19 May 2017

WATCH THIS Mesa Council Study Session Thu 18 May 2017

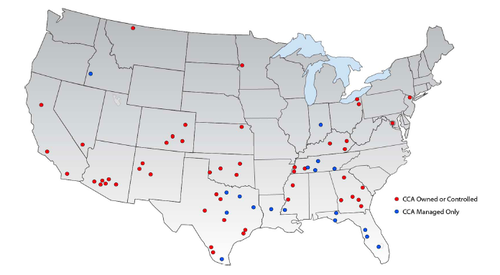

One item that's captured in the screen-shot with this post is for a review of what is on the City Council's agenda for Monday's meeting to approve or not approve tentative arrangements for making a deal with a corporation - Core Civic - for a private prison that [1] is highly questionable and [2] appears to be heavily promoted and encouraged by Interim Police Chief Mike Dvorak. The City of Mesa received a FOIA request from the American Civil Liberties Union asking for documents and records . . . More information about that can be found here .

Readers and viewers will note that District 2 Councilmember was the only one who spoke out against privatization.

See an article about the private prison contract presentation and discussion here.

[Readers will note that the Core Civic representative who appears cannot answer questions or wants to dodge them completely. After the police department's presentation, opposition is expressed by three individuals from organizations with an interest in this pending item]

This study session's Agenda is in a previous post in this blog site earlier today with some notes and details for reference.

“With the contract for the jail services, there was an increased workload in our holding facility that we found during the year,” Cannistraro said. “There were needs there and so we re-allocated some of the savings from the jail costs over into the detention area.”. . .

The budget request submitted to the council Monday shows that the Police Department has hired five full-time detention officers and one full-time administrative support assistant to “support the holding facility and to provide safe and effective process for intake, housing, and transport of arrestees

Biden Order Hits Private U.S. Prisons’ Credit Ratings

For years, private U.S. prison companies have faced scrutiny from social justice advocates, politicians and investors. Now that the Biden administration is severing the federal government’s ties, the industry’s creditworthiness is taking a hit.

Geo Group Inc. and CoreCivic Inc. -- the nation’s largest operators of private detention facilities -- citing growing questions about the outlook for the companies’ profits and concerns over their ability to refinance debt. A few hours later, Moody’s Investors Service took similar actions on both companies.

The review was prompted by President Joe Biden’s executive order in January that instructed the Department of Justice not to renew contracts with private prisons. These deals accounted for about 27% of Geo’s revenue and 24% of CoreCivic’

Both companies have seen their financing options dwindle in recent years, after major investment banks pledged to cut ties with private prison operators and as money managers face increased pressure to incorporate environmental, social and governance criteria into their investment selection.

CoreCivic clobbered on debt sale, rival’s news

authors Geert De Lombardi

Shares of private prison operator CoreCivic lost 17 percent of their value Wednesday after the company said it was raising debt and the leaders of its largest peer said they are suspending their dividend payments

Brentwood-based CoreCivic said early in the day it planned to raise $400 million in debt. Around the same time, executives of rival GEO Group said they are halting quarterly dividend payments and evaluating the company’s status as a real estate investment trust. (CoreCivic moved on from its tax-friendly REIT structure several months ago.) Both companies are facing the loss of several federal contracts in coming years after the Biden administration’s Department of Justice said it would not renew deals.

CoreCivic shares (Ticker: CXW) fell 5 percent out of the gate Wednesday after closing the previous afternoon at $9.05. But they slid steadily for another 90 minutes on heavy volume, and while investors bid them up slightly in the ensuing hours, they ended the day at $7.51, only slightly above session lows.

The drop erased a month’s worth of gains for the stock, which has a 52-week low of $5.76 and is down more than 30 percent year over year.

In addition to pressure from D.C., CoreCivic and GEO also are having to deal with a financial sector no longer as interested in funding their work. (Although pledges to stop financing the private prison sector have their limits, Bloomberg reported last week.)

Investors also are asking for a juicier return to commit their money: Late on Wednesday, CoreCivic execs said their $400 million debt plan had grown to $450 million — but that the company is pricing its five-year notes at 99 percent of their face value and setting their interest rate at 8.25 percent

No comments:

Post a Comment