|

EMBARGOED UNTIL RELEASE AT 8:30 a.m. EST, Wednesday, December 18, 2024

U.S. International Transactions, 3rd Quarter 2024

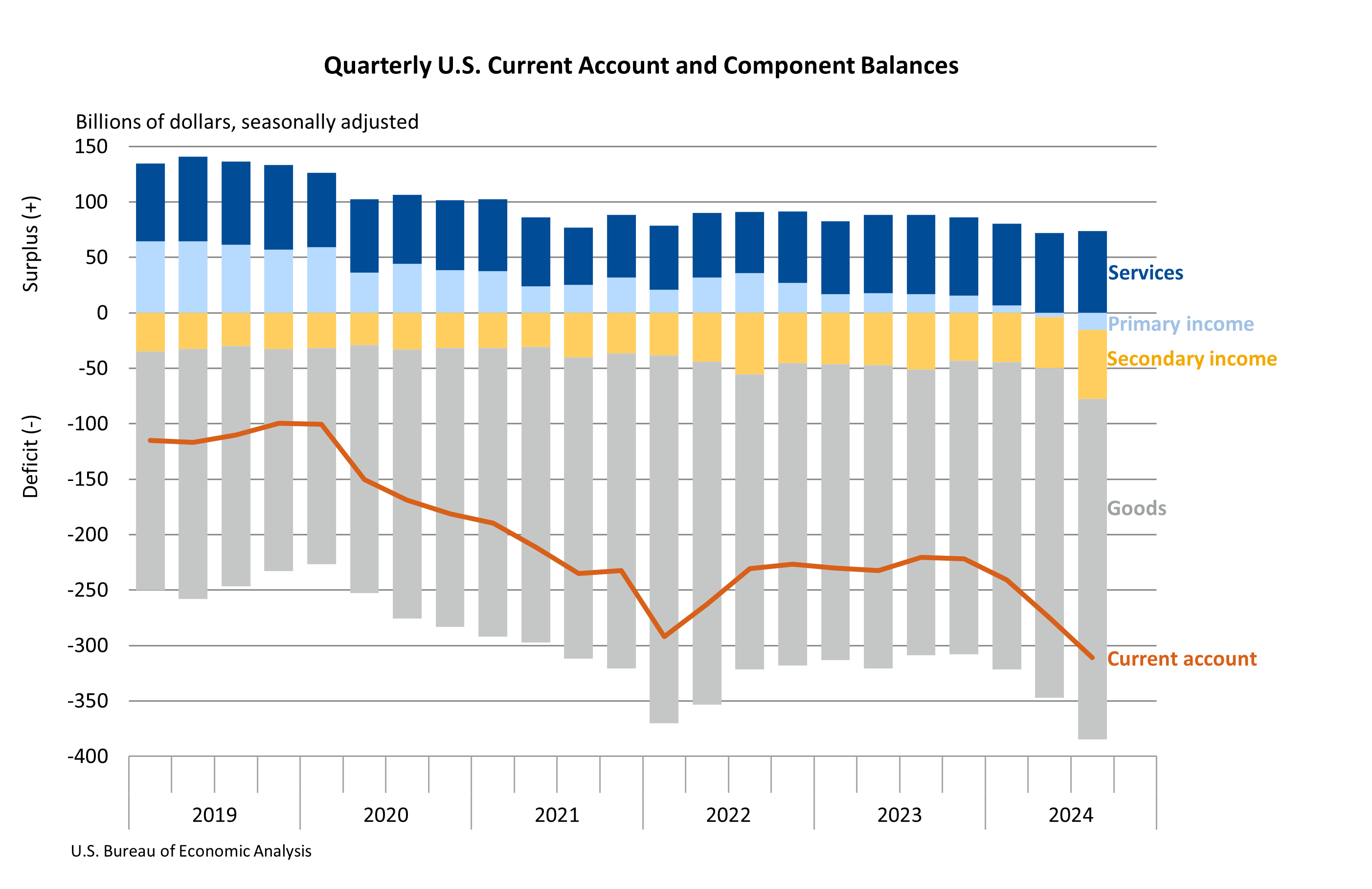

Current-Account Deficit Widened by 13.1 Percent

Current-Account Balance (chart 1)

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $35.9 billion, or 13.1 percent, to $310.9 billion in the third quarter of 2024, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). The revised second-quarter deficit was $275.0 billion.

The third-quarter deficit was 4.2 percent of current-dollar gross domestic product, up from 3.7 percent in the second quarter.

The $35.9 billion widening of the current-account deficit in the third quarter reflected expanded deficits on secondary income, on primary income, and on goods.

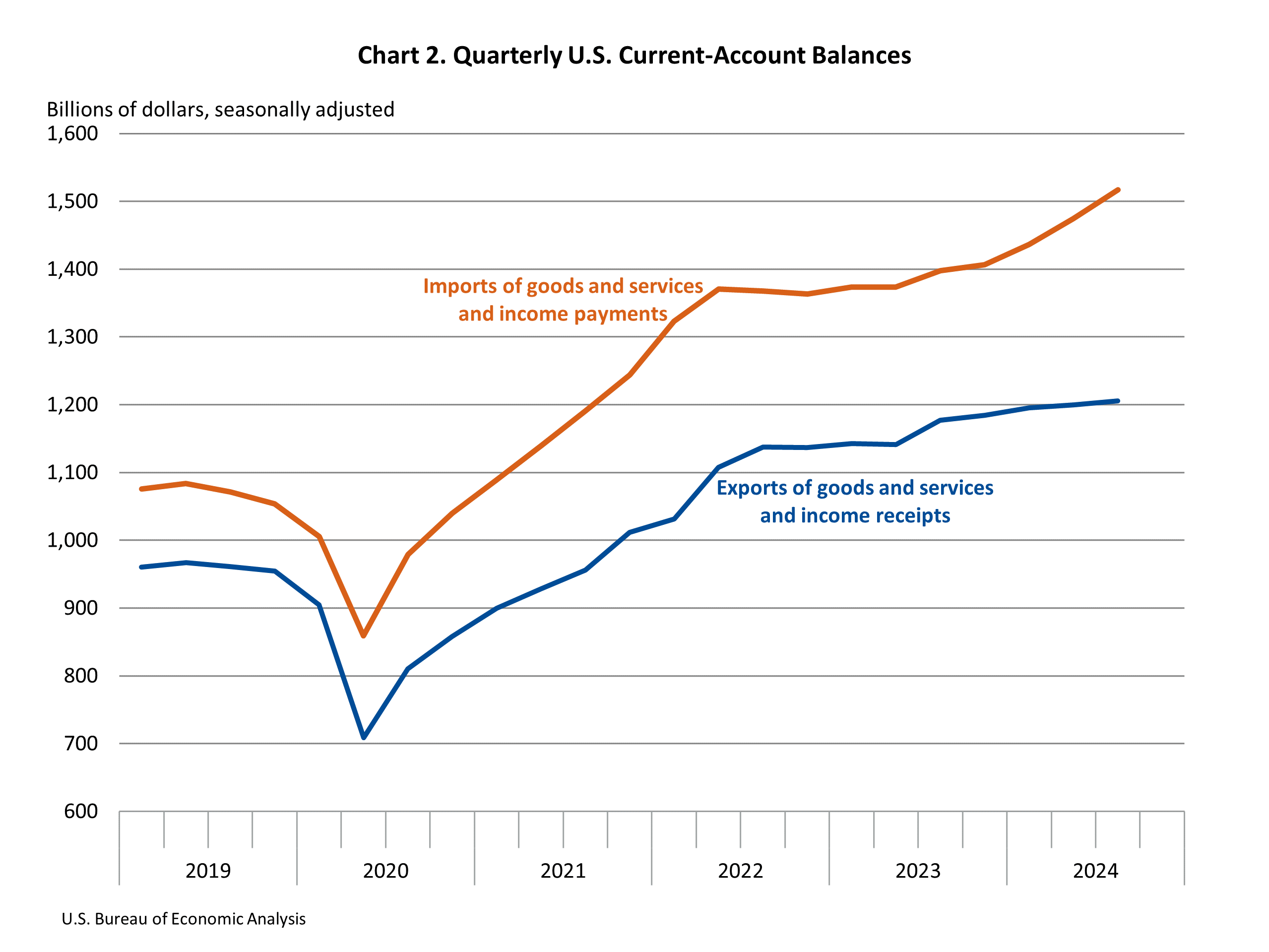

Current-Account Transactions (tables 1–5 and chart 2)

Exports of goods and services to, and income received from, foreign residents increased $6.0 billion to $1.21 trillion in the third quarter. Imports of goods and services from, and income paid to, foreign residents increased $42.0 billion to $1.52 trillion.1

Trade in goods (table 2)

Exports of goods increased $13.6 billion to $530.0 billion, reflecting an increase in capital goods, mostly semiconductors; computer accessories, peripherals, and parts; and civilian aircraft. Imports of goods increased $23.7 billion to $837.2 billion, reflecting increases in capital goods, mostly computer accessories, peripherals, and parts; electric-generating machinery, electric apparatus, and parts; and computers, and in consumer goods, mainly medicinal, dental, and pharmaceutical products.

Trade in services (table 3)

Exports of services increased $7.7 billion to $279.9 billion, reflecting increases in government goods and services, mostly military units and agencies, and in telecommunications, computer, and information services, mostly computer services. Imports of services increased $6.0 billion to $206.2 billion, reflecting increases in charges for the use of intellectual property, mostly licenses to reproduce and/or distribute audiovisual products, and in insurance services, mostly reinsurance.

Primary income (table 4)

Receipts of primary income decreased $15.5 billion to $345.7 billion, reflecting a decrease in direct investment income, mainly earnings. Payments of primary income decreased $3.8 billion to $361.2 billion, reflecting decreases in direct investment income, mainly earnings, and in portfolio investment income, mainly interest on long-term debt securities.

Secondary income (table 5)

Receipts of secondary income increased $0.2 billion to $50.2 billion, reflecting an increase in private transfers, mostly insurance-related transfers. Payments of secondary income increased $16.1 billion to $112.0 billion, reflecting an increase in general government transfers, mostly international cooperation.

Capital-Account Transactions (table 1)

Capital-transfer receipts were $1.6 billion in the third quarter. The transactions reflected receipts from foreign insurance companies for losses resulting from Hurricane Helene. For information on transactions associated with hurricanes and other disasters, see “How do losses recovered from foreign insurance companies following natural or man-made disasters affect foreign transactions, the current account balance, and net lending or net borrowing?”. Capital-transfer payments increased $1.8 billion to $3.3 billion, reflecting an increase in infrastructure grants.

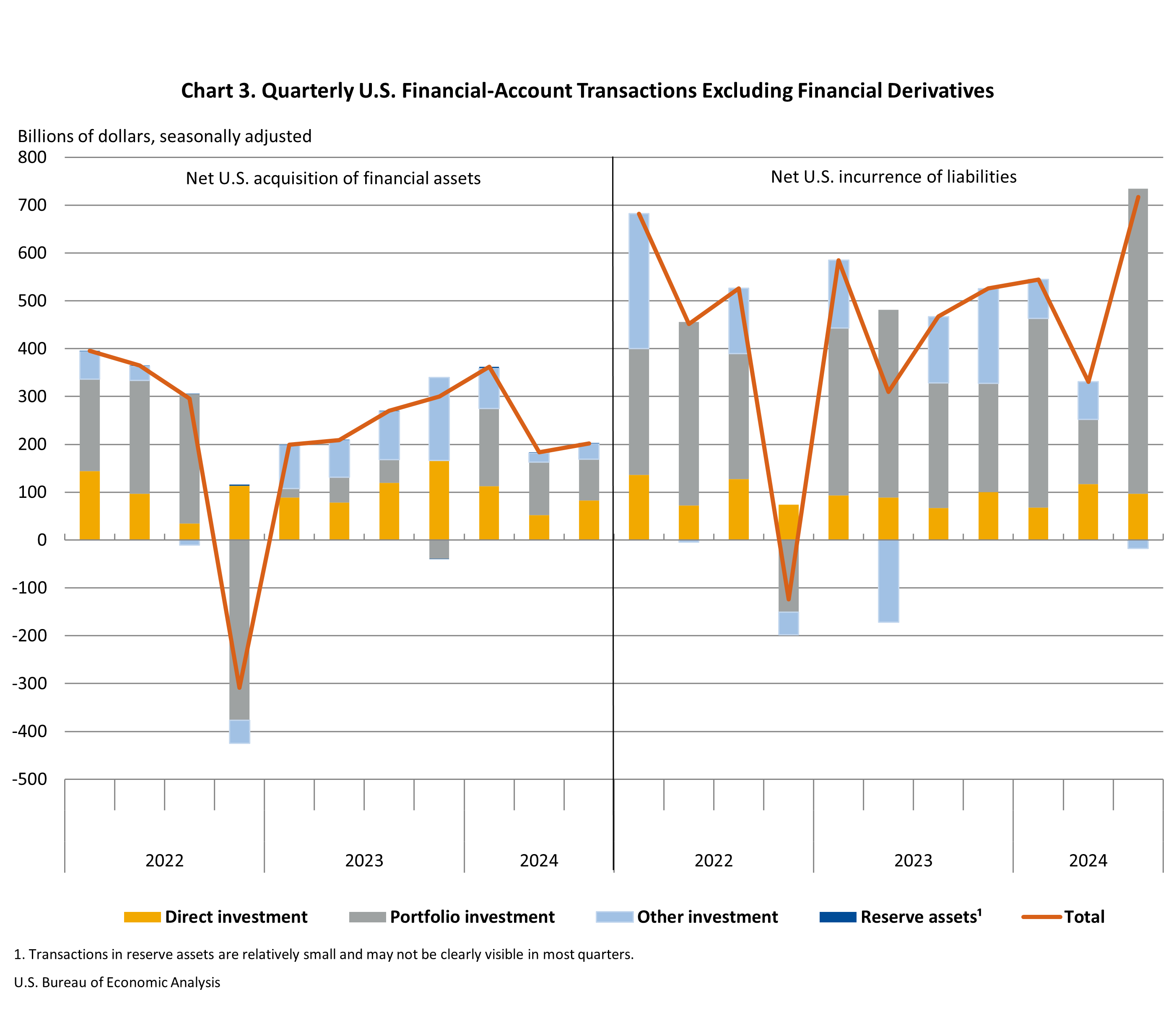

Financial-Account Transactions (tables 1, 6, 7, and 8 and chart 3)

Net financial-account transactions were −$493.6 billion in the third quarter, reflecting net U.S. borrowing from foreign residents.

Financial assets (tables 1, 6, 7, and 8)

Third-quarter transactions increased U.S. residents’ foreign financial assets by $201.9 billion. Transactions increased portfolio investment assets, both equity and debt securities, by $86.4 billion; direct investment assets, mostly equity, by $82.6 billion; “other investment assets,” primarily deposits, by $32.8 billion; and reserve assets by $7 million.

Liabilities (tables 1, 6, 7, and 8)

Third-quarter transactions increased U.S. liabilities to foreign residents by $716.7 billion. Transactions increased portfolio investment liabilities, both debt securities and equity, by $637.6 billion, and direct investment liabilities, mostly equity, by $96.6 billion. Transactions decreased “other investment liabilities” by $17.6 billion, reflecting a decrease in deposits that was mostly offset by an increase in loans.

Financial derivatives (table 1)

Net transactions in financial derivatives were $21.2 billion in the third quarter, reflecting net U.S. lending to foreign residents.

Table A. Updates to Second-Quarter 2024 International Transactions Accounts Balances [Billions of dollars, seasonally adjusted] | ||

| Preliminary estimates | Revised estimates | |

|---|---|---|

| Current-account balance | –266.8 | −275.0 |

| Goods balance | −297.1 | −297.2 |

| Services balance | 73.9 | 71.9 |

| Primary income balance | 1.1 | −3.8 |

| Secondary income balance | −44.7 | −46.0 |

| Net financial-account transactions | −304.3 | −218.3 |

| U.S. Bureau of Economic Analysis | ||

Next release: March 20, 2025, at 8:30 a.m. EDT

U.S. International Transactions, 4th Quarter and Year 2024

Note: With the release of “U.S. International Transactions, 4th Quarter and Year 2024” on March 20, 2025, BEA will discontinue the “Release Highlights” document that has accompanied each news release as part of the release’s “Related Materials.” Information previously included in Highlights will continue to be available in the release and on BEA’s website.

U.S. International Transactions Release Dates in 2025 | ||

| 4th Quarter and Year 2024 | March 20 | |

| 1st Quarter 2025 and Annual Update | June 24 | |

| 2nd Quarter 2025 | September 23 | |

| 3rd Quarter 2025 | December 18 | |

1 U.S. international transactions are presented in current dollars in accordance with international statistical presentation guidelines. For a comparison of current-dollar, or nominal, and inflation-adjusted, or real, measures of international transactions, see “SECTION 4 – FOREIGN TRANSACTIONS” of the National Income and Product Accounts.==

No comments:

Post a Comment