Go long or Go Short, or reduce risk...There's only so much Alpha in the world

How the Best Hedge Funds Are Smoking the Competition

The most successful funds in recent years have pursued multiple strategies, while avoiding risk.

Updated January 23, 2024 / Original January 23, 2024

The stars of the hedge fund world used to take big swings and sometimes hit grand slams, like John Paulson when he shorted the U.S. housing market before the 2007-09 financial crisis and made $20 billion.

- But swing-for-the-fence hedge funds haven’t been the big winners in recent years.

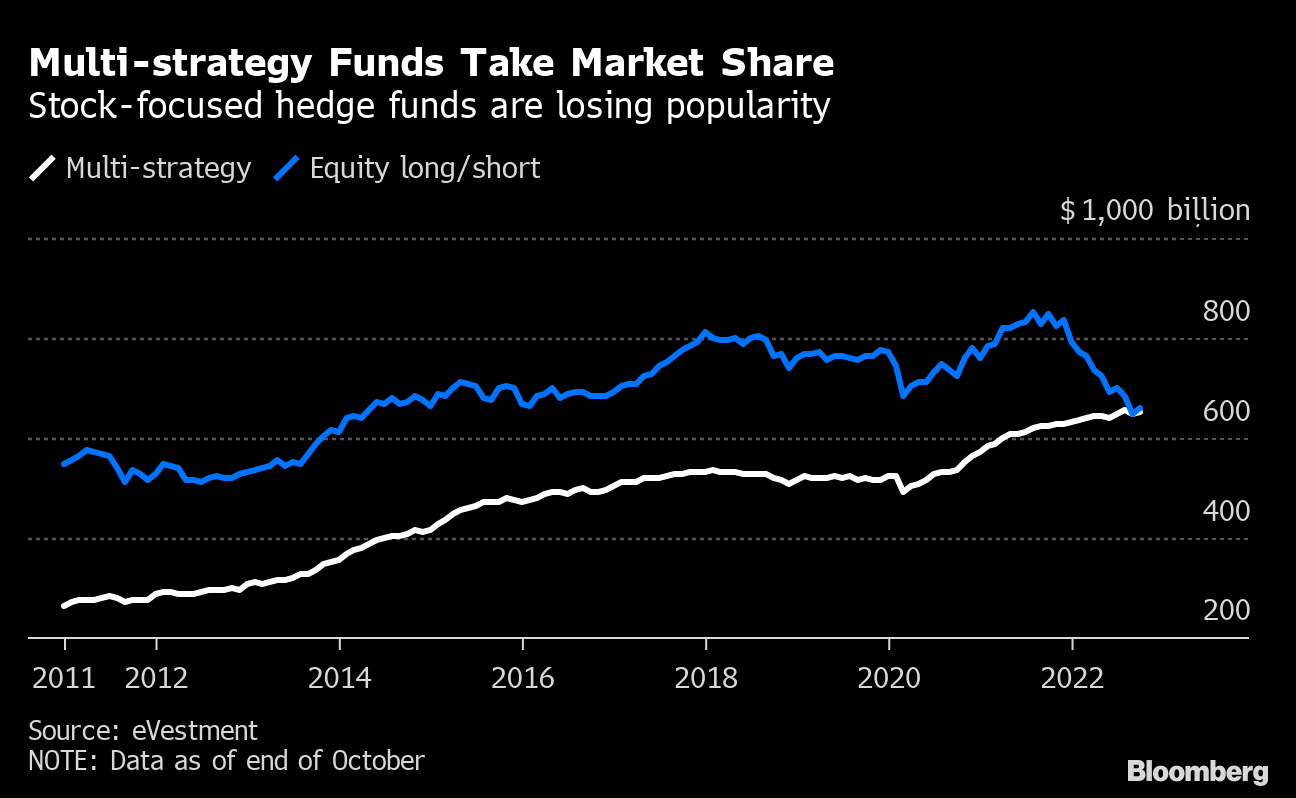

- Instead, the best returns have come from the multi-strategy, multi-manager hedge funds that rivals derisively call “pod shops.”

Multi-strategy shops like Citadel and Millennium Management continuously shift bets around their firms’ roster of strategies and portfolio managers.

What they have over single-strategy shops is that they reliably make money.

- Annual returns at Citadel have ranged from 15% to 38% in the past five years, as founder Ken Griffin and his colleagues moved capital among dozens of teams—some finding interest-rate plays, commodity speculations, or quantitative patterns, others going long or short on specific stocks.

- Returns at Izzy Englander’s Millennium ranged from 6% to 26% during the same period.

The multi-manager model has generated years of exceptional returns, even after fees. But rising interest rates and a brutal battle for talent are taking their toll.

Over the past five years in particular, it has emerged as the fastest-growing and most profitable corner of the global hedge fund industry.But the model is facing a moment of reckoning. It is confronting challenges wrought by capacity constraints, including a ferocious and increasingly expensive talent war. Higher interest rates have increased the risk-free returns available to investors, making outperformance harder to achieve and raising the cost of borrowing.Investors have also started to question multi-manager funds’ high fees and demands to lock away cash for years. A recent report by Goldman Sachs, which interviewed 340 investors accounting for over $US1 trillion in assets, pointed to a slight increase in those looking to reduce their exposure to multi-manager platforms

No comments:

Post a Comment