CRED iQ is a commercial real estate valuation, market analytics and lead generation tool providing actionable intelligence to CRE and capital markets investors. Developed with leading-edge technologies, CRED iQ delivers real-time commercial real estate and market assessments through a user-friendly interface. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

__________________________________________________________________________

CMBS Delinquency at Highest Level Since 2021 (July 2023)

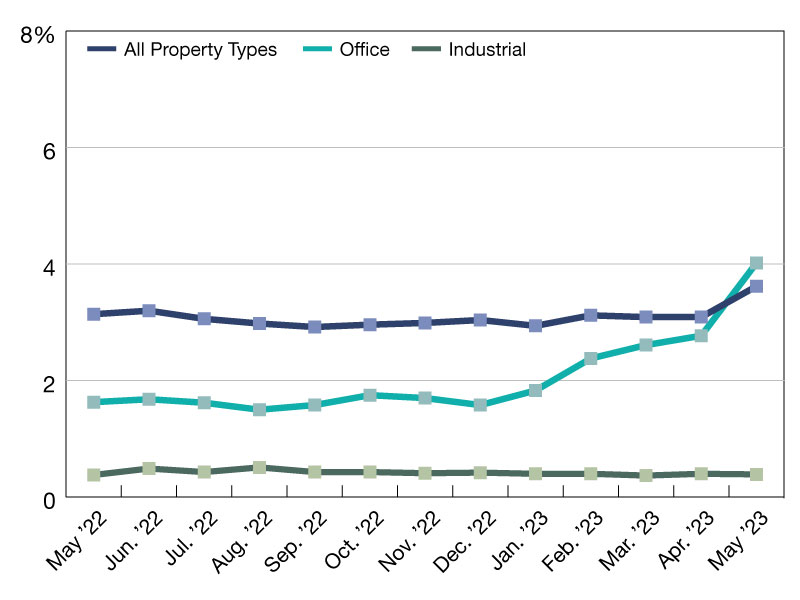

This was a 20 basis point increase from the prior month's rate of 4.2 percent, which represents a 5 percent increase. The CMBS delinquency rate is now at its highest level since the end of 2021. As of June, over $4 billion in aggregate CMBS debt was reported as newly delinquent. More than 80 percent of newly delinquent loans, by outstanding balance, were attributed to maturity defaults or refinancing issues. CRED iQ's delinquency rate is equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans for its sample universe of $600-plus billion in CMBS conduit and single-asset single-borrower (SASB) loans. The special servicing rate, which is the percentage of CMBS loans with the special servicer (delinquent and non-delinquent), increased month-over-month to 6.21 percent from 6.01 percent. The special servicing rate has climbed in five out of six months so far in 2023. Combining the two indicators of distress—delinquency rate and special servicing rate—into an overall distressed rate (delinquencies plus special service percent) equates to 6.56 percent of CMBS loans that are specially serviced, delinquent, or a combination of both. The May distressed rate was equal to 6.43 percent, which was 13 basis points lower than the June distressed rate. The month-over-month increase in the overall distressed rate mirrors increases in the delinquency and special servicing rates. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer. By property type, distress in the office sector continued to build in June. The office delinquency rate increased to 4.6 percent, compared to 3.98 percent as of May 2023. The month-over-month surge of 62 basis points in office delinquency was equal to a 16 percent increase. When comparing data across the trailing 12 months, the delinquency rate for the office sector is nearly 2.5 times higher than that of July 2022.

The natural progression of long- to intermediate-term rolling leases, coupled with ongoing refinancing difficulties at loan maturity, has caused the velocity of new delinquencies to accelerate during the first half of 2023.

2023 CMBS Delinquency Rates

August 31, 2023

Trepp's monthly update.

While the rest of the US economy has seen relief in terms of higher equity prices, better-than-expected corporate earnings, and falling inflation numbers, the commercial real estate (CRE) market continues to be left behind.

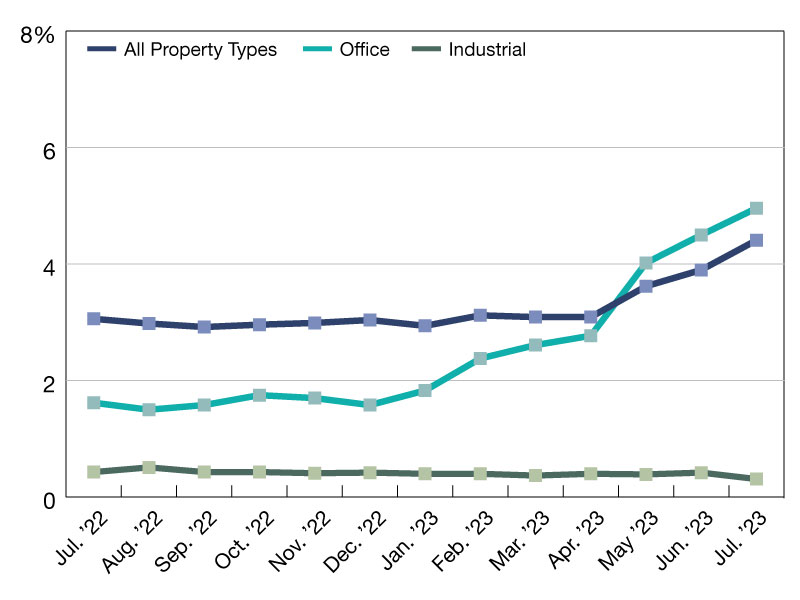

The Trepp commercial mortgage-backed securities (CMBS) delinquency rate jumped again in July 2023 with four of the five major property segments posting sizable increases. Overall, the delinquency rate rose 51 basis points to 4.41 percent. That is the highest level since December 2021.

Office delinquencies rose another 46 basis points and the rate for that segment is now 4.96 percent. The office delinquency rate is now up more than 350 basis points since the end of 2022. Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current in interest payments. That is because many of those loans are ones for which borrowers are in the process of finalizing extension options that are embedded in the loan. Now, however, borrowers are more often foregoing those extension options.

If Trepp included loans that are beyond their maturity date but current on interest, the delinquency rate would be 4.77percent (compared to 4.41percent). The percentage of loans in the 30 days delinquent bucket is 0.49 percent, up 31 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on Aug. 31, 2023

The Trepp commercial mortgage-backed securities (CMBS) delinquency rate jumped again in July 2023 with four of the five major property segments posting sizable increases. Overall, the delinquency rate rose 51 basis points to 4.41 percent. That is the highest level since December 2021.

Office delinquencies rose another 46 basis points and the rate for that segment is now 4.96 percent. The office delinquency rate is now up more than 350 basis points since the end of 2022. Since the advent of the calculation, Trepp has not included delinquent loans that are past their maturity date but are current in interest payments. That is because many of those loans are ones for which borrowers are in the process of finalizing extension options that are embedded in the loan. Now, however, borrowers are more often foregoing those extension options.

If Trepp included loans that are beyond their maturity date but current on interest, the delinquency rate would be 4.77percent (compared to 4.41percent). The percentage of loans in the 30 days delinquent bucket is 0.49 percent, up 31 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on Aug. 31, 2023

The CRED iQ CMBS delinquency rate has continued to rise, reaching 5.07 percent in August 2023 to mark a 40 basis point increase from a month prior and a 177 basis point jump since January.

- Notably, 62 percent of the newly delinquent loans, based on their outstanding balances, were a result of maturity defaults or refinancing challenges.

The special servicing rate has continued to climb year to date in 2023. Aggregating the two indicators of distress — delinquency rate and special servicing rate — the overall distressed rate (delinquency plus special servicing percent) rose to 7.17 percent, an increase of 14 basis points.

The August distressed rate was equal to 7.03 percent, which was 14 basis points lower than the July distressed rate. The month-over-month increase in the overall distressed rate mirrors increases in the delinquency and special servicing rates. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

By property type, distress in the office sector continued to build in August. The office distressed rate for August was 9.36 percent, which compared to 8 percent in July. The month-over-month surge of 136 basis points in office delinquency was equal to a 17 percent increase. The natural progression of long- to intermediate-term rolling leases coupled with ongoing refinancing difficulties at loan maturity have caused the velocity of new delinquencies to accelerate during 2023.

An example of why office delinquency rates have gone up significantly per month can be seen with 995 Market Street in San Francisco, which was part of the LSTR 2016-4 transaction and had a balance of $45 million. On July 21, it was transferred to special servicing and it is currently 30 to 59 days behind in payments. The special servicer reports that the borrower hasn’t paid for July and has indicated they won’t make any more payments.

Unfortunately, the situation with 995 Market Street is likely to continue nationally as office vacancies increase and net absorption (the rate at which office space is being occupied) continues to decline.

The retail distressed rates decreased slightly in August from 10.74 percent in July to 10.66 percent in August, an 8 basis point drop. The multifamily distressed rate increased slightly, rising by 31 basis points to reach 4.96 percent in August.

The lodging distressed rate improved slightly in August, dropping by 6 basis points to 7.69 percent. This improvement is due to increased business and leisure travel, which has now surpassed pre-pandemic levels.

CRED iQ’s CMBS distressed rate by property type accounts for loans that qualify for either delinquent or special servicing subsets. For August, the overall distressed rate for CMBS increased to 6.56 percent, which was 13 basis points higher than May’s distressed rate (6.43 percent), equal to a 2 percent increase. A severely limited refinancing market for office properties and a “higher for longer” interest rate environment continues to contribute to sustained increases in commercial real estate distress.

It’s important to clarify that the delinquency rate is calculated as the percentage of all delinquent loans, whether specially serviced or non-specially serviced, in CRED iQ’s sample universe of more than $600 billion in CMBS conduit and single-asset single-borrower loans.

The August distressed rate was equal to 7.03 percent, which was 14 basis points lower than the July distressed rate. The month-over-month increase in the overall distressed rate mirrors increases in the delinquency and special servicing rates. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

By property type, distress in the office sector continued to build in August. The office distressed rate for August was 9.36 percent, which compared to 8 percent in July. The month-over-month surge of 136 basis points in office delinquency was equal to a 17 percent increase. The natural progression of long- to intermediate-term rolling leases coupled with ongoing refinancing difficulties at loan maturity have caused the velocity of new delinquencies to accelerate during 2023.

An example of why office delinquency rates have gone up significantly per month can be seen with 995 Market Street in San Francisco, which was part of the LSTR 2016-4 transaction and had a balance of $45 million. On July 21, it was transferred to special servicing and it is currently 30 to 59 days behind in payments. The special servicer reports that the borrower hasn’t paid for July and has indicated they won’t make any more payments.

Unfortunately, the situation with 995 Market Street is likely to continue nationally as office vacancies increase and net absorption (the rate at which office space is being occupied) continues to decline.

The retail distressed rates decreased slightly in August from 10.74 percent in July to 10.66 percent in August, an 8 basis point drop. The multifamily distressed rate increased slightly, rising by 31 basis points to reach 4.96 percent in August.

The lodging distressed rate improved slightly in August, dropping by 6 basis points to 7.69 percent. This improvement is due to increased business and leisure travel, which has now surpassed pre-pandemic levels.

CRED iQ’s CMBS distressed rate by property type accounts for loans that qualify for either delinquent or special servicing subsets. For August, the overall distressed rate for CMBS increased to 6.56 percent, which was 13 basis points higher than May’s distressed rate (6.43 percent), equal to a 2 percent increase. A severely limited refinancing market for office properties and a “higher for longer” interest rate environment continues to contribute to sustained increases in commercial real estate distress.

It’s important to clarify that the delinquency rate is calculated as the percentage of all delinquent loans, whether specially serviced or non-specially serviced, in CRED iQ’s sample universe of more than $600 billion in CMBS conduit and single-asset single-borrower loans.

Harry Blanchard is managing director and head of data and analytics at CRED iQ.

__________________________________________________________________

RELATED

No comments:

Post a Comment