China's industrial output and retail sales data on Tuesday showed the economy slowed further last month, intensifying pressure on already faltering growth and prompting authorities to cut key policy rates to shore up activity.

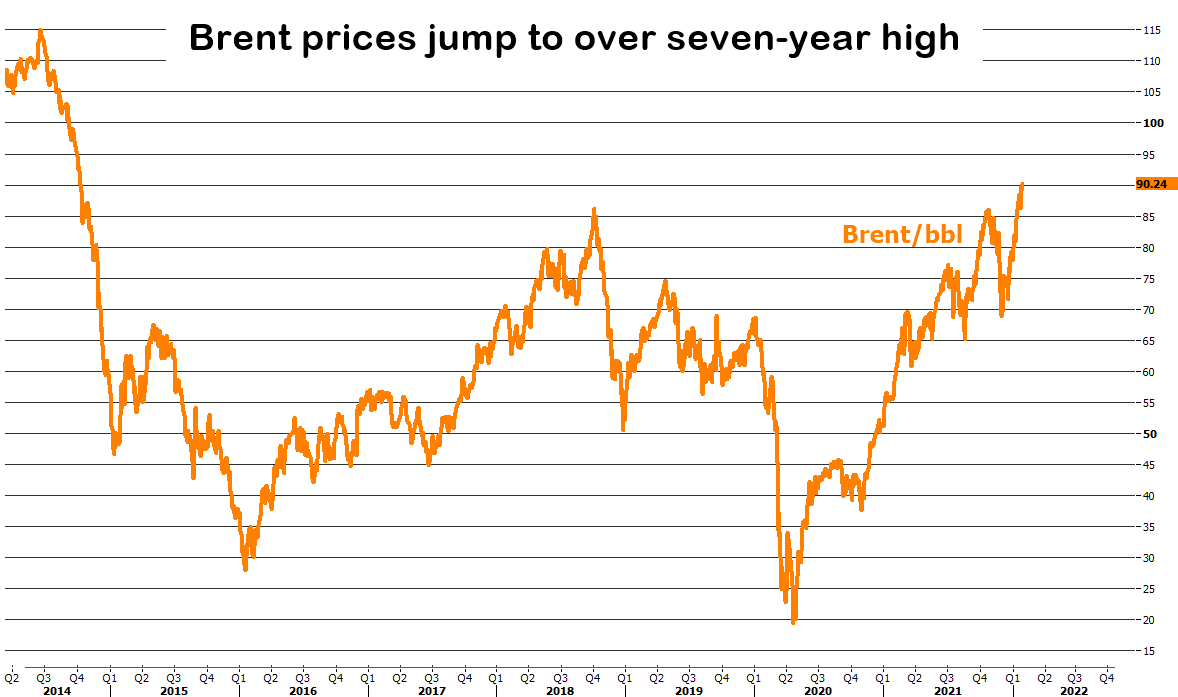

"When the oil market appears to be comfortable in rally of late, it is often the case that China is the number one fire douser, throwing a wet blanket over those dreaming for heady ($)90-handle crude and beyond," said John Evans of oil broker PVM.

"When the oil market appears to be comfortable in rally of late, it is often the case that China is the number one fire douser, throwing a wet blanket over those dreaming for heady ($)90-handle crude and beyond," said John Evans of oil broker PVM.

Oil dips as China data sours sentiment

LONDON, Aug 15 (Reuters) - Oil prices edged lower on Tuesday as sluggish Chinese economic figures were countered by Beijing unexpectedly cutting key policy rates for the second time in three months.

Brent crude futures dipped 53 cents to $85.68 per barrel by 1008 GMT. U.S. West Texas Intermediate crude slipped 66 cents to $81.85 a barrel.

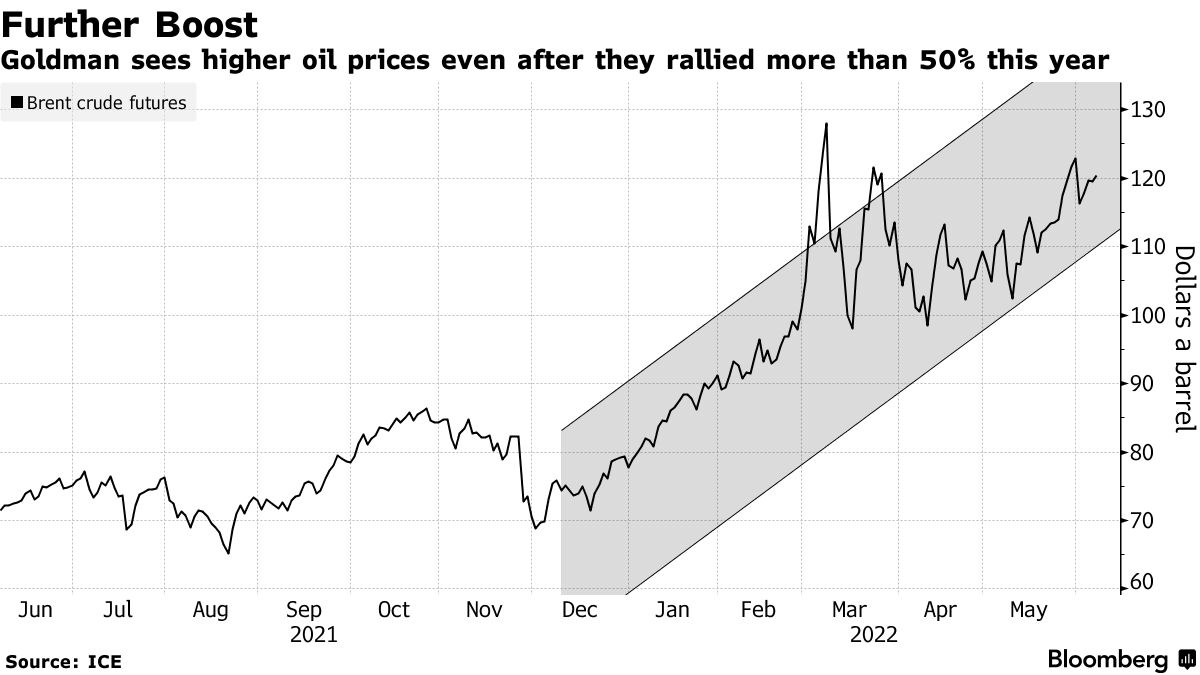

Supply cuts by Saudi Arabia and Russia, part of the OPEC+ group comprising the Organization of the Petroleum Exporting Countries and allies, had helped galvanize a rally in prices over the past seven weeks.

Brent crude futures dipped 53 cents to $85.68 per barrel by 1008 GMT. U.S. West Texas Intermediate crude slipped 66 cents to $81.85 a barrel.

Supply cuts by Saudi Arabia and Russia, part of the OPEC+ group comprising the Organization of the Petroleum Exporting Countries and allies, had helped galvanize a rally in prices over the past seven weeks.

In an effort to shore up support, the People's Bank of China (PBOC) lowered the rate on 401 billion yuan ($55.3 billion) in one-year medium-term lending facility (MLF) loans to some financial institutions by 15 basis points to 2.5%.

"The market was expecting the PBOC to wait until September before easing again, and today's cuts suggest that the authorities' concern about the state of the macroeconomy is mounting," said Robert Carnell, Asia Pacific head of research for ING Bank.

"The market was expecting the PBOC to wait until September before easing again, and today's cuts suggest that the authorities' concern about the state of the macroeconomy is mounting," said Robert Carnell, Asia Pacific head of research for ING Bank.

- On a brighter note, refinery throughput in July at the world's biggest oil importer rose 17.4% from a year earlier, as refiners kept output elevated to meet demand for domestic summer travel and to cash in on high regional profit margins by exporting fuel.

"Markets are...becoming bored of the tepid stimulus shown so far from officials who think if they keep talking big and delivering small repeatedly, investors will believe them."

Reporting by Natalie Grover; Additional reporting by Muyu Xu and Katya Golubkova; editing by Tom Hogue and Jason Neely

__________________________________________________________________________________

Oil gains halt after a seven-week rally amid concerns regarding China's declining economic growth and a stronger U.S. dollar. Yahoo Finance Markets Reporter Ines Ferre takes a look at oil's stock ...

__________________________________________________________________________________

RELATED

Oil prices in July saw their sharpest rise since January 2022. CNN's Becky Anderson speaks to Noah Brenner, Energy Intelligence's Executive Editor for Operations.

No comments:

Post a Comment