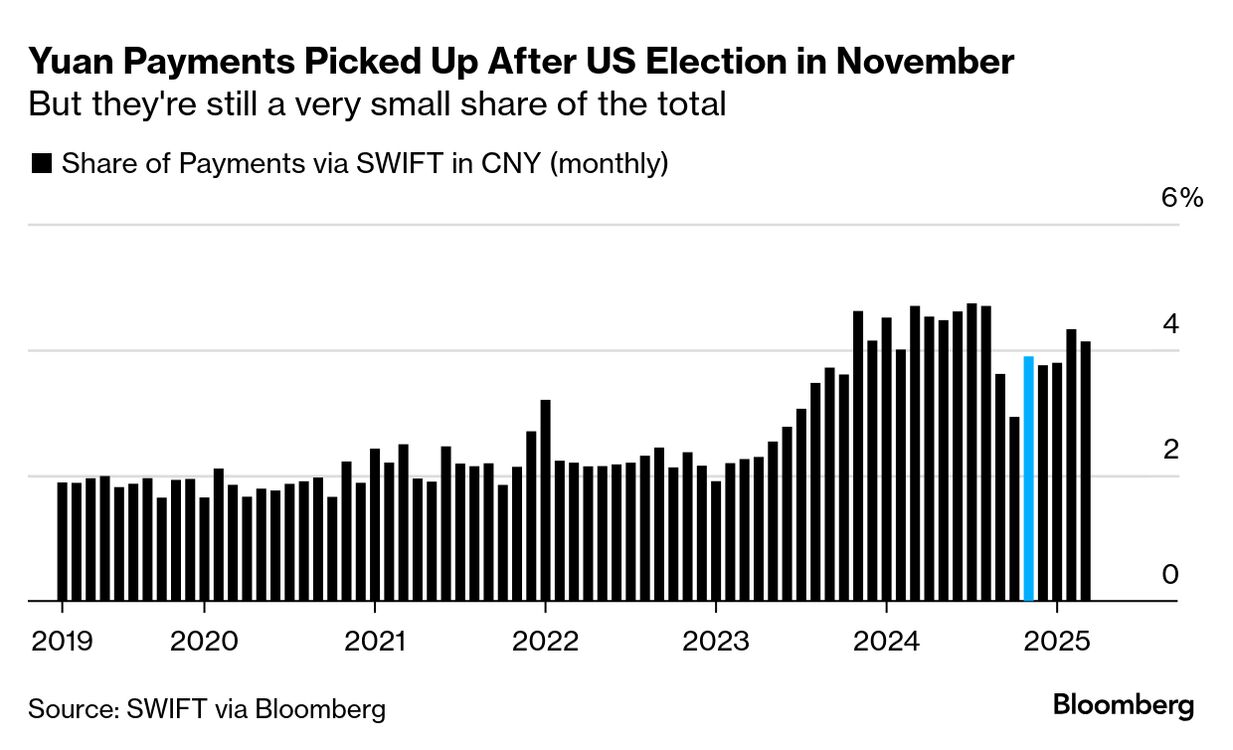

Global shift to bypass the dollar is gaining momentum in Asia

Firms

are receiving more requests for transactions including hedges that

sidestep the dollar and involve currencies such as the yuan, the Hong

Kong dollar, the Emirati dirham and the euro

US Fed’s Williams says crucial to anchor inflation expectations

(May 9): Federal Reserve Bank of New York president John Williams said keeping inflation expectations anchored near policymakers’ target forms the “bedrock” of central banking.

- Consumers’ expectations for inflation in the medium term spiked in April, according to a New York Fed survey. Household views on the jobs market also deteriorated.

- At the same time, President Donald Trump is placing increased pressure on policymakers to cut interest rates to support the economy against the impact of tariffs on growth and the labor market.

Williams’ comments suggest he’s especially attentive to the inflation side of the Fed’s mandate. That aligns with recent remarks from Fed chair Jerome Powell, who said sustained full employment cannot be achieved without maintaining price stability.

“Today, regardless of economic shocks, changes in government policies or swings in globalisation and deglobalisation, central banks recognise that maintaining price stability is their job: They are the protectors of price stability,” Williams said. He added that by effectively delivering on their mandate “central banks have earned credibility with the public.”

Fed officials held borrowing costs steady earlier this week despite rising risks of higher unemployment and inflation. Policymakers are waiting to gain clarity on how an aggressive set of tariffs will shape the economy.

“There’s no doubt that uncertainty will continue to be the defining characteristic of the monetary policy landscape for the foreseeable future,” Williams said.

The Trump administration is set to begin talks with Chinese representatives this weekend in what analysts hope will be the first step toward an agreement to lower tariffs.

Williams said in mid-April that policymakers needed to make sure a one-time spike in inflation driven by tariffs won’t become a more persistent inflation problem.

Uploaded by Magessan Varatharaja

18 hours ago — Banks and brokers are seeing rising demand for currency derivatives that bypass the dollar, with firms receiving more requests for transactions ...

No comments:

Post a Comment