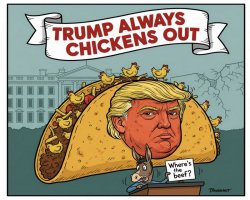

- The term gained rapid traction among traders, investors, and political analysts as a framework for understanding not merely trade policy but a broader pattern of presidential behavior characterized by dramatic threats followed by strategic retreats.

The concept builds on an earlier Wall Street coinage, the "Trump put," which during Trump's first term described his apparent tendency to modify policies when financial markets reacted negatively, suggesting that investors could effectively rely on market pressure to constrain presidential actions that might harm asset values. The TACO formulation represents a more pointed and provocative articulation of this same insight, transforming what had been neutral financial jargon into explicitly pejorative political commentary. The acronym's adoption reflects growing recognition among market participants and policy observers that Trump's negotiating style, while producing considerable volatility and uncertainty, follows sufficiently consistent patterns to enable strategic positioning. Traders who recognized this pattern early in 2025 reportedly profited by purchasing stocks after tariff announcements drove prices down, then selling after subsequent policy reversals produced rebounds, a strategy some financial professionals explicitly labeled the "TACO trade."2

Liberation Day and the Tariff Cycle

The pattern that crystallized the TACO concept centered on Trump's April 2, 2025, announcement of what he termed "Liberation Day" tariffs, which represented perhaps the most dramatic example of this cycle. In a White House Rose Garden ceremony, Trump signed Executive Order 14257, declaring a national emergency over the United States trade deficit and invoking the International Emergency Economic Powers Act to authorize sweeping tariffs on foreign imports. The order imposed a ten percent baseline tariff on imports from nearly all countries beginning April 5, with country-specific tariff rates scheduled to commence April 9. Trump characterized these measures as "reciprocal," asserting they mirrored trade barriers faced by American exports, and declared April 2 as "one of the most important days in American history" and "our declaration of economic independence."3 The actual tariff structure proved considerably more complex and arbitrary than the reciprocal framing suggested, with rates apparently based substantially on bilateral trade deficits rather than matching foreign tariffs, resurrecting a decades-old proposal from former Representative Richard Gephardt that President Ronald Reagan had vetoed in 1987.4

Markets responded with immediate and severe turbulence. Following the Liberation Day announcement, the United States total stock market index plunged by approximately 12.4 percent over the subsequent week, marking the largest decline since the COVID-19 pandemic disruption in 2020. The S&P 500 fell more than 15 percent from its earlier 2025 highs, erasing trillions of dollars in market capitalization as investors grappled with uncertainties about supply chain disruptions, rising input costs, and potential retaliatory measures from trading partners. Major retailers warned that the tariffs would force immediate price increases and product shortages. Congressional Republicans, while publicly supporting the president, privately expressed alarm about the economic and political consequences.5 China responded by announcing matching retaliatory tariffs, initiating a tit-for-tat escalation that ultimately saw American tariffs on Chinese goods reach 145 percent while Chinese tariffs on United States imports climbed to 125 percent, creating the highest trade barriers between the world's two largest economies in modern history.6

The pattern that gave rise to the TACO meme materialized with striking speed. On April 9, just seven days after the Liberation Day announcement and mere hours before the higher country-specific tariff rates were scheduled to take effect, Trump signed an executive order pausing those increases for 90 days while maintaining the baseline ten percent tariff. White House Senior Counselor for Trade and Manufacturing Peter Navarro promised "90 deals in 90 days," suggesting the administration planned to negotiate bilateral agreements during this period that would render the threatened tariffs unnecessary. Markets responded euphorically, with the S&P 500 rallying approximately 9.5 percent in a single trading session, one of the largest single-day gains in market history, as investors interpreted the reversal as confirmation that market pressure could effectively constrain presidential action. Trading volumes surged as institutional and retail investors rushed to capitalize on what many now explicitly termed the TACO dynamic.7

The 90-day pause would be extended repeatedly over subsequent months as bilateral negotiations proceeded more slowly than the administration had projected. By late July, the United States had announced trade frameworks with only eight partners: the United Kingdom, Vietnam, the Philippines, Indonesia, Japan, South Korea, the European Union, and a temporary truce with China. The substance of many of these agreements appeared limited, often maintaining significant tariff levels while providing modest adjustments to create political cover for both sides. Navarro's promise of "90 deals in 90 days" fell dramatically short of realization, with Commerce Secretary Howard Lutnick subsequently lowering expectations to perhaps ten to twelve significant agreements by Labor Day. Trump announced on July 8 that he would delay implementation of higher tariffs yet again, pushing the deadline from July 9 to August 1, then subsequently offered additional extensions for several countries. By early August, the president was providing Mexico a further 90-day negotiating period, demonstrating the pattern's continuation well beyond the initial Liberation Day cycle.8

Variations on the Theme: Additional Trade Retreats

The Liberation Day sequence, while particularly dramatic, represented merely the most prominent example of a pattern that repeated across multiple policy domains throughout Trump's second term. On May 26, Trump announced that he would impose 50 percent tariffs on European goods, only to delay their implementation to July 9 just three days later on Memorial Day, ostensibly to provide more time for negotiations while the baseline ten percent tariff continued. Markets, which had fallen sharply on the Friday announcement, rallied 2.1 percent when trading resumed after the holiday, with traders expressing increasing confidence that Trump would ultimately retreat from his most aggressive positions when faced with economic pressure. The Financial Times' Katie Martin identified this episode as exemplifying what she termed "the Taco factor," wherein Trump reverses decisions in response to negative market reactions.9

No comments:

Post a Comment