Heading into the meeting, pricing indicated virtually no chance of a cut this week and less than 30% probability of a move in June, with the next reduction expected in July. Traders are pricing in a total of three cuts this year, though that could change following Wednesday’s decision.

The committee’s decision to hold the benchmark rate steady was unanimous. The fed funds rate is used by banks for overnight lending but also feeds into other consumer debt such as mortgages, auto loans and credit cards.

Policymakers have largely been in agreement that the central bank is in a

good position, with the economy generally holding up for now, to be

patient as it calibrates monetary policy.

Fed holds rates steady as it notes rising uncertainty and stagflation risk

- The Federal Reserve held its key interest rate unchanged in a range between 4.25%-4.5%, where it has been since December.

- The post-meeting statement noted the recent market volatility and how that is factoring into the central bank’s policy decisions.

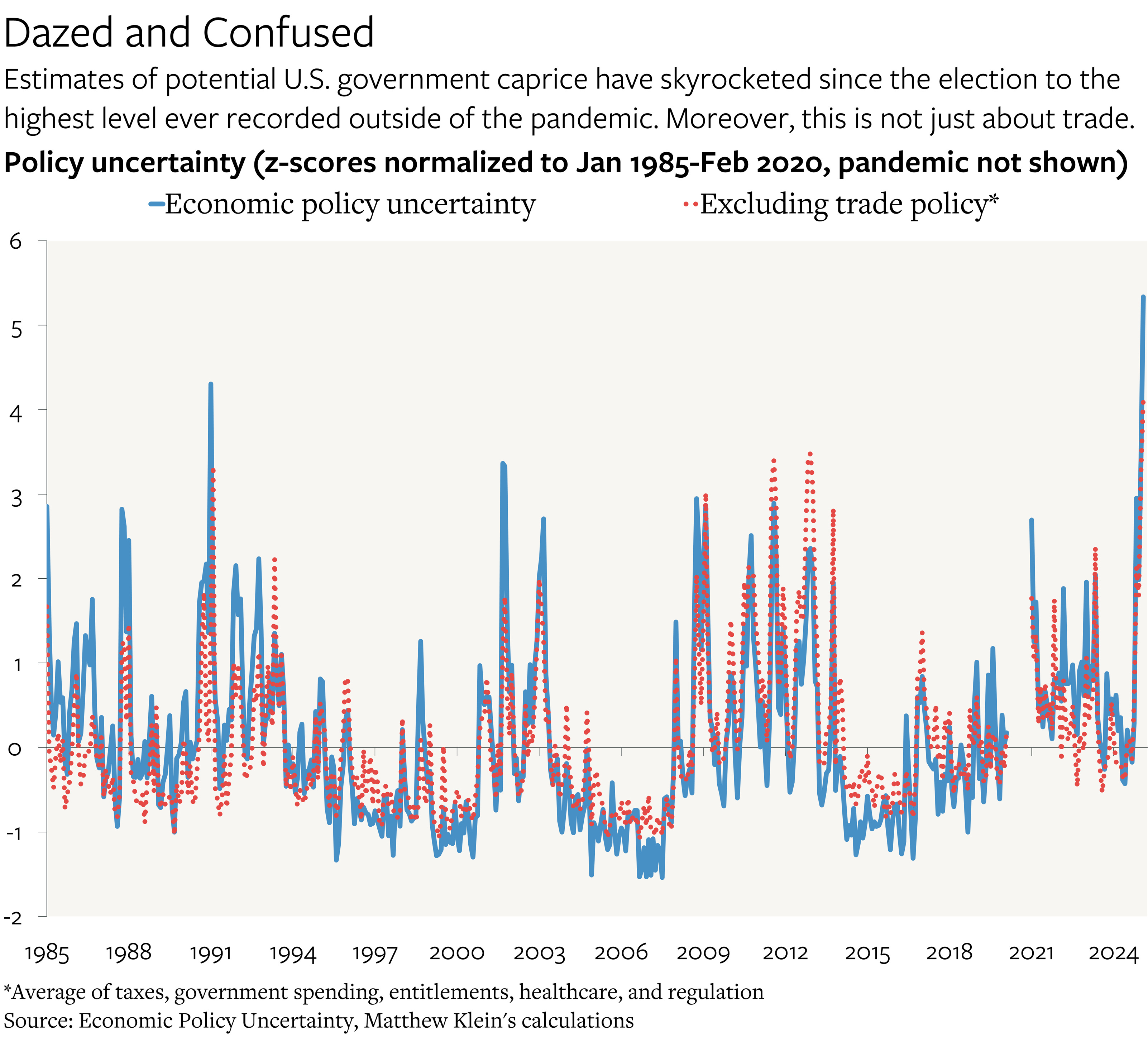

- “Uncertainty about the economic outlook has increased further,” the statement said.

Stocks briefly ceded some gains after the rate announcement but mostly recovered, with the Dow Jones Industrial Average up nearly 300 points despite some worries over the Fed’s characterization of the economic risks.

“The May FOMC statement in effect warns that a large trade shock is still set to hit the economy in spite of efforts by the Trump administration to deescalate, with the Fed seeing the risks ahead as two-sided and not providing any early dovish lean in favor of a June rate cut,” wrote Krishna Guha, head of global policy and central bank strategy at Evercore ISI. “The net implications for risk assets are negative.”

A possible stagflationary scenario

Finding the balance between the two elements of the Fed’s so-called dual mandate of full employment and stable prices has been made more difficult lately amid President Donald Trump’s tariff push.

In noting that tariffs both threaten to aggravate inflation as well as slow economic growth, the statement raises the possibility of a stagflationary scenario largely absent from the U.S. since the early 1980s.

Policymakers have largely been in agreement that the central bank is in a good position, with the economy generally holding up for now, to be patient as it calibrates monetary policy. . .

Source: CNBC

Fed holds rates steady amid rising risks, leaving markets in limbo

Published: 15:25 07 May 2025 EDT

The Federal Reserve left interest rates unchanged on Wednesday, a widely anticipated move that underscored growing concerns about both inflation and employment in the face of escalating trade tensions.

In a unanimous decision, the Federal Open Market Committee (FOMC) held the benchmark federal funds rate at a range of 4.25% to 4.5%.

While the Fed’s baseline outlook remains largely intact—describing the economy as expanding at a “solid pace”—its post-meeting statement carried a sharper tone on emerging risks.

“The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen,” the Fed said, a notable shift from its March language.

Wait and see

Analysts say the Fed is signaling a pivot to a more cautious, watchful stance as the economic crosswinds grow stronger.

“The best course of action for the FOMC may simply be to wait for more clarity about trade policy and its implications for the US economy,” economists at Wells Fargo wrote in a note following the decision. “There may be some tension in terms of the Fed's dual mandate in coming months.”

With inflation still hovering above the Fed’s 2% target—recent readings show core PCE inflation at 2.6%—and a fresh round of tariffs poised to lift prices further, the central bank faces a difficult balancing act. At the same time, softening labor market indicators suggest that the job market may be losing momentum. Job openings have declined, companies are dialing back hiring plans, and consumer spending is showing signs of fatigue.

“The Federal Reserve is in a bind,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management. “Concerns about inflation and an economic slump are pulling them in two opposite directions. The Fed is going to have to wait for unemployment to spike before they resume cutting rates, and by that point it might be too late.”

Trade policy looms large

Markets largely took the Fed’s announcement in stride on Wednedsay, but the underlying message has some investors bracing for renewed volatility if the trade environment doesn’t stabilize.

“Unless some trade deals are made before the tariff pause runs out, we are going to see markets drop again like they did in early April,” Zaccarelli added.

Indeed, the Fed’s latest statement appeared to place greater emphasis on the risks stemming from trade policy. Jamie Cox, managing partner at Harris Financial Group, said the Fed “isn’t pulling any punches on the potential for tariffs to cause stagflation.”

“They see growth as better than expected,” Cox said, “but the uncertainty around tariffs is too large to ignore.”

An open mind

Chair Jerome Powell, in his post-meeting press conference, reiterated the Fed’s wait-and-see approach, noting that while the first-quarter GDP was weighed down by import volatility, labor market conditions remain solid. Still, Powell acknowledged that consumer sentiment has soured and that businesses are becoming more cautious, in part due to the unpredictable tariff landscape.

According to Bill Adams, chief economist at Comerica Bank, the Fed is signaling an open mind for its next move but is unlikely to act until it sees more clarity on the real economic effects of tariffs.

Behind the headlines, businesses are wrestling with difficult decisions on hiring, spending, and inventory management, as they weigh whether to absorb higher costs or bet on a possible easing of tariffs.

“If tariffs stay at current levels or rise further, they would likely result in a big increase in inflation, higher unemployment, and a retrenchment of consumer spending,” Adams warned.

For now, the Fed appears content to stay put, hoping that time and diplomacy will provide the clarity it needs. But with inflation proving stubborn and the job market losing steam, the room for error is shrinking.

No comments:

Post a Comment