US regulators are preparing to introduce a plan to require that banks tap the Federal Reserve 's discount window at least once a year to reduce the stigma and ensure lenders are ready for troubled times.

The Fed's Super Discount Window is not QE

FAQs on the new program from the Fed to shore up liquidity for the Banks and avoid a Banking Crisis

There are perhaps misconceptions surrounding the issue of the banks borrowing at the Discount Window but, the most important thing to remember is that no new money is being created. Hence, this is not QE, this is not bullish and this is just a temporary fix.

Since, no new money is being created this is actually not going to be inflationary either. This is just depositors getting their money back in a timely manner.

If anything, this gives the Fed the stability and ability to keep tightening without causing a full-blown banking crisis. But, even this is temporary.

The Fed is monitoring the liquidity situation at banks. The last thing a Bank needs is a bank run, which could cause the bank to collapse. So, they would not even dream of using this liquidity for any other reason, than to make depositors whole.

There was news today that about $120.93 billion being poured into US money-market funds in the week to March 15. Of this amount, retail money accounted for $20.15 billion of the total increase, while institutional cash climbed by $100.78 billion. This is a sign that people are taking money out of their banks and putting it in highly liquid securities with high credit ratings, i.e., a flight to safety.

This shows you the level of decrease in bank deposits, and why the Fed needed to put this funding program in place.

But, borrowing at the Discount Window carries a stigma. Market participants have always seen borrowing at the Discount Window as a situation where the system is under extreme stress.

Some credit the Continental Illinois debacle for creating the stigma attached to borrowing at the Fed's discount window, a signal that the bank is in trouble.

Previously, such overnight loans were a more routine way for banks to manage occasional reserve shortfalls. It was always a bad sign if any institution relied on it frequently.

Paul Volcker - Keeping at it

Therefore, Banks will actually not want to borrow from the discount window because of the perceived stress that could incite a bank run. To combat this, the Fed will not reveal the names of the borrowers until one year after the loan.

So what do you think the all-time high in borrowing at the Discount Window implies?

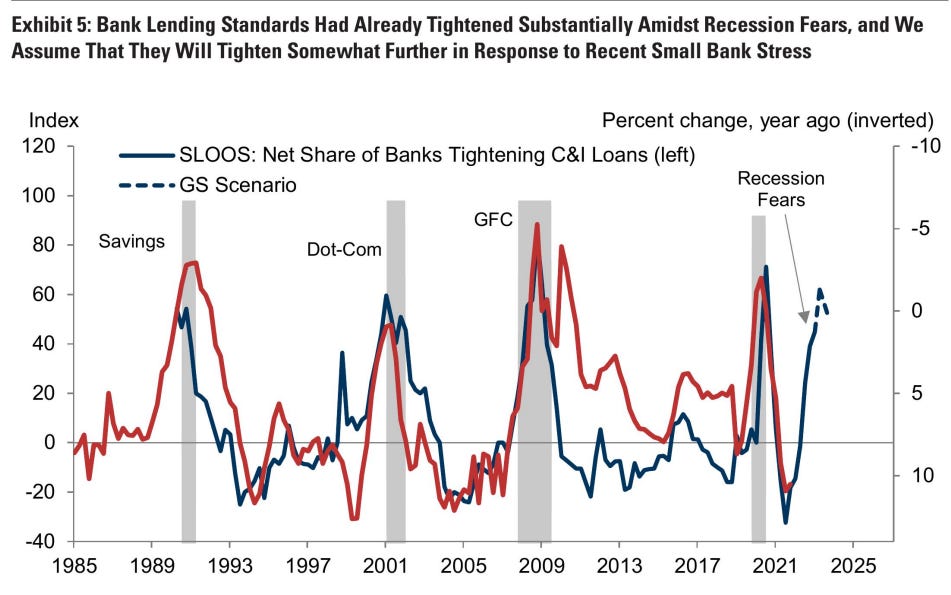

As for the Banks - this will actually stop the Banks from lending and they will tighten their lending standards, so that they can increase liquidity organically from loans that get repaid. Goldman Sachs forecasts lending standards will tighten substantially after this.

Read on for FAQs concerning what’s going on with the Discount Window, the Fed’s new Super Discount Window and the Banks.

What is the Fed’s Discount Window?

The Fed’s Discount Window is a facility that is available to banks, credit unions and basically any depository institution for short-term borrowing against eligible collateral. The discount window is something that's been there since the beginning of the Fed and used as a source of liquidity in times of distress.

In 2003, the Fed went from extending credit at a subsidized rate, which required a lot of rules, to extending credit at an above market rate. Some of it was done to deter institutions from making too much use of the Discount Window.

What is the BTFP?

After the collapse of Silicon Valley Bank, the Fed rolled out a new program, called the Bank Term Funding Program (BTFP) to ensure that the Banks can meet their deposit obligations, i.e., you can go to your bank and withdraw cash.

This is a new Super Discount Window and there are important differences from the regular discount window. ⤵

What is the difference between BTFP and borrowing at the Fed’s Discount Window?

Loans from the Fed’s Discount Window is for a term of 90days; the BTFP loans can be taken for up to 1 year. Depending on the situation, it can be extended after this term ends but that is totally up to the Fed.

The Discount Window “discounts” the collateral. Say the face value of treasuries is $100. The current value on the Bank’s book is $50. The Fed will lend the Bank against the $50. The BTFP will lend the Bank $100, i.e., the original face value or par value, despite the current value being $50.

So what the banks are essentially doing is taking their collateral and exchanging it for cash to fulfill deposits. This does not create new money in the system. It is just a temporary fix for liquidity.

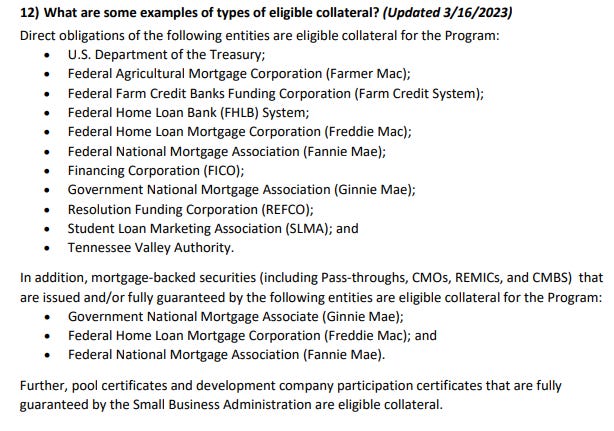

What is counted as eligible collateral for the BTFP program?

The Fed has updated the list of eligible collateral on their website yesterday.

Why are the lending against par value of the collateral?

Many of the banks had parked their deposits in longer term treasuries, wanting to hold them to maturity. When you hold a treasury to maturity, regardless of the fluctuation, you get 100% of the par value or face value or initial value back.

During the last one year, as rates increased, the value of these treasury bonds fell. (Rate increase, bond value / price decreases). And the banks are holding on to bonds that have lower than 100% of the original value.

Normally, this would not be a problem. But, in times of stress and decreasing liquidity, this means that the bank does not have ready cash to give back to the depositors. So if you go to the bank to take out your cash, they can’t give you the cash because they are locked up in these bonds.

So their options are:

Ask for loan repayment from borrowers - This will bankrupt borrowers and cause bigger issues

Borrow from other banks - takes time for approval and can be expensive

Raise equity - also takes time and will cause the share price to decline

Sell the bonds held as investments

But, they would have to sell it for the current market price, taking a loss. This is what happened with Silicon Valley Bank.

The Fed wants to prevent this from happening again and is therefore, allowing Banks to pledge the treasury as collateral and take 100% of the face value as a loan so they don’t have to incur losses and can meet the liquidity requirements. So, you can withdraw cash from your bank account if you want.

So, if the BTFP is there why did the Discount Window lending increase last week?

The Fed’s report (H.4.1) on these facilities show:

- Discount window = $153 billion (from $4 billion)

- Super Discount Window = $12 billion in advances within the first 3 days

The borrowing at the Discount Window hit an all-time high and this was mainly because the Banks started borrowing before the BTFP was open for business. So the Banks were left with no choice. However, it is likely that this will shift to the BTFP as time goes on.

Why is this not QE if the Fed’s balance sheet is increasing?

Because the Fed is taking in the bonds as collateral and that is what is inflating the Fed’s balance sheet. However, these are just being held as collateral against the loan given to the Banks and therefore, they will be returned as the Banks pay off the loan. This is not the active purchase of treasuries that will inject money into the system that will be further loaned out to customers. This is not Quantitative Easing by any means. The Fed is still doing QT and they still have bonds and MBS’ rolling off.

Can we find out which banks are borrowing under the BTFP?

No, the Fed will not give out this detail now because it can cause further bank runs. The Fed will only reveal the names one year after the program ends which is March 11, 2025.

The names of the original discount window borrowers (i.e., these are called primary credit borrowers) are given out two years after making the loan.

Why can’t banks take this money and loan it out to customers, i.e., create credit or take the money and invest it in the stock market?

As I said in the beginning, the Bank would rather not use these for anything other than to make depositors whole, and the Fed is monitoring the situation.

However, there are other reasons as well:

It is expensive - the BTFP funding rate is 4.69% as of today. The rate is the 1-year overnight index swap rate + 10bps. Borrowing at this rate would actually eat into profitability of Banks, and the required return on the investment or loan would be much higher. This just does not make economic sense to the bank.

It is short-term - the Bank can borrow up to a period of one year. And they have to pay back the principal within this time. Which means if they do use this money for other reasons and lock it up, they are faced with the same situation that started the whole issue.

Old securities - The eligible collateral has to be owned by the banks prior to March 12, 2023 so they cannot go out and buy more securities to pledge.

The Fed has recourse to the institution - This means that the Fed has the right to penalize the institution should they not be able to fulfill their obligations.

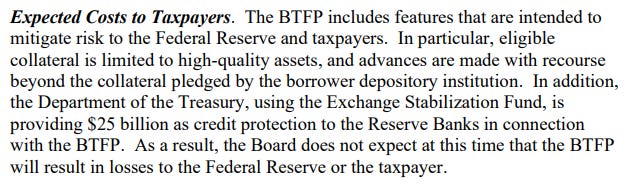

What is the Treasury backstop?

The US Treasury has committed $25B as credit protection to the Federal Reserve Banks in connection with this program. The funds will come from the Exhange Stabilization Fund. But, it’s quite likely that the Fed will not have to use this backstop

Will the taxpayers foot the bill for this?

No. The Fed has put in place mechanisms to ensure that the burden doesn’t fall on taxpayers.

Closing Thoughts

I hope I have managed to explain the situation. Borrowing at the discount window is the last thing any bank want. The Fed is rolling out this program out of necessity to create temporary liquidity. The increase in the Fed’s balance sheet is also temporary collateral and not free money to invest or lend out. There is a liquidity squeeze in the system. The YoY change in M2 has become negative. Cash is drying up.

The money printer has not been turned back on!

No comments:

Post a Comment