Americans are exhausting their excess savings - and could run out funds this quarter, Fed study says

..."The Bureau of Economic Analysis recently revised its previous estimates to show household disposable income was lower and personal consumption was higher than previously reported for the fourth quarter of 2022 and first quarter of 2023," Abdelrahman and Oliveira said.

"The combined revisions brought down the Bureau's measure of aggregate personal savings by more than $50 billion," they added.

The downbeat forecast comes as Americans prop up the economy through their strong spending habits, helping temper fears that the US could slip into recession. But dwindling savings could pose challenges for the US economy, given consumer spending is a key engine of growth.

- In one sign of falling savings, Americans are using their credit cards more, racking up nearly $1 trillion of such debt, Fed data shows.

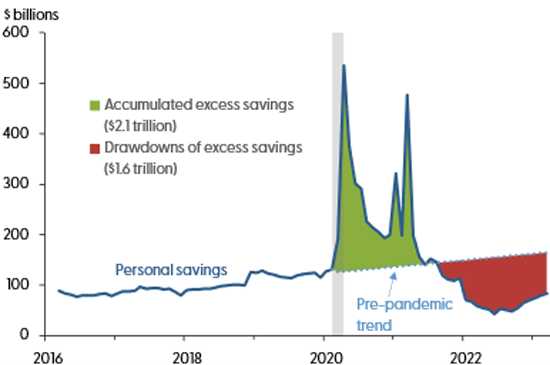

The accumulated difference between actual savings and the pre-pandemic trend can be interpreted as the stock of excess savings in the overall economy. Figure 2 defines the pre-pandemic trend as the forward-looking, out-of-sample projection implied by a linear regression on monthly aggregate personal savings for the 48 months leading to the onset of the pandemic recession. We estimate that accumulated excess savings, in nominal terms, totaled around $2.1 trillion through August 2021, when it peaked (green area).

Figure 2

Aggregate personal savings versus the pre-pandemic trend

Source: Bureau of Economic Analysis and authors’ calculations.

Note: Excess savings calculated as the accumulated difference in actual de-annualized personal savings and the trend implied by data for the 48 months leading up to the first month of the 2020 recession as defined by the NBER.

After August 2021, aggregate personal savings dipped below the pre-pandemic trend, signaling an overall drawdown of pandemic-related excess savings. The drawdown to on household savings was initially slow, averaging $34 billion per month from September to December 2021. It then accelerated, averaging about $100 billion per month throughout 2022, before moderating slightly to $85 billion per month in the first quarter of 2023. Cumulative drawdowns reached $1.6 trillion as of March 2023 (red area), implying there is approximately $500 billion of excess savings remaining in the aggregate economy. Should the recent pace of drawdowns persist—for example, at average rates from the past 3, 6, or 12 months—aggregate excess savings would likely continue to support household spending at least into the fourth quarter of 2023. This outlook can be possibly extended into 2024 and beyond if, for instance, drawdown rates moderate or household preferences for savings increase.

No comments:

Post a Comment