"This is like something I've never seen," he said via webcast, who was quoted by Bloomberg, adding, "The amount of money being invested in this area is breathtaking. It's happening now all over the world."

The co-founder and chairman of the world's largest alternative asset manager warned,

"Different states in the US are starting to run out of electricity" and "the lack of capacity in the electric grids in the industrial world with AI and EVs is creating enormous investment opportunities."

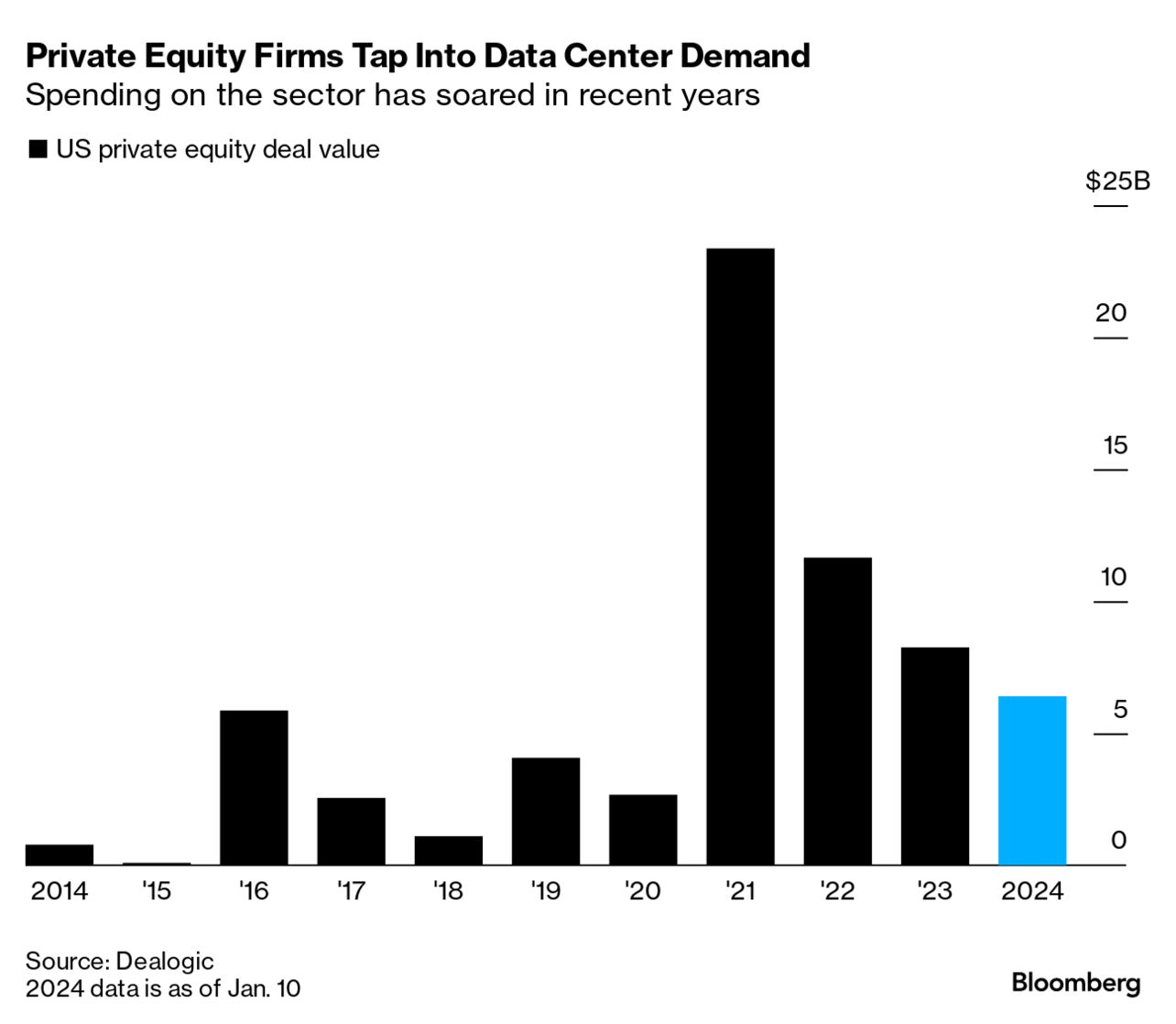

- In 2021, Blackstone purchased QTS Realty Trust, a company with more than 25 data centers in its portfolio across North America and Europe, for $10 billion.

Schwarzman should also consider investment opportunities in the nuclear power plant space. Last month, we showed how a nuclear renaissance is underway in a note titled "In Historic Reversal, US To Restart A Shut Down Nuclear Power Plant For The First Time Ever."

In "The Next AI Trade," we explain what equity exposure is needed to capitalize on powering up America for the digital age.

US electric utilities brace for surge in power demand from data centers

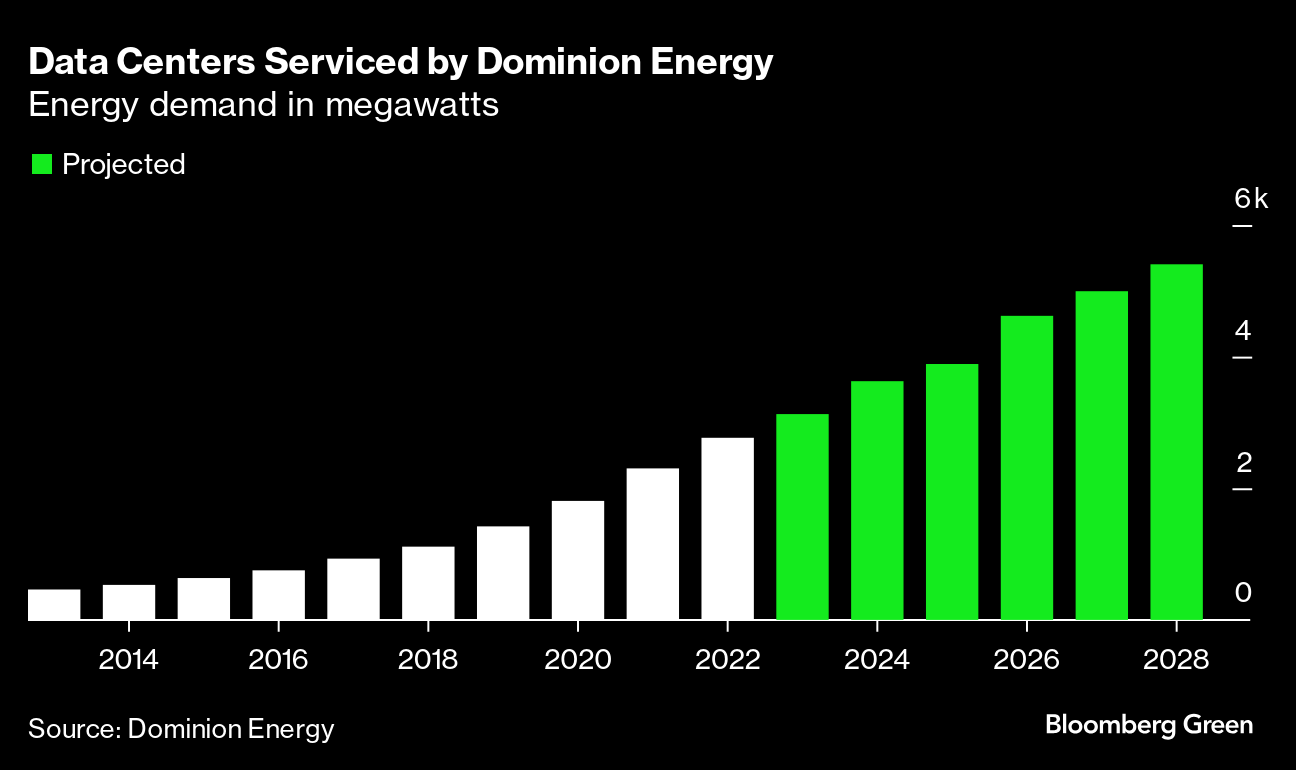

- Longer term power demand from IT equipment in U.S. data centers is expected to reach more than 50 gigawatts (GW) by 2030, up from 21 GW in 2023, according to consulting firm McKinsey's latest estimates. Last year, it had forecasted demand rising to over 35 GW by 2030.

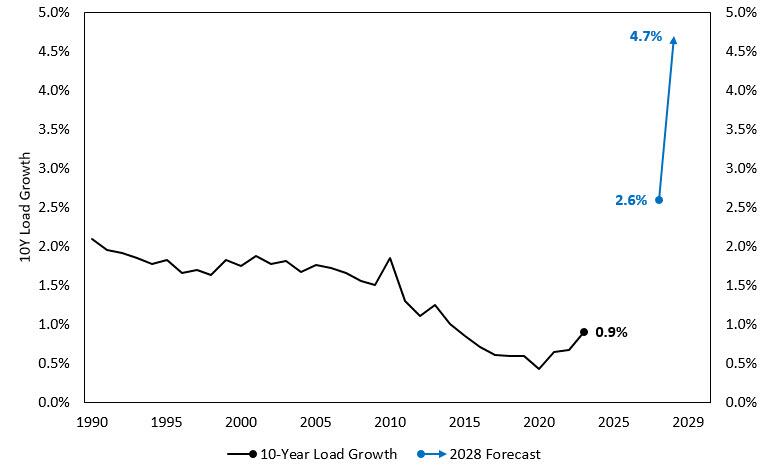

- Surging electricity demand from data centers, along with an increase in U.S. manufacturing and the electrification of sectors like transportation, was evident in the most recent round of utility earnings calls with investors.

GROWING BACKLOG

The rapid growth has raised concerns that the U.S. electric utility industry, historically known for slow and steady returns, will be unable to respond quickly to the rise in power demand because of a swelling backlog of power generation and transmission projects in line to connect to the grid.

"What we're seeing in the market is that these projects are not coming online fast enough to meet the local demand for the for the data centers," said Rystad Energy analyst Geoff Hebertson.

The Georgia Senate voted last month to suspend some tax breaks for data centers, saying the businesses failed to create enough jobs to stimulate the state's economy.

That decision was "unfortunate" but will not be enough to undercut the lure the state has for new data center development," said Raul Martynek, CEO of DataBank, which is developing 225 megawatts of data center capacity across 14 U.S. markets, including the Atlanta area.

___________________________________________________________________________________

US Data Centres Confront the Strain of Rising Power Demands

By Amber Jackson

April 15, 2024

4 mins

Such rapid growth has ultimately raised concerns that the US electric utility industry will be unable to respond quickly to the rise in power demand

Data centres across the United States (US) are preparing for a continued surge in power demand, as customers seeking technology like AI strain power grids

With one of the large data centre markets, the US holds the most data centre sites in the world, with its total data centre revenue expected to reach US$99.16bn in 2024.

Its market influence cannot be overstated. Given that the country is the single largest region for connectivity and cloud in the world today, alongside many technology companies being based there, its data centre industry is inevitably scaling up rapidly to meet rising demands.

Electric utilities across the country are predicting a ‘tidal wave’ of new demand from data centres now powering new technologies such as generative AI (Gen AI). In fact, some power companies are now projecting electricity sales growth several times higher than previous estimates.

As reported by Reuters, in 2023, electric utility in the US shares fell by more than 10%, the biggest yearly drop since 2008. Companies that have suffered a prolonged demand lull after the introduction of new energy efficiencies at the start of the millennium are currently up by about 4% so far in 2024.

Concerns over demand not matching supply

According to research by the International Energy Agency (IEA), data centres are expected to consume well over 1,000TWh of electricity by 2026 - a figure that has more than doubled. In particular, AI has been cited as one of the causes of excess energy requirements. Demand for the technology is currently predicted to require as much energy as a medium-sized country, which causes additional challenges for both data centre operators and energy providers alike.

Likewise, Laurel Durkay, Head of Global Listed Real Assets at Morgan Stanley explains in the below video how the data centre industry is going to continue experiencing a transformative level of demand.

“This is ultimately going to require billions of dollars of new capital investment into the space that will transform the market and really grow the cash flows of these companies in a way that we haven’t seen before,” she says.

Such rapid growth has ultimately raised concerns that the US electric utility industry will be unable to respond quickly to the rise in power demand because of a swelling backlog of projects in line to connect to the grid.

This has also emerged as a threat to electricity demand in certain regions across the country, as some state officials are concerned about how much data centres could strain power grids.

For instance, the senate in Georgia voted in March 2024 to suspend some tax breaks for data centres. According to them, the relevant businesses were failing to create enough jobs for the local economy.

With AI and cloud technologies putting immense pressures on the data centre industry, companies are now having to find new ways to reduce energy consumption.

One of the ways it does this is by maximising renewable energy usage with new sustainable strategies such as harnessing excess heat to power local communities. Likewise, using cooling technologies like liquid cooling is also helping to keep systems cooler and less demanding for power.

With data centres around the world expected to grow at roughly 34% each year, it is now inevitable for data centre businesses to tackle rising energy challenges.

==========================================================================

==========================================================================

%20(2).gif)

.jpg)

%20(2).gif)

No comments:

Post a Comment