But none of that happened, as inflation was throttled and only minor, short recessions happened later on. Good jobs (or college, via the GI Bill) welcomed our soldiers, plus new homes for their Baby Boom kids and balanced budgets with growth to cut the debt-to-GDP in half by the late 1950s, all because of the wisdom of those who remembered their mistakes of 1919 – notably British economist John Maynard Keynes, who was present at Versailles and wrote “The Economic Consequences of the Peace” in 1919.

So, let us first honor the birthday tomorrow of John Maynard Keynes, born June 5, 1883, in Cambridge. Although he died shortly after the war, in 1946, his primary contribution at Bretton Woods was arguing against stiff war reparations on Germany or Japan. Bretton Woods gave immediate birth to the U.S. dollar standard, the World Bank and the International Monetary Fund (IMF), and the spirit of Bretton Woods begat the Marshall Plan and rebuilding Japan (instead of punitive war reparations) and GATT’s free trade."

6-4-24: America’s New D-Day:

The Day Debt Doubled Growth

by Gary Alexander

June 4, 2024

This week we celebrate the 80th anniversary of D-Day, June 6, 1944, by honoring those few remaining heroes that survived that harrowing day on the beaches of Normandy. As this is a financial newsletter, we’ll also mark a different birthday, a month later, of the postwar planning session in Bretton Woods, New Hampshire, July 1-22, which set the framework for the remarkable success of the postwar era.

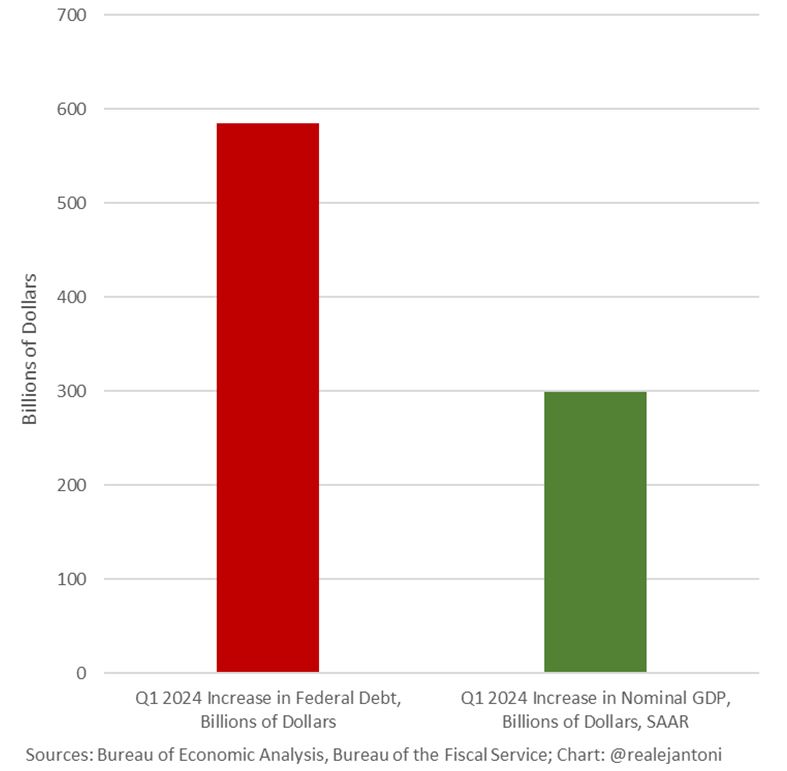

Last Thursday also marked a dour D-Day, when we learned that federal debt in the first quarter grew twice as fast as our economy – nearly $600 billion in federal red ink vs. $300 billion in nominal GDP growth. More on that in a minute, but first let me share the good news about how we did it right in 1944.

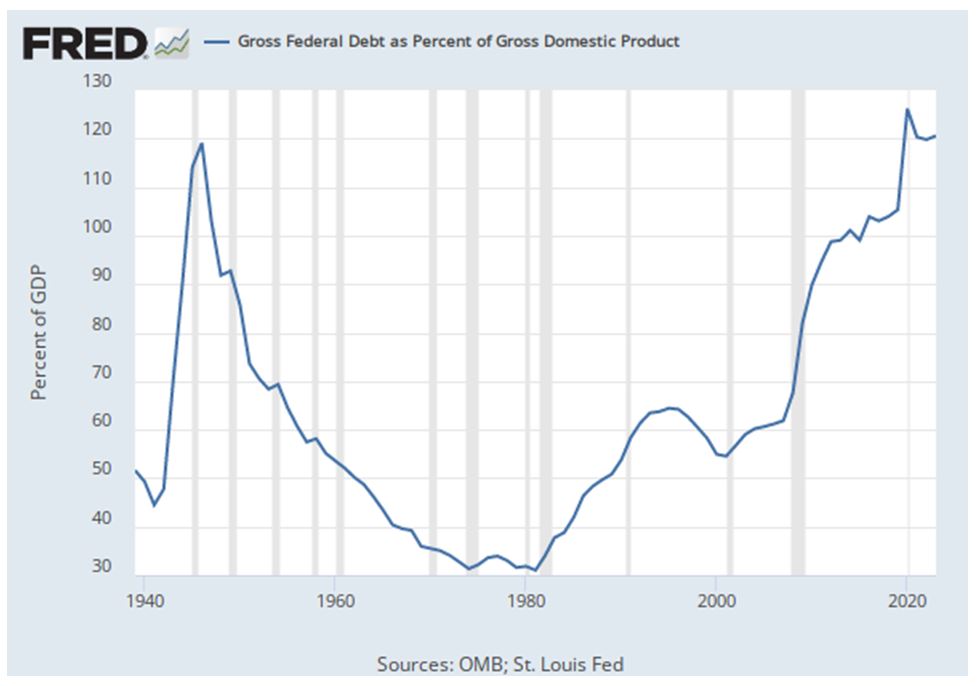

At the close of World War II, the U.S. had accumulated an unconscionable level of debt to fight the largest war ever, on two fronts, starting with a weak economy after 12 years of a Great Depression and a depleted military. America’s gross debt as a percent of GDP shot up from 45% in 1941 to nearly 120% at the end of World War II, with inflation soaring and a near certainty of a new Depression, as 12 million soldiers returned home to fewer jobs in a debt-plus-inflation-ridden economy – just like after WWI.

But none of that happened, as inflation was throttled and only minor, short recessions happened later on. Good jobs (or college, via the GI Bill) welcomed our soldiers, plus new homes for their Baby Boom kids and balanced budgets with growth to cut the debt-to-GDP in half by the late 1950s, all because of the wisdom of those who remembered their mistakes of 1919 – notably British economist John Maynard Keynes, who was present at Versailles and wrote “The Economic Consequences of the Peace” in 1919.

So, let us first honor the birthday tomorrow of John Maynard Keynes, born June 5, 1883, in Cambridge. Although he died shortly after the war, in 1946, his primary contribution at Bretton Woods was arguing against stiff war reparations on Germany or Japan. Bretton Woods gave immediate birth to the U.S. dollar standard, the World Bank and the International Monetary Fund (IMF), and the spirit of Bretton Woods begat the Marshall Plan and rebuilding Japan (instead of punitive war reparations) and GATT’s free trade.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As this chart shows, America started overspending again in the 1980s, then briefly balanced budgets from 1998 to 2001, then it was off to the races with average trillion-dollar-a-year deficits since 2002.

Now, here’s the bad news about our new D-Day, released last week, May 30th: America’s first-quarter GDP was marked down to +1.3% last Thursday, from the +1.6% originally reported, but that’s not the most important metric. At the same time, first-quarter federal debt grew twice as fast as nominal GDP (that is, in current dollars, without inflation subtracted). The economy grew by $300 billion last quarter, but the national debt increased by nearly $600 billion, an annual rate of $2.3 trillion, near COVID levels.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This means our debt-to-GDP ratio will start to rise again, after dipping briefly after COVID spending.

Are We in Danger of Going the Way of Japan — or Italy?

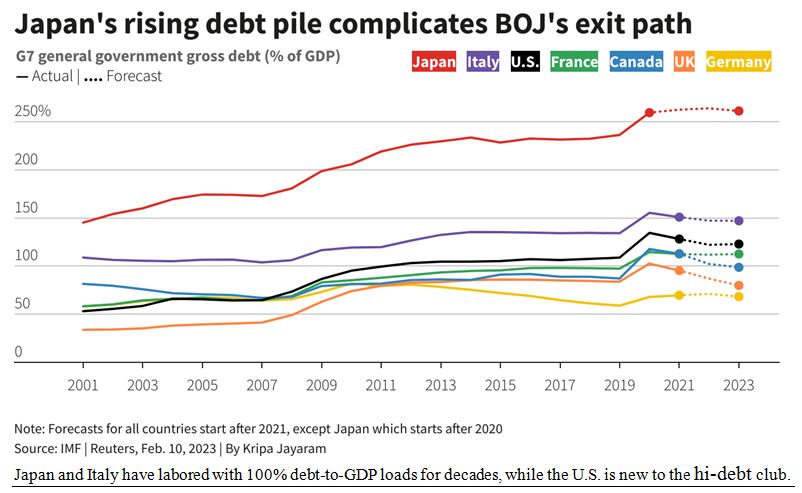

Only two developed nations today have a greater debt-to-GDP ratio than the U.S. has now – Japan (at a lofty 262%) and Italy (at 138%). The U.S. stands at around 120%, with a few Euro-zone nations slightly behind us (France, Spain and Portugal, at around 112%), but those three nations have their budget deficits reasonably in control, compared to America, so we seem to have the bronze medal for debt all locked up.

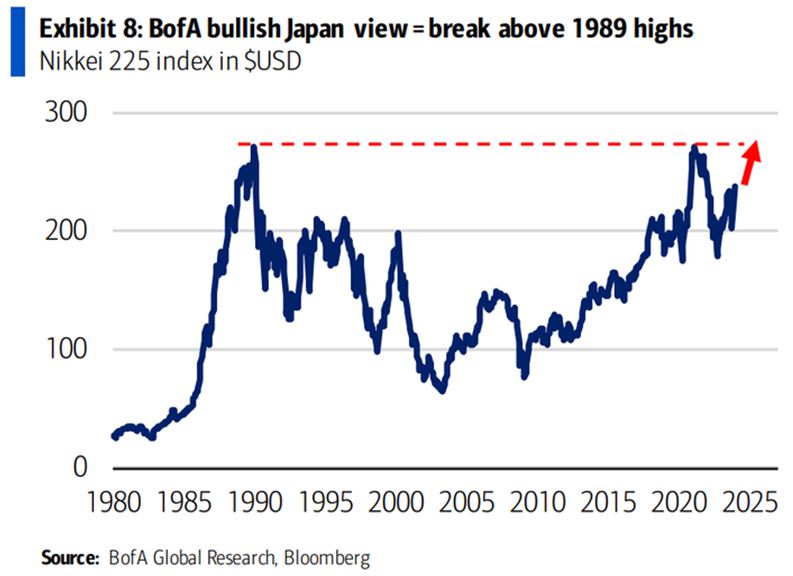

The financial report cards for Japan and Italy are not good. According to the current edition of The Economist, Japan’s latest quarterly GDP growth rate is an annualized negative -2%, its budget deficit this year is -4.8% of GDP, and its yen is down 11.5% to the dollar so far this year. In addition, Japan’s stock market index, though up recently, took over 30 years to climb back to its previous all-time high in 1989 – much longer than the 25 years it took the Dow to recover from its similar 1929 bubble peak – in 1954.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

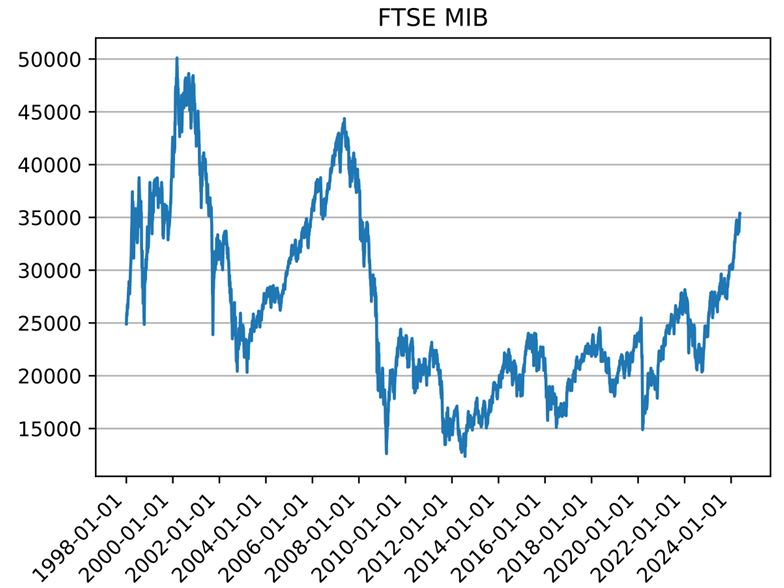

Italy has a similar death-warmed-over economic report card. Its GDP is up an anemic 0.6% year-over-year, its current budget deficit is -5.4% of GDP, and it sports a jobless rate of 7.2%. Its stock market index, the FTSE MIB, is down about 30% from its 2001 peak. Italian governments are historically known for their corruption, while the people mirror their leaders, often working “off the books” to avoid taxes.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

There is hope for recovery. Japan and Italy have labored under a 100% debt-to-GDP burden for several decades, while America just entered the triple-digit debt club in the last five years of COVID spending for benefits far and above families impacted by the pandemic. We are currently “pre-diabetic” debtors and can reverse the disease, but we must act fast to cut the carbs and sweets from our budgetary binges.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

If we don’t bring debt-to-GDP back under 100% this decade, we could go the deflationary route of Japan or the inflationary route of Italy, but it would be slow growth either way, and dismal stock market gains.

Wise up voters, and Congress. This is a key decision year for our future, our D-Day Debt Decision year.

Today in Military History Takes No Back Seat to D-Day

June 4th in 1944 was a Sunday, and nobody wanted to fight on the Lord’s Day, so the Normandy landing was slated for early Monday, June 5, but weather prevented the invasion then, so June 6 became D-Day.

However, today is the anniversary of several important events during the Second World War – a long list:

June 4th marked (1) the final evacuation of Allied forces from Dunkirk in 1940; (2) the Battle of Midway in 1942; (3) the liberation of Rome in 1944, and (4) the occupation of Okinawa in 1945.

In late May 1940, the British were trapped at Dunkirk with their back to the sea, with little chance of breaking out, but most were evacuated by a great flotilla of fishing boats, lifeboats and pleasure yachts. Then, in the Battle of Midway (1942), the Japanese fleet outnumbered the U.S., so they forced a showdown by dispatching four heavy aircraft carriers to occupy Midway, north of Hawaii. But the U.S. cracked their naval code and were ready. U.S. planes sank all four Japanese carriers in the first U.S. victory of the war. Two years later, Allied troops entered Rome, and on June 4, 1945, in celebrations dwarfed by D-Day. Then, the 6th Marine division occupied Orokoe Peninsula, Okinawa, at great cost.

A lot of other military events happened on June 4th

1805: The Barbary War ended in Tripoli, recalling a line in the Marine hymn: To the Shores of Tripoli.

1859: The French under Napoleon III beat the Austrians in the Battle of Magenta, Italy.

1917: The U.S. draft began, for service in the “Great War,” World War I.

1919: U.S. Marines attacked Costa Rica, while President Wilson was in Versailles.

1924: An Eternal Light was dedicated at Madison Square in New York City, to honor WWI veterans.

1967: The Six Day War began on June 5, in Israel.

1989: The Tiananmen Square riots took place in China, known there as “the June 4th incident” (on the same day the Ayatollah Khomeini died), 35 years ago today.

So, happy D-Day Celebrations…but also, “May June the 4th be with you” today.

All content above represents the opinion of Gary Alexander of Navellier & Associates, Inc.

No comments:

Post a Comment