Kathy Jones, chief fixed-income strategist at Charles Schwab, looks at what President Joe Biden's decision to abandon his reelection bid and endorse Vice President Kamala Harris means for financial ...

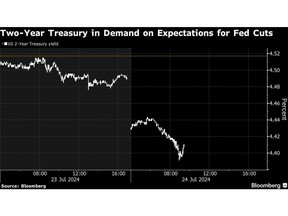

(Bloomberg) -- The yield on two-year Treasuries plunged to the lowest since February as speculation mounted that Federal Reserve officials will soon cut US interest rates.

Most Read from Bloomberg

What Initial Polling Data Show About the Trump-Harris Matchup

Stocks Get Hit as ‘AI Trade’ Slams Into a Wall: Markets Wrap

Tesla Slumps as Musk Tethers Its Future to Delayed Robotaxis

Investors were focused on former New York Fed President William Dudley’s call for lower US borrowing costs and weaker economic data as yields slipped around the globe on Wednesday. In a Bloomberg Opinion column, Dudley said policymakers should reduce rates soon — preferably at next week’s gathering.

Swaps traders are pricing in about 64 basis points of Fed rate reductions this year, with the first move seen coming in September.

Swaps traders are pricing in about 64 basis points of Fed rate reductions this year, with the first move seen coming in September.

On Wednesday, short-term Treasury rates saw the biggest declines, outstripping moves lower in long-term peers.

- Two-year yields fell as much as seven basis points to below 4.39% for the new issue sold at an auction this week, while benchmark 10-year yields slid as much as four basis points.

“We are seeing a perfect storm for the continuation of a major steepening trade in the US Treasury market,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC.

With short-dated Treasury yields declining the most, widely watched differentials hit their most extreme levels in months. The two-year note’s yield exceeded the 10-year’s by about 15 basis points, the smallest margin seen this year.

Another popular differential, between five- and higher-yielding 30-year yields, increased to about 36 basis points, just shy of a January high.

Brenner cited unexpectedly soft manufacturing data in Germany that signaled global growth was slowing and Dudley’s remarks as catalysts.

Another popular differential, between five- and higher-yielding 30-year yields, increased to about 36 basis points, just shy of a January high.

Brenner cited unexpectedly soft manufacturing data in Germany that signaled global growth was slowing and Dudley’s remarks as catalysts.

- Business activity in the US accelerated in early July at the fastest pace in more than two years on stronger services demand, though manufacturing slipped back into contraction territory.

- Sales of new US homes unexpectedly declined for a second month in June.

To Kushma, two-year yields have already fallen about enough to reflect at least most of any upcoming Fed cuts. “I don’t think the Fed is going to cut rates enough in the next six to nine months to justify two-year notes 4.25% or lower than that,” he said.

No comments:

Post a Comment