US national debt hits record $34 trillion

The US government’s debt has topped $34 trillion for the first time, just weeks ahead of deadlines for Congress to agree to new federal funding plans.

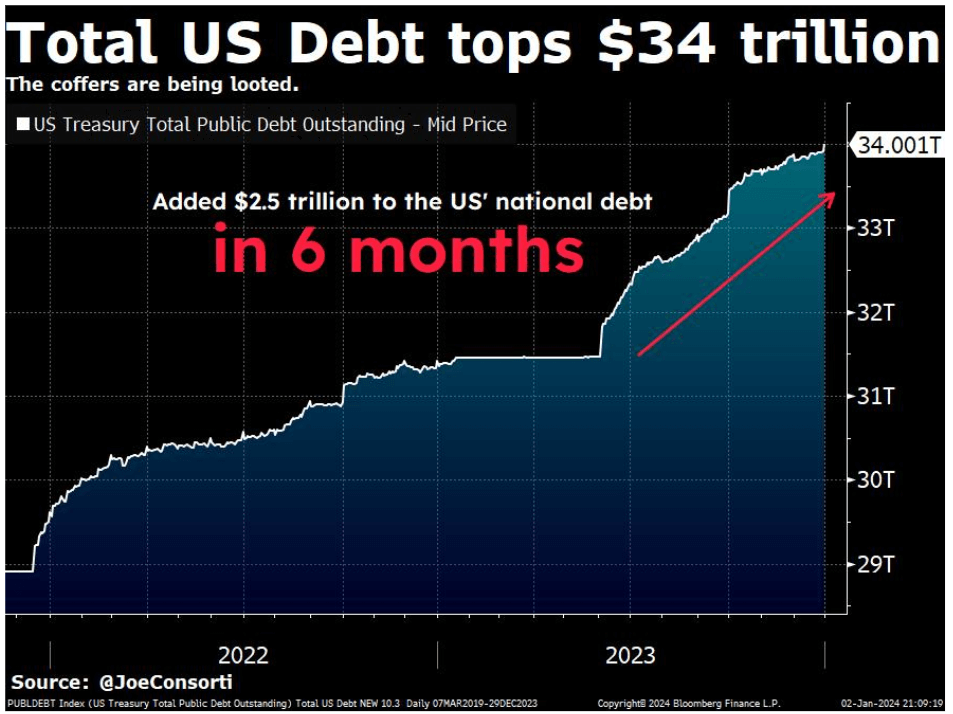

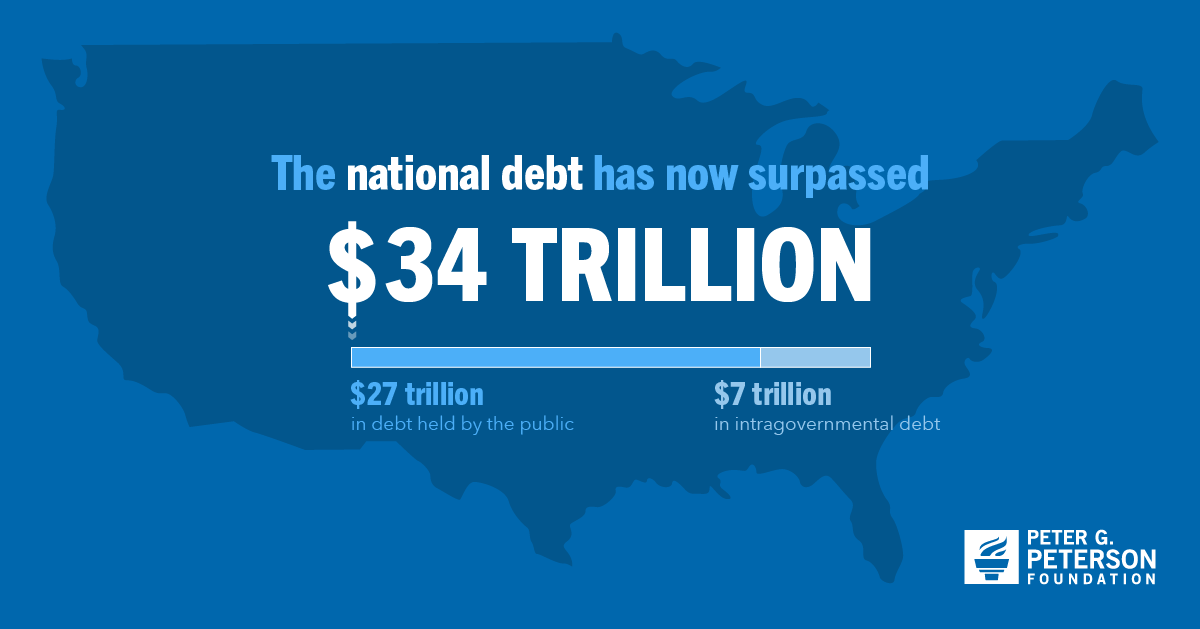

Data published by the Treasury Department showed that “total public debt outstanding” rose to $34.001 trillion on December 29. That figure, also known as the national debt, is the total amount of outstanding borrowing by the US federal government accumulated over the nation’s history.

The milestone comes just three months after the US national debt surpassed $33 trillion, as the budget deficit — the difference between what the government spends and what it receives in taxes — ballooned.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a fiscal watchdog, called the record figure “a truly depressing ‘achievement.’”

“Though our level of debt is dangerous for both our economy and for national security, America just cannot stop borrowing,” she said in a statement Tuesday.

The national debt has become a major point of contention between Republicans and Democrats, aggravating standoffs over the federal budget that threaten to shut down the government periodically.

Republicans say federal spending programs championed by the Biden administration are too expensive, and Democrats say GOP-backed tax cuts have squashed revenue.

White House spokesperson Michael Kikukawa said the rising sum was “driven overwhelmingly by repeated Republican giveaways skewed to big corporations and the wealthy,” which led to cuts to Social Security, Medicare and Medicaid that hurt ordinary Americans.

Kikukawa said President Joe Biden had a plan to reduce the deficit by $2.5 trillion by “making the wealthy and big corporations pay their fair share and cutting wasteful spending on special interests,” including large pharmaceutical and oil companies.

Whoever is to blame, mounting debt and political brinksmanship have already taken their toll on America’s credit rating. Fitch cut its rating on US sovereign debt to AA+ from AAA last August; in November, Moody’s warned that it could also remove the US’ last perfect AAA rating.

Lawmakers in Washington are facing deadlines for the passage of permanent department budgets in January and February after the Senate agreed a stopgap funding bill to avert a government shutdown in November.

That bill extended funding until January 19 for priorities including military construction, veterans affairs, transportation, housing and the Energy Department. The rest of the government was funded until February 2. It did not include additional aid for Ukraine or Israel.

“We remain hopeful that policymakers will take further measures to reduce our borrowing either by raising taxes, reducing spending, or creating a fiscal commission — or ideally by doing all of the above,” MacGuineas said.

According to the Treasury, the debt that counts towards the debt ceiling — which limits how much the government is allowed to borrow and is also a frequent source of political brinksmanship — rose to $33.89 trillion.

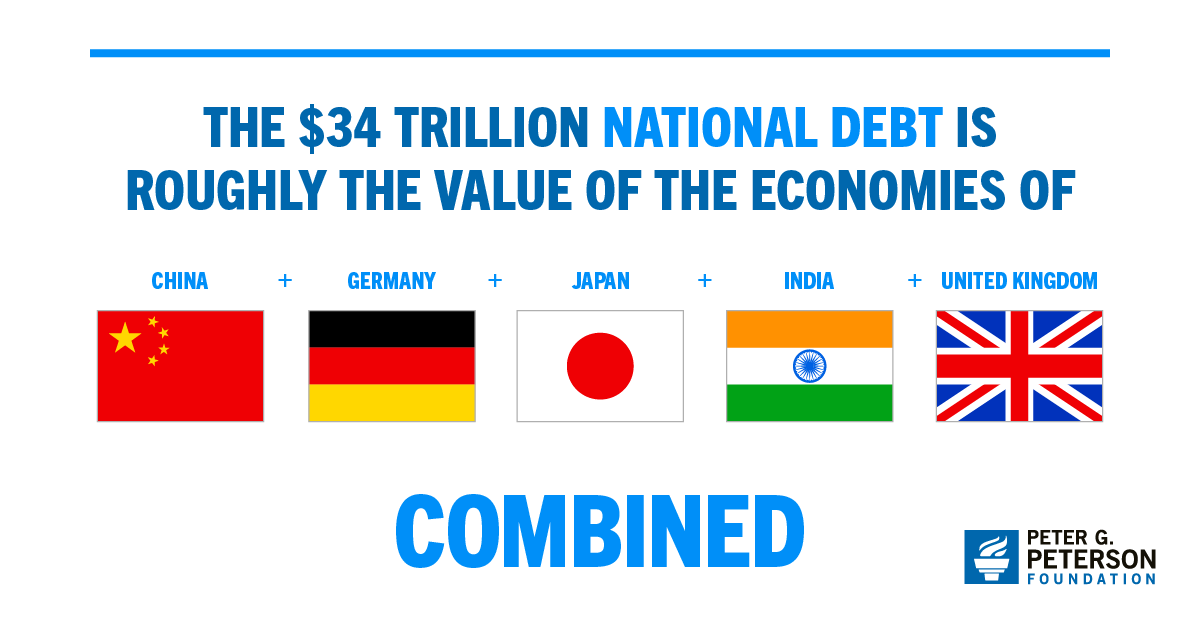

Rising government debt burdens in the United States and elsewhere have become a growing cause for concern because of a recent rapid rise in interest rates, which has made it much more expensive to service that debt.

According to the Peter G. Peterson Foundation, an American bipartisan group that advocates for fiscal responsibility, the US government spends $2 billion a day on debt interest payments alone.

“America’s high and rising debt matters because it threatens our economic future,” the foundation said in a statement Tuesday.

It noted that within 10 years, the federal government will spend more on interest payments than it traditionally has on research and development, infrastructure and education, combined.

— Arlette Saenz contributed reporting.

TOP STORIES

The US national debt hits a new all-time high of $34 trillion

- The US national debt just hit a new all-time high of $34 trillion.

- Lawmakers had raised the government's borrowing limit last June to skirt a national default.

- Government forecasters in 2020 had projected the US to reach this level of debt in 2029.

The data show that the total public debt outstanding climbed to $34.001 trillion on December 29.

The record-breaking amount arrives after lawmakers and the White House agreed last June to lift the debt ceiling to skirt a national default. The deal expires in January 2025 and is likely to bring further economic and political tensions.

Republican lawmakers largely point to the Biden Administration's spending programs for running up the deficit, while Democrats blame tax-cuts that favor large corporations.

In January 2020, before the start of the COVID-19 pandemic, the Congressional Budget Office forecasted that total debt would reach current levels in 2029. The US accelerated its borrowing through the pandemic as the economy shut down then attempted to stage a rebound over several years. The US government enacted massive fiscal stimulus programs to keep American households afloat during the unprecedented economic upheavals of the COVID era.

In August Fitch slashed its ratings outlook on US sovereign debt from AAA to AA+, and Moody's also lowered its outlook on the US's credit rating to negative in November, citing concerns over the country's growing mountain of debt.

___________________________________________________________________________________

__

No comments:

Post a Comment