector to assess fast-evolving climate and water risks and curate cohesive climate strategies to survive them,” Tan said.

- “For the ICT sector, the time to tackle water risks is now – we must get on top of these before the explosion of AI,” Tan said.

A water neutral company is one that offsets its water footprint, while a water positive one replenishes more than its water footprint, ideally after reducing water use as much as possible, according to the report.

Strategies to minimise and offset water use include watershed restoration, improving water efficiency in existing facilities, reusing waste water and collecting rainwater.

Tan added that the Chinese government was taking steps to manage rivers holistically, “from source to sea”, and could be expected to adopt tighter regulations and water usage effectiveness standards for the ICT sector.

According to the report, more than three-quarters of China’s data centre racks are located in the basins of three rivers: the Yellow River, the Yangtze River and the Pearl River.

==========================================================================

RELATED

=============================================================

Mesa LalaPaLooza: All The Hype That's Fit-to-Print > Data Hub

It is time for a TIME OUT.

Here's the most recent low-key report on all of Google's Data Centers with no over-the-top exaggeration, even though a press release from the City of Mesa News Room took pains to issue a carefully-worded announcement immediately after last Thursday's public meeting stating it was not a done deal. That's quite a different slant from Giles stating "In terms of a financial deal, this is home run. This is a great day."

_______________________________________________________________

Google’s Western US Data Center Capacity Is Swelling Up

In recent years, the Alphabet subsidiary has been investing heavily to expand its computing infrastructure around the world. It’s been spending billions every quarter on network and data center construction to support its products for regular internet users – things like Search, Maps, YouTube, and Gmail – but even more so to scale the Google Cloud platform that provides computing services to enterprises.

In recent years, the Alphabet subsidiary has been investing heavily to expand its computing infrastructure around the world. It’s been spending billions every quarter on network and data center construction to support its products for regular internet users – things like Search, Maps, YouTube, and Gmail – but even more so to scale the Google Cloud platform that provides computing services to enterprises.Historically, the bulk of Google’s US computing

infrastructure has been concentrated in the Midwest and in the South, but the company’s pursuit of a greater share of the cloud market (dominated by Amazon Web Services and Microsoft Azure) appears to be driving a need for more capacity in the west.

This April, Google announced plans to build data centers to support a new cloud availability region in Salt Lake City, and last July it announced the launch of a Los Angeles region. The Nevada data center will also host a new availability region for Google Cloud.

_________________________________________________________________________

Related: Cloud Giants Continue Pouring Billions Into Data Centers

_________________________________________________________________________

Google doesn’t expect to finish the first phase if the Mesa data center until 2025, according to a report by AZ Central.

Google doesn’t expect to finish the first phase if the Mesa data center until 2025, according to a report by AZ Central.What's omitted from the Data Center Knowledge report two days ago is this tentative and conditional statement:

"Google is considering acquiring property in Mesa, AZ., and while we do not have a confirmed timeline for development for the site, we want to ensure that we have the option to further grow should our business demand it

The Las Vegas and Salt Lake builds are part of a $13 billion investment in new US offices and data centers the company announced earlier this year.

Google suggested that customers will be able to distribute their workloads across up to four regions in the west, once Las Vegas and Salt Lake come online (it expects to launch both next year).

Each new infrastructure region is also meant to target industries that are concentrated in its corresponding population center –

- 1 gaming and entertainment in Las Vegas

- 2 Hollywood in L.A.

- 3 healthcare, IT, and financial services in Salt Lake

- 4 _____________________________ in Mesa???

Reference: https://www.datacenterknowledge.com

The data center will be built on 187 acres of farmland in the Elliot Road Technology Corridor, which already has five existing or planned data centers. Construction is expected to begin within five years, with the first part of the data center projected to be in place by 2025.

Arizona Republic Mesa approves deal for $1 billion Google data center

US electric utilities brace for surge in power demand from data centers

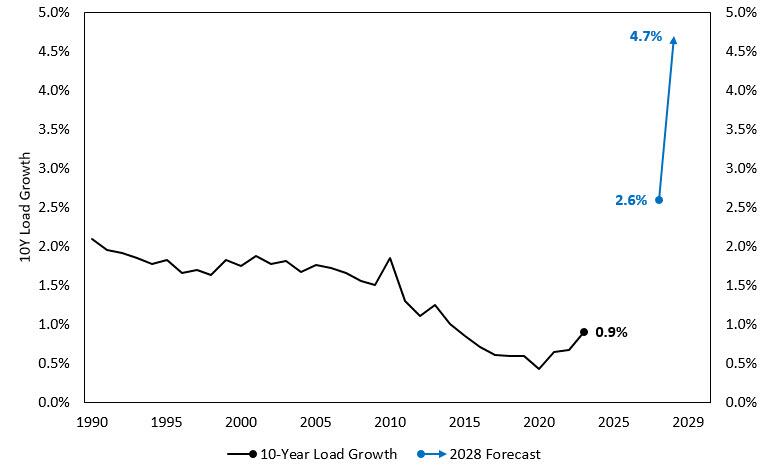

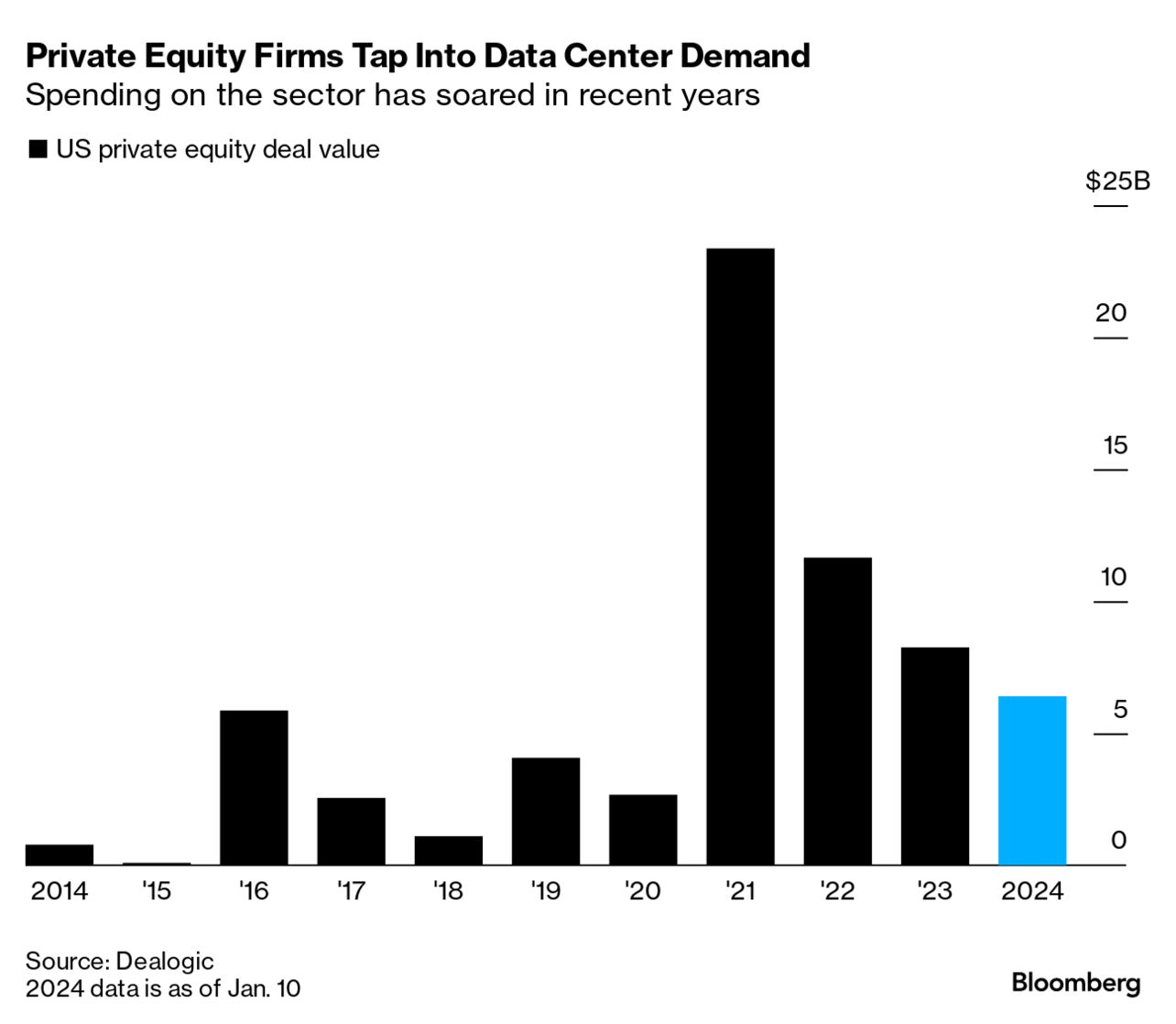

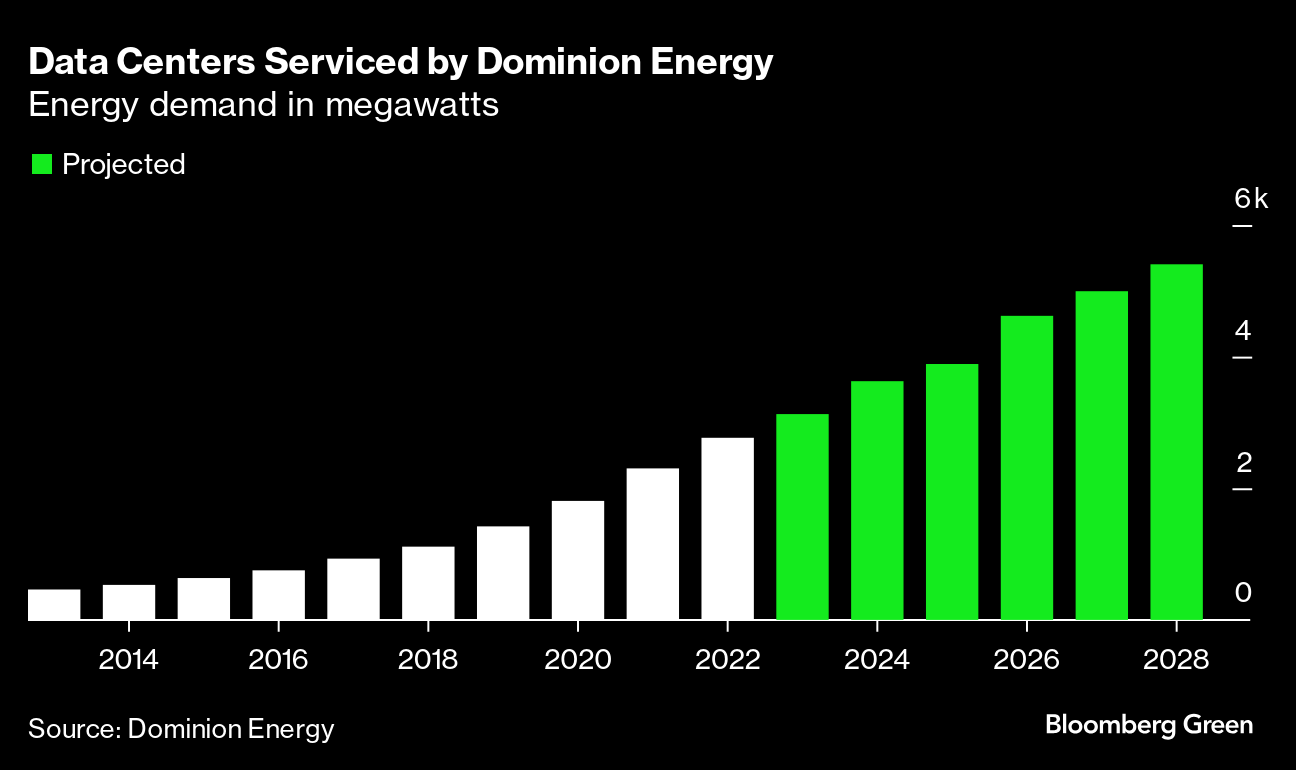

- Projections for US electricity demand growth over the next five years have doubled from about one year ago, primarily because of the expected explosion of artificial intelligence data centers, federally subsidized manufacturing plants, and the government-fueled electric vehicle transition.

The co-founder and chairman of the world's largest alternative asset manager warned,

"Different states in the US are starting to run out of electricity" and "the lack of capacity in the electric grids in the industrial world with AI and EVs is creating enormous investment opportunities."

- In 2021, Blackstone purchased QTS Realty Trust, a company with more than 25 data centers in its portfolio across North America and Europe, for $10 billion.

Schwarzman should also consider investment opportunities in the nuclear power plant space. Last month, we showed how a nuclear renaissance is underway in a note titled "In Historic Reversal, US To Restart A Shut Down Nuclear Power Plant For The First Time Ever."

In "The Next AI Trade," we explain what equity exposure is needed to capitalize on powering up America for the digital age.

US electric utilities brace for surge in power demand from data centers

- Longer term power demand from IT equipment in U.S. data centers is expected to reach more than 50 gigawatts (GW) by 2030, up from 21 GW in 2023, according to consulting firm McKinsey's latest estimates. Last year, it had forecasted demand rising to over 35 GW by 2030.

- Surging electricity demand from data centers, along with an increase in U.S. manufacturing and the electrification of sectors like transportation, was evident in the most recent round of utility earnings calls with investors.

GROWING BACKLOG

The rapid growth has raised concerns that the U.S. electric utility industry, historically known for slow and steady returns, will be unable to respond quickly to the rise in power demand because of a swelling backlog of power generation and transmission projects in line to connect to the grid.

"What we're seeing in the market is that these projects are not coming online fast enough to meet the local demand for the for the data centers," said Rystad Energy analyst Geoff Hebertson.

The Georgia Senate voted last month to suspend some tax breaks for data centers, saying the businesses failed to create enough jobs to stimulate the state's economy.

That decision was "unfortunate" but will not be enough to undercut the lure the state has for new data center development," said Raul Martynek, CEO of DataBank, which is developing 225 megawatts of data center capacity across 14 U.S. markets, including the Atlanta area.

___________________________________________________________________________________

US Data Centres Confront the Strain of Rising Power DemandsBy Amber Jackson

April 15, 2024

4 mins

Such rapid growth has ultimately raised concerns that the US electric utility industry will be unable to respond quickly to the rise in power demand

Data centres across the United States (US) are preparing for a continued surge in power demand, as customers seeking technology like AI strain power grids

With one of the large data centre markets, the US holds the most data centre sites in the world, with its total data centre revenue expected to reach US$99.16bn in 2024.

Its market influence cannot be overstated. Given that the country is the single largest region for connectivity and cloud in the world today, alongside many technology companies being based there, its data centre industry is inevitably scaling up rapidly to meet rising demands.

Electric utilities across the country are predicting a ‘tidal wave’ of new demand from data centres now powering new technologies such as generative AI (Gen AI). In fact, some power companies are now projecting electricity sales growth several times higher than previous estimates.

As reported by Reuters, in 2023, electric utility in the US shares fell by more than 10%, the biggest yearly drop since 2008. Companies that have suffered a prolonged demand lull after the introduction of new energy efficiencies at the start of the millennium are currently up by about 4% so far in 2024

- According to research by the International Energy Agency (IEA), data centres are expected to consume well over 1,000TWh of electricity by 2026 - a figure that has more than doubled.

- In particular, AI has been cited as one of the causes of excess energy requirements. Demand for the technology is currently predicted to require as much energy as a medium-sized country, which causes additional challenges for both data centre operators and energy providers alike.

“This is ultimately going to require billions of dollars of new capital investment into the space that will transform the market and really grow the cash flows of these companies in a way that we haven’t seen before,” she says.

Such rapid growth has ultimately raised concerns that the US electric utility industry will be unable to respond quickly to the rise in power demand because of a swelling backlog of projects in line to connect to the grid.

This has also emerged as a threat to electricity demand in certain regions across the country, as some state officials are concerned about how much data centres could strain power grids.

For instance, the senate in Georgia voted in March 2024 to suspend some tax breaks for data centres. According to them, the relevant businesses were failing to create enough jobs for the local economy.

With AI and cloud technologies putting immense pressures on the data centre industry, companies are now having to find new ways to reduce energy consumption.

One of the ways it does this is by maximising renewable energy usage with new sustainable strategies such as harnessing excess heat to power local communities. Likewise, using cooling technologies like liquid cooling is also helping to keep systems cooler and less demanding for power.

With data centres around the world expected to grow at roughly 34% each year, it is now inevitable for data centre businesses to tackle rising energy challenges.

==========================================================================

==========================================================================

%20(2).gif)

.jpg)

%20(2).gif)

No comments:

Post a Comment