Since reaching a local bottom in October of last year, XAUUSD has experienced a strong uptrend of over 13%.

Middle East conflict & US interest rates send Gold back towards all-time highs.

16 January 2024

Since reaching a local bottom in October of last year, XAUUSD has experienced a strong uptrend of over 13%. Closing its third consecutive positive session, Gold is inching closer to its all-time high, now sitting just above $2,050 USD per ounce.

From a technical standpoint, Gold is following a well-defined rising channel that has been predominantly respected since November 2023. As the price approaches the midpoint of this channel, there is a possibility, especially on lower time frames, that this point may act as temporary resistance. This is a crucial level to monitor closely.

Image: GOLD Chart

The recent positive momentum in XAUUSD is closely tied to escalating tensions in the Middle East. The enduring conflict between Gaza and Israel, coupled with the initiation of a new US-led conflict in Yemen against the Houthis, has contributed to the precious metal’s strength.

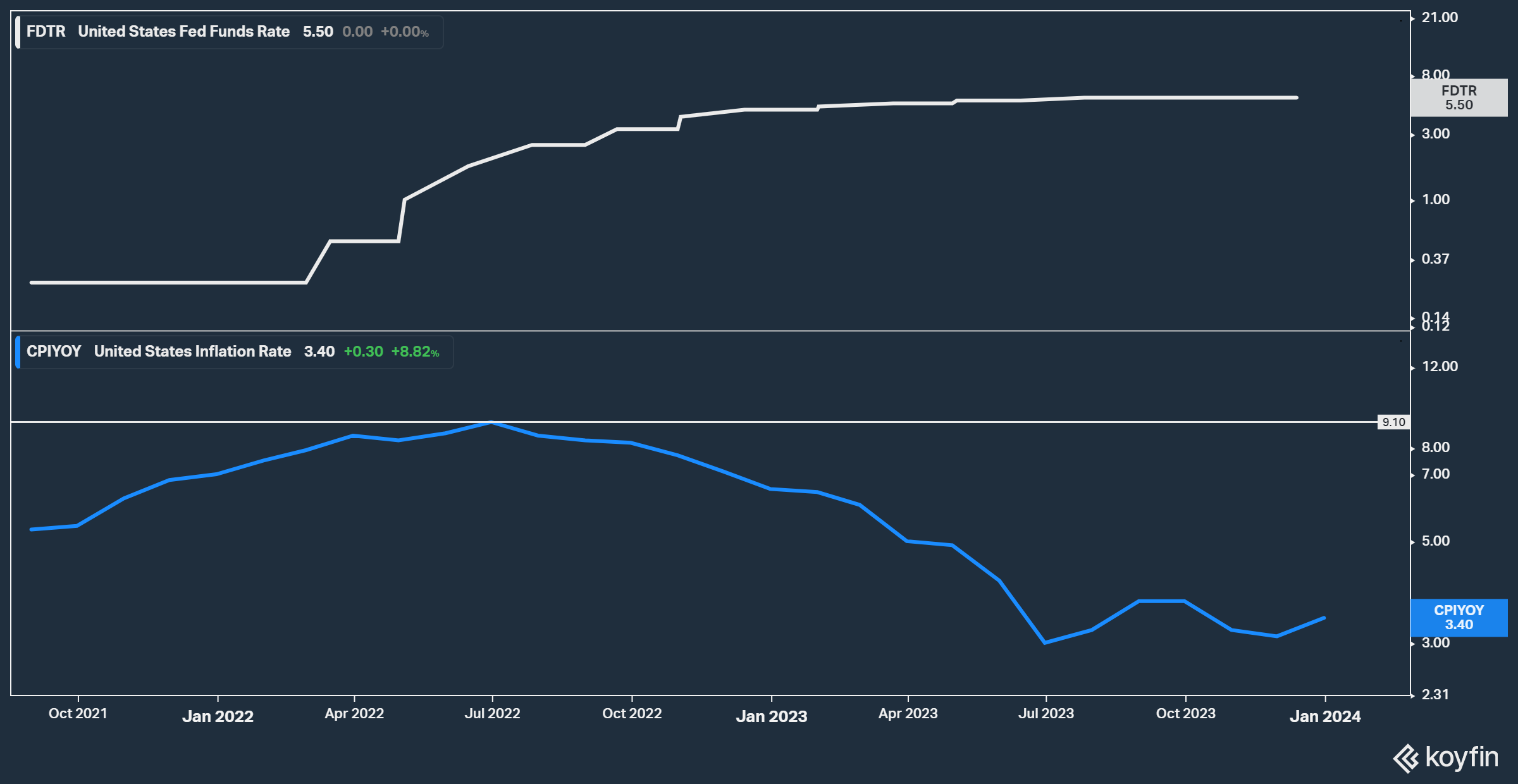

The current economic landscape in the United States, along with projections for rate cuts in 2024, also is playing a pivotal role in Gold’s recent performance. In response to US inflation climbing from nearly 0% to a peak of 9.10% in July 2022, the US Federal Reserve has raised interest rates 11 times. The rates have surged from 0.25% to the current 5.50%.

Image: CPI and Federal Funds Rate (FFR) Chart

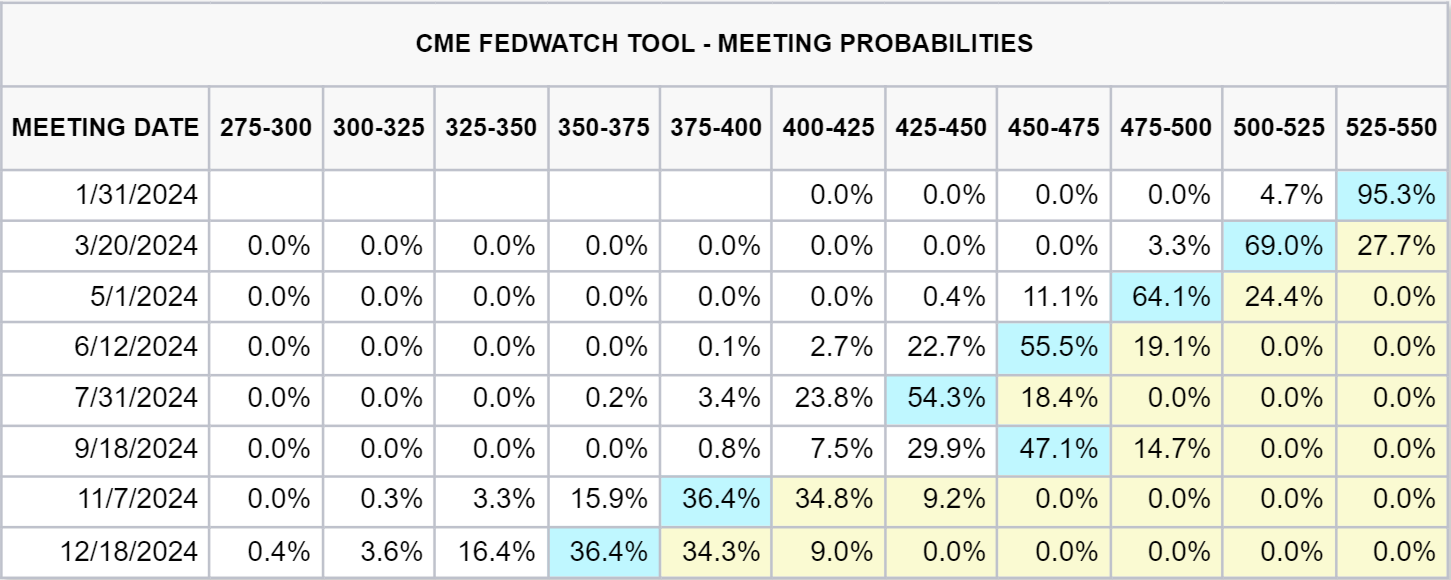

Data suggests the possibility of multiple rate cuts in 2024, with some anticipating cuts as early as the March Federal Open Market Committee (FOMC) meeting. According to CME data, market expectations indicate a projection of six rate cuts for 2024, culminating in an effective rate of approximately 3.50-3.75% by year-end.

Image: CME FedWatch

Historically, the appeal of non-interest-bearing assets like Gold tends to rise when interest rates decrease, contributing to the recent upward trajectory of Gold prices.

Gold traders will be closely monitoring the evolving tensions in the Middle East and upcoming US Consumer Price Index (CPI) data. This scrutiny aims to draw insights into the potential timing of Federal Reserve rate cuts and their subsequent impact on Gold’s market dynamics.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

- The United States and Britain launched strikes against sites linked to the Houthi movement in Yemen.

- The United States and Britain launched strikes against sites linked to the Houthi movement in Yemen.

- In wider financial markets, Asian shares were cautious on Friday as the escalating conflict in the Red Sea region sent oil prices surging.

- Data on Thursday showed US consumer prices rose more than expected in December, but excluding volatile food and energy costs, the pace of price increases fell to 3.9% from 4% on an annual basis.

Despite hotter headline CPI, core inflation remained muted, sending 10-year Treasury yields below 4%, showing "data is not that hot, helping support gold," Wong said.

Market bets of 150 basis points (bps) of Fed rate cuts this year were undeterred, with traders pricing in a 73% chance that they could begin as soon as March, according to IRPR, LSEG's interest rate probability app. However, Fed officials on Thursday signaled inadequate progress on the inflation front for the central bank to start cutting rates as early as March.

The Fed is expected to hold its policy rate steady at its Jan. 30-31 meeting.

Investors will next look out for US producer prices data, due at 1330 GMT.

Spot silver rose 0.4% to $22.82 per ounce, platinum gained 0.2% to $917.48, and palladium ticked 0.1% higher to $989.29.

Gold Price Rises on Middle East Tension. Why It’s Poised for a Bullish Breakout.

Gold prices were rising in early trading amid further geopolitical tensions in the Middle East, which are pushing investors to look for haven assets. And one analyst believes the precious metal could soon soar.

___________________________________________________________________________________

Gold Prices Forecast: Investors Turn to XAU/USD as Geopolitical Tensions Rise

Published: Jan 14, 2024, 23:53 PST•2min read

A sustained move above $2,050 will demonstrate gold’s resilience, driven by Middle East tensions and anticipated Fed rate cuts.

Key Points

- Global unrest fuels safe-haven demand for gold

- U.S. economic indicators strengthen gold’s appeal

- Gold’s bullish trend backed by market and geopolitical factors

Gold Experiencing Volatility with Bullish Undercurrents

Despite this pullback, the overall sentiment in the gold market remains bullish.

Geopolitical Tensions Fueling Bullish Sentiment

- These factors are exerting a strong upward pressure on gold prices, a trend that is likely to persist in the face of continued unrest.

Economic Data Bolstering Gold’s Position

Recent U.S. economic data, particularly the unexpected drop in producer prices, is causing Treasury yields to fall, further cementing gold’s position as a preferred investment. The market is increasingly betting on Federal Reserve rate cuts, potentially beginning in March, a factor that could favorably influence the future direction of gold prices.

Gold as a Resilient Investment

- Its dual role as an inflation hedge and a safe-haven asset is increasingly relevant, especially against the backdrop of the latest CPI and PPI reports.

Short-Term Forecast: Bullish on Gold

Technical Analysis

The proximity to the minor resistance level at 2067.00 suggests potential for an upward move, while its closeness to the minor support of 2009.00 marks a critical pivot point. The broader trading range is defined by the main support at 1952.21 and main resistance at 2149.00.

Overall, gold’s position above significant moving averages and near a key resistance level points towards a continued bullish trend, with a focus on the 2067.00 level for possible breakout signals.

No comments:

Post a Comment