Yemen’s Houthis say they attacked ships in Gulf of Aden, Indian Ocean

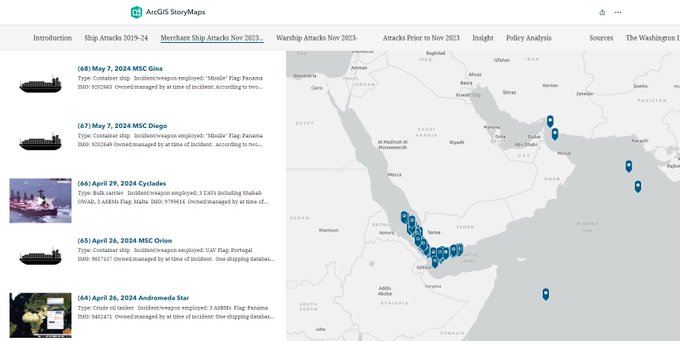

The MSC Diego and the MSC Gina were attacked with ballistic missiles and drones in the Gulf of Aden, the Iran-aligned group’s military spokesperson Yahya Saree said on Thursday.

- The Houthis claimed to hit a third container ship, the MSC Vittoria, in the Indian Ocean.

KEEP READINGThis article will be opened in a new browser window

What the designation of ‘terrorist’ means for Yemen’s Houthis

Seafarers pay the price for the murky business of ship nationality

The centre, a coalition of countries responding to Houthi attacks on shipping in the Middle East, said the vessels were “likely targeted due to perceived Israeli affiliation”.

The two vessels were “Panama-flagged container ships” operating for a Geneva-based company, The Associated Press news agency reported.The Houthis claimed to hit a third container ship, the MSC Vittoria, in the Indian Ocean.

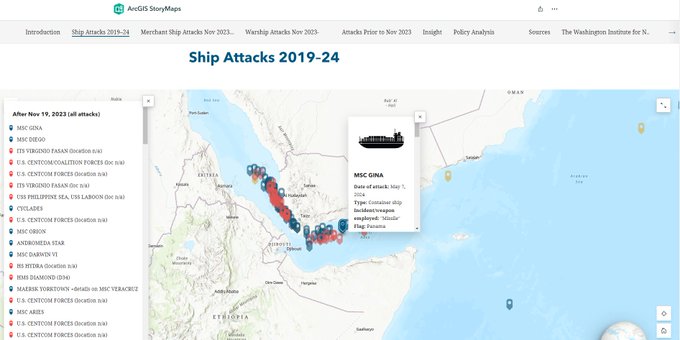

The group has launched repeated drone and missile attacks on vessels in the crucial shipping channels of the Red Sea, the Bab al-Mandab strait and the Gulf of Aden since November in what it says is a campaign of solidarity with Palestinians and against Israel’s war on Gaza.

This has forced shipping firms to reroute vessels to longer and more expensive journeys around Southern Africa.

______________________________________________________________________________

___________________________________________________________________________________

To Safely Transit the Red Sea,Red Sea, Shadow a Chinese Ship

[By Clay Robinson]

It was a sunny morning with calm seas on March 6, 2024, a fine day for sailing the tranquil waters of the Gulf of Aden. The crew of M/V True Confidence, however, were on edge: less than 10 hours before, their ship had come under attack from a Houthi-launched Iranian missile. Through sheer luck, the missile missed its intended target, and the ship continued its westerly journey bound for Jeddah, Saudi Arabia. At 11:34 AM, the crew’s luck ran out: another Houthi missile ripped through the deck house, exploding in a massive fire ball that set the bridge ablaze. Two innocent civilian mariners were killed and four more critically injured. The captain ordered the fifteen surviving crew to abandon ship, leaving it adrift and in flames, yet another victim of the Houthis’ senseless and indiscriminate violence.

Red Sea Fast Pass: Chinese Opportunism

Even as the tumultuous situation in the Red Sea takes ever more deadly and dangerous turns, China continues to sit idly by and reap the economic and diplomatic benefits thanks to the Houthis’ Iranian patronage and their own calculated self-interest. While much of the world’s shipping has been forced to take longer and more expensive routes to avoid Houthi missiles in the Red Sea, Chinese shipping continued virtually undisturbed, protected as it were under a modern day “non-aggression pact” between China and Houthi forces. However, just a few days after the Houthis granted this assurance to China that their ships would not be targeted in exchange for political support, on March 23, 2024, a Houthi missile struck the Chinese-owned M/V Huang Pu. Houthi spokesmen were unusually tight-lipped4 after this attack, likely the result of severe chastisement behind the scenes by both China and Iran, and will take extra efforts to avoid targeting Chinese shipping in the future.

It is not clear yet whether this Houthi attack should be attributed to an administrative oversight, missing that M/V Huang Pu’s ownership had recently transferred to China. Or perhaps the Houthis were targeting another vessel nearby. Either way, the safest place to transit the Red Sea is now onboard Chinese-owned ships.

The combination of the Houthi’s public agreement with China to not target their shipping and the likely private reprimand after striking the M/V Huang Pu sets up a scenario whereby Chinese shipping will be getting a free pass through the Red Sea. That provides China a significant competitive advantage at the precise moment its economy is starting to falter. There is a way, however, to both remove that advantage and force China to abide by its international obligations.

The time has come to exact a cost on this unbridled Chinese opportunism.

Panda Express: A Proposed Convoy Operation

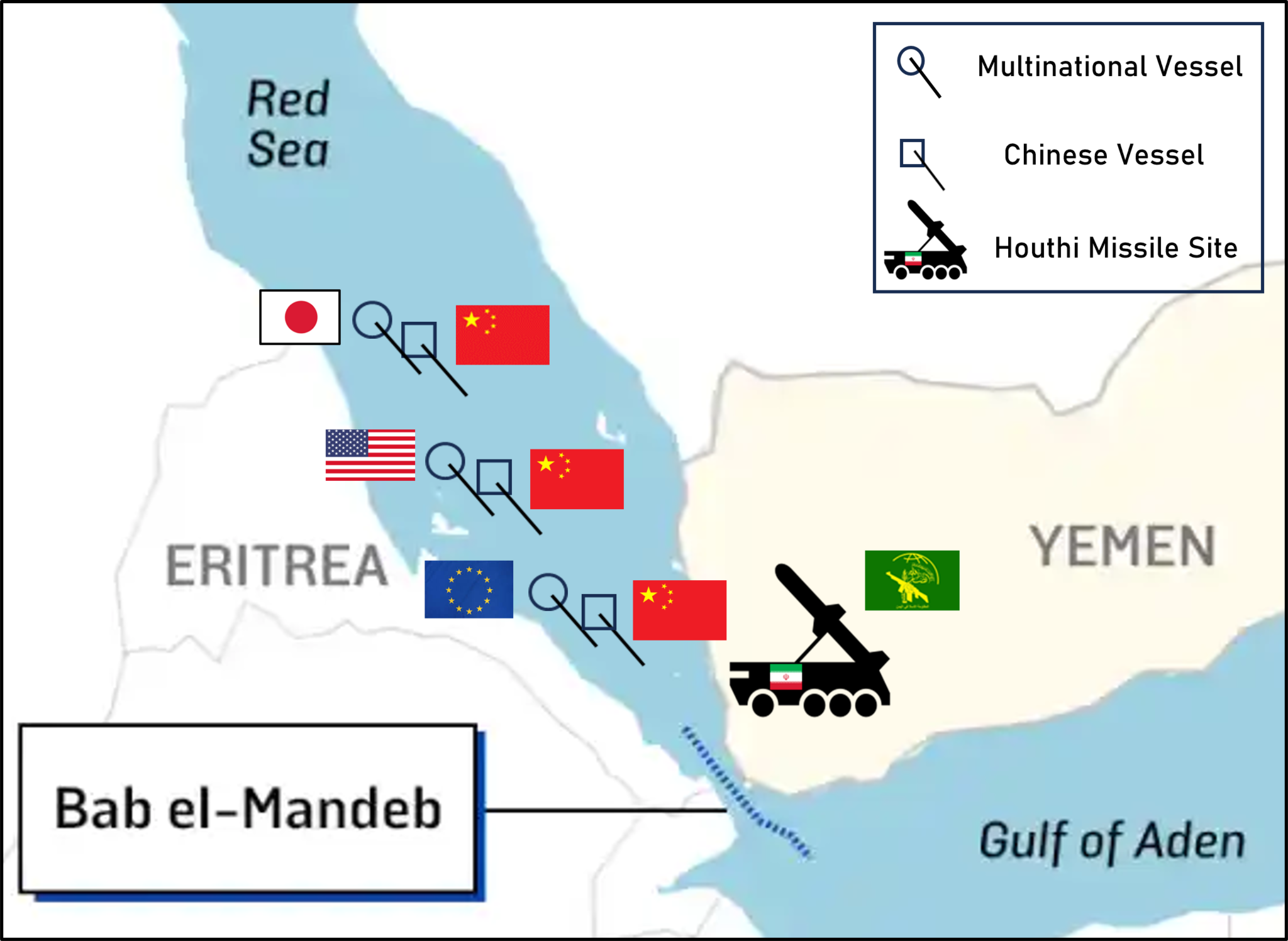

The idea is simple: vulnerable multinational commercial vessels would closely shadow Chinese ships as they transit safely past Houthi missile launchers in a convoy-type operation. The Houthis, knowing their targeting is lacking, would refrain from shooting lest they accidentally hit a Chinese ship and anger both Beijing and Tehran. The U.S.-led Combined Maritime Forces or the European Union Naval Forces’ Operation Aspides are the most obvious candidates to organize such a convoy – nicknamed Panda Express – but arguably it could be self-organizing or organized under an alternative multinational coalition. The shipping industry could institute a loosely organized program to surreptitiously appropriate passive escort of commercial vessels by Chinese vessels sharing the same shipping lanes. In short, these vessels will shadow Chinese vessels at a safe but proximate distance such as to keep the Chinese vessel between them and the direction of the Houthi missile threat. A limited handful of multinational commercial vessels will transit under the shield of the security that each of the Chinese vessels enjoy, taking advantage of a reliable and predictable, yet passive escort courtesy of China.

The current situation (Figure 1) consists of multinational commercial vessels transiting independently under the impressive but less-than-omnipresent protection of the multinational warships participating in Operation Prosperity Guardian and Operation Aspides. These warships endeavor to intercept Houthi missiles and attack drones targeting commercial shipping.

Figure 1: Status quo of Operation Prosperity Guardian. (Author graphic)

Figure 1: Status quo of Operation Prosperity Guardian. (Author graphic)

A brief vignette will serve as an example of what Panda Express might accomplish. Prior to a southbound transit of the Red Sea, a multinational commercial vessel will loiter temporarily at the southern end of the Suez Canal, awaiting the passage of another southbound Chinese vessel. This will occur ostensibly every few hours as an average of over five Chinese vessels transit the Suez Canal per day. The multinational vessel will then take station on the starboard quarter of the Chinese vessel at a safe distance, but in close proximity such that a sort of passive, perhaps even unwitting, screen of the vessel by the Chinese vessel will occur (Figure 2).

Figure 2: Panda Express concept. (Author graphic)

Figure 2: Panda Express concept. (Author graphic)

Some might argue that Panda Express would put innocent civilian mariners at risk by shadowing Chinese merchant vessels, and from a practical standpoint, that threat would exist. But therein lies its value as a deterrent because the Houthis have already stated that they will not attack Chinese shipping. As the two vessels reach the Bab el-Mandeb Strait, air defense vessels of Operation Prosperity Guardian and Operation Aspides can provide a more robust ability to detect and engage any Houthi missile that might be close enough to discern the multinational vessels from the Chinese one. Once through the western reaches of the Gulf of Aden and outside the threat area, the vessel can once again resume navigating independently.

Panda Express leverages opportunities fomented by China for both a protective and influence advantage. This concept is not an evaluation of the technical aspects of a possible tactical advantage on a notional battlefield. Assessments would need to be made about just how close these vessels would have to transit near their Chinese escorts to achieve sufficiently low levels of probability hit (PH) or probability of kill (PK) for inbound Houthi missiles. Similarly, there would be limits to how many vessels could safely transit in company with each Chinese vessel. This concept is rather about taking advantage of the deterrent value of the present situation and using it as a way to exact diplomatic costs on China for sticking to its opportunistic agenda in the Middle East. This is a way to erode China’s economic and diplomatic advantages by highlighting China’s malign opportunism and providing safe passage through the Red Sea. Panda Express is a low cost, legal, and pragmatic way to compete with China.

What will Panda Express accomplish? This escort tactic would begin to serve as a strategic deterrent against Houthi attacks in three ways. First and foremost, the risk of the Houthis accidentally hitting a Chinese vessel while targeting other vessels one would be too great, and it would deter attacks on any ships traveling in close company with Chinese ships. Additionally, Panda Express could reduce the strain on the contingent of warships supporting Operation Prosperity Guardian and Operation Aspides that are spread very thin by helping to better position these assets in order to more efficiently focus their layered defense on the places where they can be most effective. Lastly, diplomatically, China could be held accountable for malign hedging behavior and an opportunistic silent partnership with Iran. Panda Express could drive China to increase pressure on Iran to rein in all Houthi attacks, not just prevent attacks on Chinese vessels.

How long could Panda Express be sustained? There are risks to be sure, but most are worth accepting. China might stop sending its ships through the Red Sea, but this is extremely unlikely. The Suez Canal and Red Sea serve as the primary route for China’s westward shipments of goods, including around 60% of its exports to Europe, representing one-tenth of the Suez Canal’s annual traffic. China cannot afford to avoid the Red Sea route altogether.

The maritime shipping industry can determine that the cost of loitering at the entrances to the Red Sea and the Gulf of Aden to wait for Chinese escort are too high. Yes, loitering temporarily for a few hours costs some money, but it is also likely to be far less than transiting around the Capes of Africa.

All this cat and mouse activity on the high seas might lead to collisions between vessels, but these are professional mariners with years of experience plying these waters. They can handle it. And, if Chinese ships were to be instructed to somehow attempt to disrupt this passive escort program, it will only cost them more in time and money.

China: A Silent Partner in the Axis of Insecurity

Is Panda Express worth it? Some points to consider: Chinese leaders have repeatedly claimed they hold very little sway over Iran, and by extension the Houthis; however, several key factors seem to indicate otherwise, and China’s opportunistic fingerprints are all over the Red Sea crisis. China asked Iran to rein in the Houthis. China is not alone in asking Houthis to cease the attacks. Yet, the Houthis publicly stated only Chinese and Russian ships have a free pass.

China knows its ships are safe, too. Despite having a significant naval presence in the region, China has kept its Naval Escort Task Force (NETF) out of the Red Sea, choosing instead to loiter in the safer waters of the eastern Gulf of Aden. In late February, the Chinese Defense Ministry denied the 46th NETF deployment is related to the Red Sea crisis and reiterated that it is a “regular escort operation.”10 That none of these NETF vessels are needed in the Red Sea to ensure the safe passage of Chinese shipping is proof China knows its vessels are exempt from Houthi attack.

China does indeed have influence over Iran and, by extension, the Houthis in what has now become an “Axis of Insecurity.” Panda Express would reduce the likelihood of new attacks like that on M/V True Confidence and M/V Huang Pu and put direct pressure on China to either explain to the court of international opinion why shadowing Chinese vessels is a safe tactic, or influence Iran and the Houthis to end their aggression in the Red Sea altogether. Either way, China loses, and the rest of the world wins. It’s time to order Panda Express.

Commander Clay Robinson is a retired surface warfare officer and antiterrorism/force protection specialist. He has worked for the U.S. Department of Defense since 2017 as a strategic planning specialist and is currently an Adjunct History Instructor with the U.S. Naval Community College. He served on board the USS Russell (DDG-59), USS Laboon (DDG-58), and USS Nitze (DDG-94), and commanded Maritime Civil Affairs Squadron One (MCAS-1).

This article appears courtesy of CIMSEC and may be found in its original form here.

Top image: File image courtesy Fletcher6 / CC BY SA 3.0

MSC and Italy’s State-Owned Railway Launch Intermodal Company

MSC Mediterranean Shipping Company and Ferrovie dello Stato Italiane, Italy's state-owned national railway company, are launching a new business to develop intermodal sea and rail transport from Italy’s ports and connecting to Europe’s railway network. The two companies have been working together to study the possibility of launching a commercial and operational partnership for the development of intermodal transport linked to maritime operations.

- Critically, they also point out that the goal is to reduce the use of road transportation for cargo which will directly contribute to reducing emissions and improving the environment.

The agreement provides for the establishment of a new company jointly owned 51 percent by Mercitalia Logistics, FS Italiane Group’s Logistics Business Division. MSC through a subsidiary MEDLOG, which specializes in intermodal transport and logistics, will hold 49 percent of the new company.

The collaborative effort will create new terminal capacity based on the development of maritime intermodal traffic, to and from Italian ports. It will also seek to improve the quality of services and provide a competitive alternative to road transport as well as on the Italy-Northern Europe axis.

According to the companies, these initiatives are part of the joint mission of Ferrovie dello Stato Italiane and MSC Group to support the development of the Italian economy through greater use of rail mobility.

They will look to increase the volume of goods transported by train by creating more effective connections between Italy’s ports and terminals and the national network. They will also look to expand to European railway corridors, consolidating the integration of sea-rail-road transport systems.

- Last month, MSC acquired an approximately 50 percent stake in Italo - Nuovo Trasporto Viaggiatori, one of Europe’s leading private high-speed rail operators.

- Since its launch in 2012, Italo has grown to operate a fleet of 51 energy-efficient electric trains, connecting 51 cities across Italy and serving over 20 million passengers per year. FS and Italo combined account for most of Italy’s cargo and passenger transport by train.

Diego Aponte, Group President of MSC Mediterranean Shipping Company, speaking about the Italo acquisition reported that the company’s goal is to further develop sustainable modes of transport, for both passengers and cargo.

- They reported that GIP would hold the other approximately 50 percent interest in Italo along with co-investors which includes Allianz Group entities and funds managed by Allianz Capital Partners.

___________________________________________________________________________________

__

This content was published on November 28, 2023 - 11:00

Secrecy: MSC’s profits and turnover are a family secret. Family and company representatives almost never give interviews. According to media reports, MSC generated a turnover of over €86 billion (CHF83 billion) and a profit of €36 billion in 2022.

_____________________________________________________________________________________

ADDENDA/REFERENCES

No comments:

Post a Comment