Trump can push the United States into a debt abyss with a "big and beautiful" law

- This came after a congressional committee on Sunday promoted a budget.

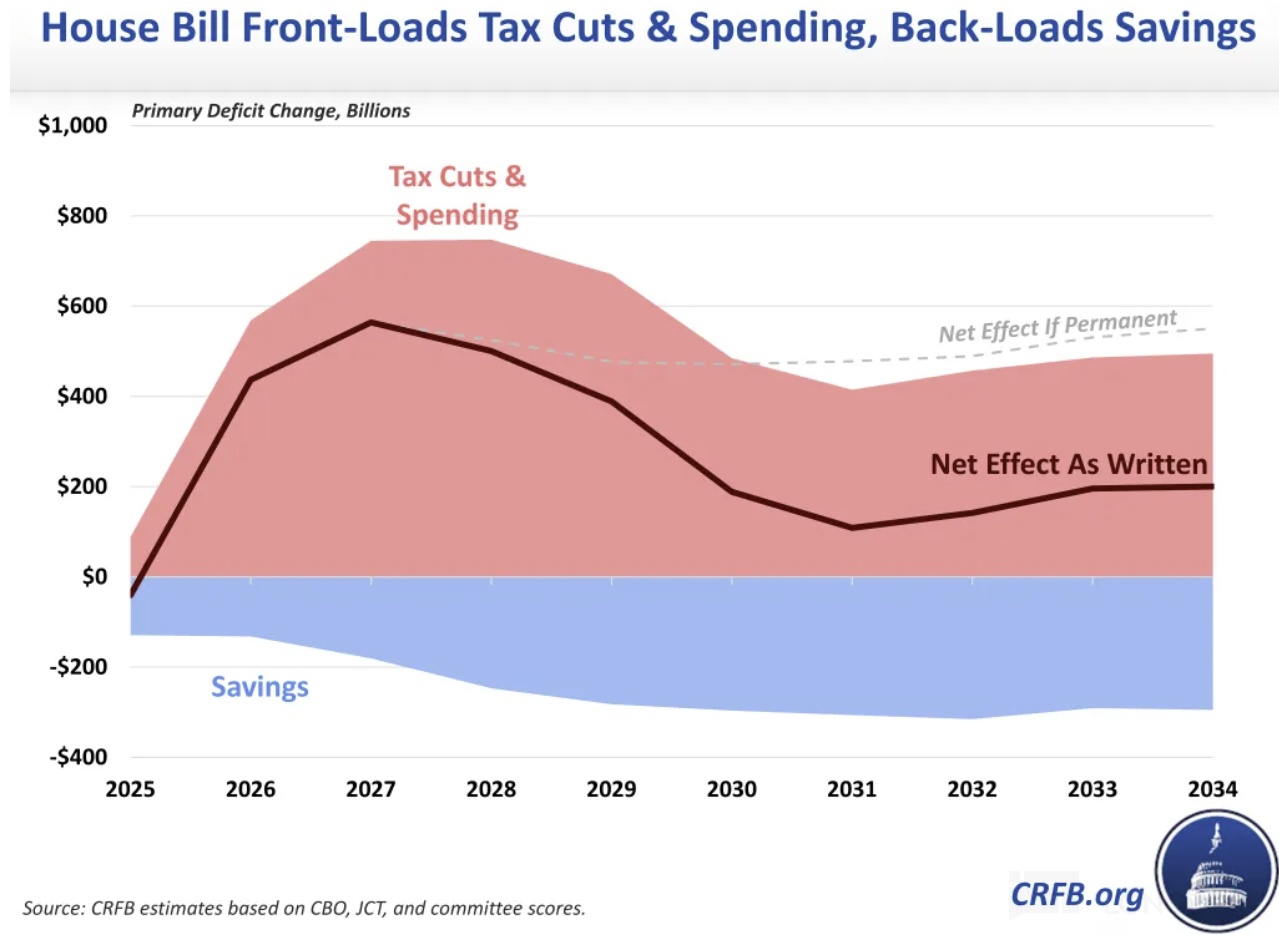

- It is expected to add trillions of dollars to the federal budget deficit over the next decade due to continued tax breaks.

- The tax return and downgrade have only raised concerns about the sustainability of public finances, especially since analysts and investors consider the current level of debt and deficit too high.

Funding for Medicaid programs (insurance for the poor) and food aid programs is also expected to be reduced. Republicans are demanding even greater spending cuts.

White House spokeswoman Carolyn Levitt said Monday that the "do not increase the deficit", reiterating the Trump administration's position that tax cuts stimulate economic growth.

- However, it is projected that the government will increase public debt by at least $ 3.3 trillion by 2034.

- The share of debt from GDP will increase from the current 100% to a record 125%, which exceeds the current forecast (117%).

- The annual budget deficit will increase from about 6.4% of GDP in 2024 to 6.9%.

To cover the growing debt, the government will have to sell bonds more actively. But investors are likely to demand higher returns, which will make borrowing more expensive.

Let's remind:

Moody's Ratings is the latest of the major rating agencies reduced credit rating of the United States. Moody's has held a flawless US credit rating since 1917.

The agency now rates US creditworthiness one level lower, Aa1. At the same time Moody's said the United States does not currently have a direct threat of re-declining.

American stock indexes decreased,, and profitability state bonds increased after that, as rating agency Moody's reduced credit rating USA for the first time since 1917.

No comments:

Post a Comment