A record $174.1 billion of investment-grade corporate-bond supply has been issued already this month, according to Informa Global Markets, with another $1.25 billion expected to clear on Friday.

Market Extra

Borrowing frenzy sparked by Fed pivot party leaves out ‘forgotten’ companies that owe $500 billion

The Fed’s “hard pivot” to potential cuts “has spurred optimism that the worst of the impact from tight monetary policy impact is now behind us,” Oleg Melentyev, credit strategist at BofA Global, wrote Friday.

But Melentyev said the bottom 30% of companies that rely on the high-yield, or junk-bond, market for funding still “face constrained access, with recent volumes running at 1/4 of the pace of the top 70%.”

He pegged the universe of “forgotten” issuers as owing about $500 billion of high-yield debt, a category that includes loans and bonds. “Even when they do have access, the average coupon here runs north of 11%, or +300bp compared to higher quality.”

Like the stock market’s SPX return in January to records set two years ago, investment-grade companies have seen spreads revisit their lowest levels in about two years.

The spread on the ICE BofA Corporate Index, which tracks the investment-grade market, this week dipped below 100 basis points for the first time since January 2022, according to Fed data.

Spreads are the compensation investors earn on bonds above benchmark Treasury rates, to help offset default risks. Lower spreads signal more favorable borrowing conditions for big companies, governments, landlords and even households.

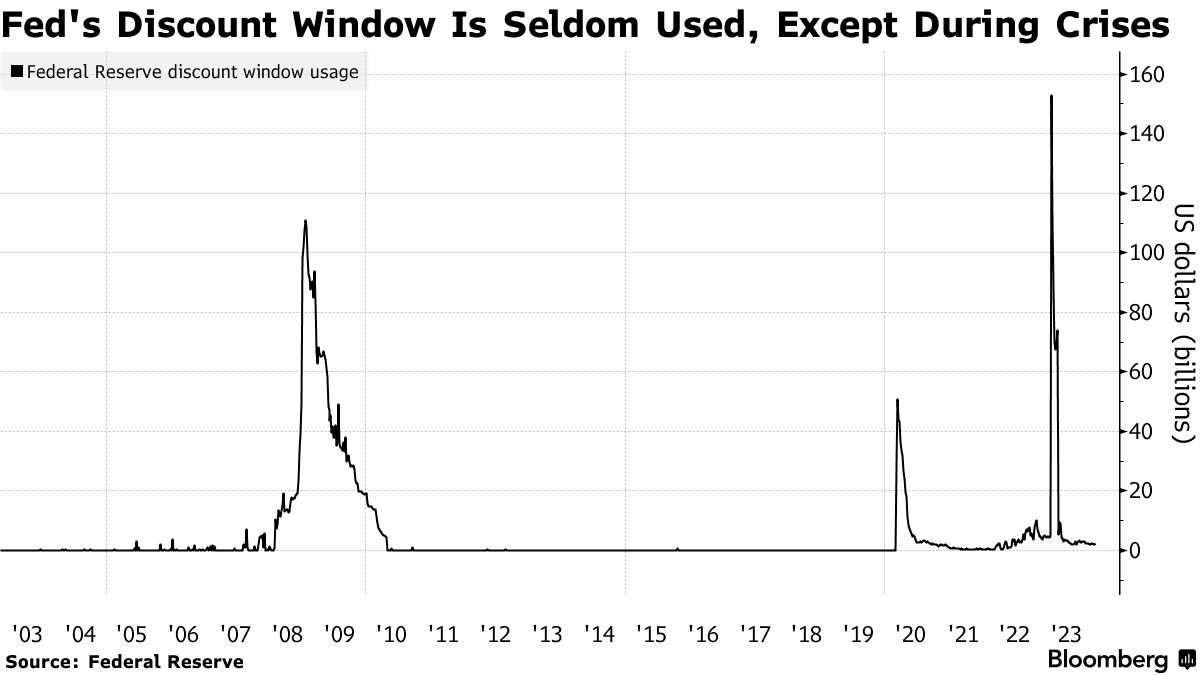

Zero rates return? Not if you ask lenders

The rally since October has been less concrete for riskier companies deemed a higher default risk, especially if the Fed cuts rates by less than some in the market expect.

An index of high-yield corporate debt that includes CCC and lower rated bonds, pegged the spread at 914 basis points above the Treasury rate, up from a roughly two-year low in late December of about 850 basis points.

“We do not think that all $500bn of debt in this group is at risk of restructuring; in fact, most likely only a fraction of it is,” Melentyev said, while suggesting a “quick fix” would be the Fed slashing its policy rate back to zero.

The Fed back in September 2020 expected its pandemic policy of near-zero rates to last through 2023. But that was before a lasting surge in inflation took hold that eventually forced the central bank’s policy rate up to its current 22-year high of 5.25% to 5.5%.

A return to zero interest rates has been viewed by many economist and investors as unlikely, and even unwanted, especially for savers.

See: Investors kissed the era of cheap money goodbye. Now what?

A FTI Consulting recent survey of lenders in the U.S. leveraged loan market found that 73% of respondents expected the Fed-funds rate to end 2024 at, or above, 4%.

Additionally, more stability in the benchmark 10-year Treasury rate BX:TMUBMUSD10Y in the new year, on the heels of rate-cut expectations, has helped bring additional confidence to capital markets, sparking the recent borrowing blitz by companies.

But as BofA’s Melentyev points out, it hasn’t benefited everyone equally. He thinks half of the issuers in his $500 billion “forgotten” category are likely to remain free-cash-flow negative, even if the Fed pulls the trigger on the amount of cuts currently priced in by the market.

The odds of six rate cuts of 65 basis points, bringing the central bank’s policy rate to a 3.75% to 4% range in December 2024 were pegged at 35.5%, according to the CME FedWatch tool.

“At their current pace of issuance, it will take 5.5 years to address funding needs that are supposed to be done in two years.”

A counterpoint to Melentyev’s argument would be that every cycle washes out weaker hands, and creates opportunities.

Exchange-traded funds related to high-yield and leveraged loan market have also rallied in the past three months, with the SPDR Bloomberg High Yield Bond ETF JNK up 7.2% through Friday and the Invesco Senior Loan ETF BKLN up 1.2% for the same stretch, according to FactSet data.

No comments:

Post a Comment