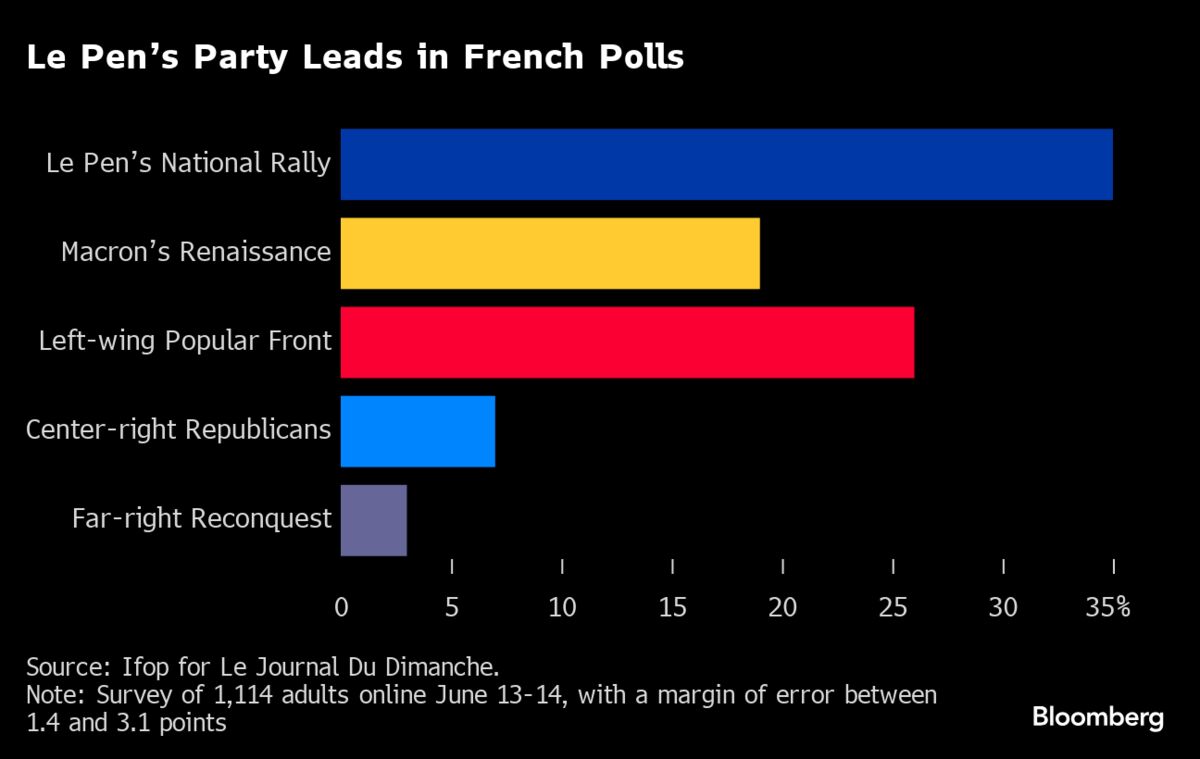

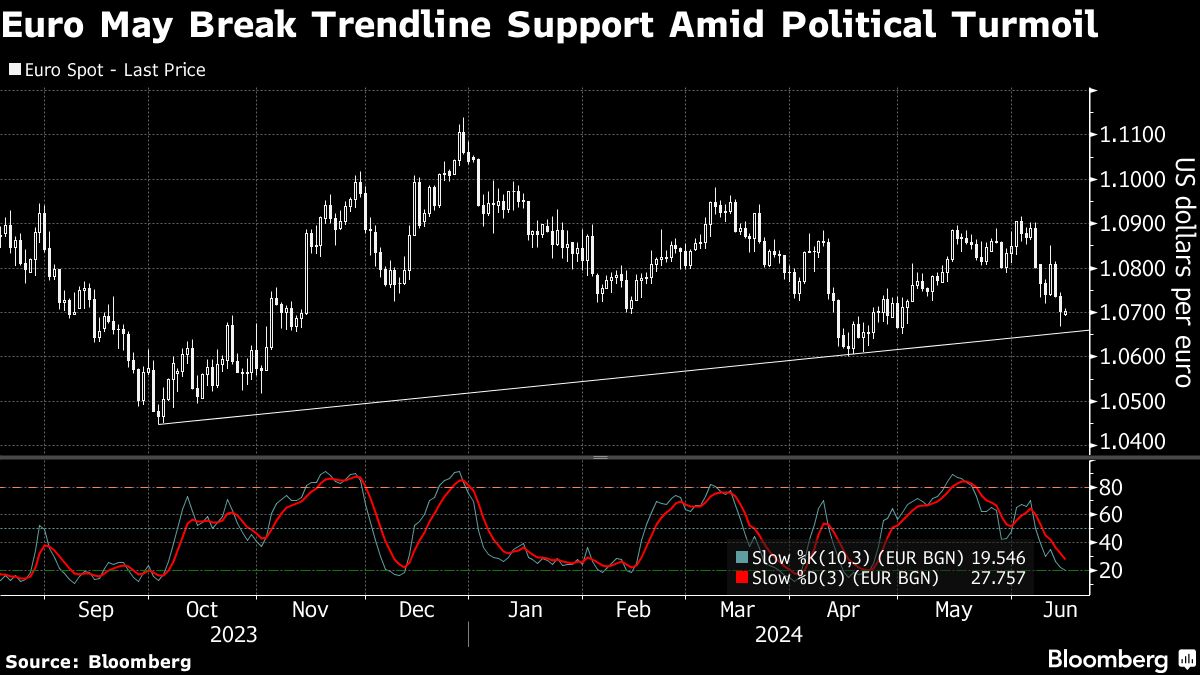

Concern about political volatility after Macron called a snap vote for later this month spurred a flight to haven assets last week, wiping out $258 billion from the market capitalization of the country’s stocks. On Monday, traders initially seized on Le Pen’s comments that she won’t try to push Macron out, but sentiment remains fragile before the first round of voting on June 30.

(Bloomberg) -- French stocks trimmed gains and bonds posted small moves as traders weighed assurances from far-right leader Marine Le Pen that she’d work with President Emmanuel Macron should she prevail in national elections.

Most Read from Bloomberg

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

How the US Mopped Up a Third of Global Capital Flows Since Covid

These Are the World’s Most Expensive Cities for Expats in 2024

Ukraine Bid for Global South Support Falters at Swiss Summit

Safeguards Against Le Pen’s Far-Right Are Starting to Unravel

France’s CAC 40 benchmark bounced as much as 1% before paring the move to trade near its lowest level since January. The main European stock measure swung between gains and losses as Citigroup Inc. downgraded the region’s equities, citing “heightened political risks” among other reasons. Yields on French government bonds rose again on Monday, while the spread over their German peers remained broadly steady.

Concern about political volatility after Macron called a snap vote for later this month spurred a flight to haven assets last week, wiping out $258 billion from the market capitalization of the country’s stocks. On Monday, traders initially seized on Le Pen’s comments that she won’t try to push Macron out, but sentiment remains fragile before the first round of voting on June 30.

“Investors should stay out of it at the moment,” said Evelyne Gomez-Liechti, rates strategist at Mizuho International. While “there can be some short-term small consolidation,” there’s still huge uncertainty given a lack of clarity over the economic policies of Le Pen’s National Rally, she said.

Europe’s Volatility Likely to Spread to Wall Street, IG Warns

Last week’s losses saw France slip behind the UK as the biggest equity market in Europe. The slump erased all of the CAC 40 benchmark’s gains for 2024 — a sharp reversal from scaling record highs a month ago. An index of euro-denominated junk bonds — almost a fifth of which comprises French companies — widened sharply to its highest spread over benchmarks since early April.

Big Trades in French Bank Bonds Surge on Snap Election Risks

The retreat last week also spread into broader European equity markets, with the benchmark Stoxx Europe 600 Index suffering its worst week since October. The gauge traded flat as of 1:21 p.m. in London after climbing as much as 0.7% earlier.

Not ‘Disorderly’

A raft of officials and strategists suggested the declines were overdone.

.jpg)

No comments:

Post a Comment