Ukraine's proposal that was rejected had asked the creditors to slash the value of their bonds by up to 60 percent.

It means the clock continues to tick down to a potential $23 billion sovereign default later in the summer. That's a headache that Kyiv and supportive institutions like the International Monetary Fund (IMF) will want to avoid, so what happens now?A first round of formal talks with bondholders did not yield a deal, the government announced on Monday,

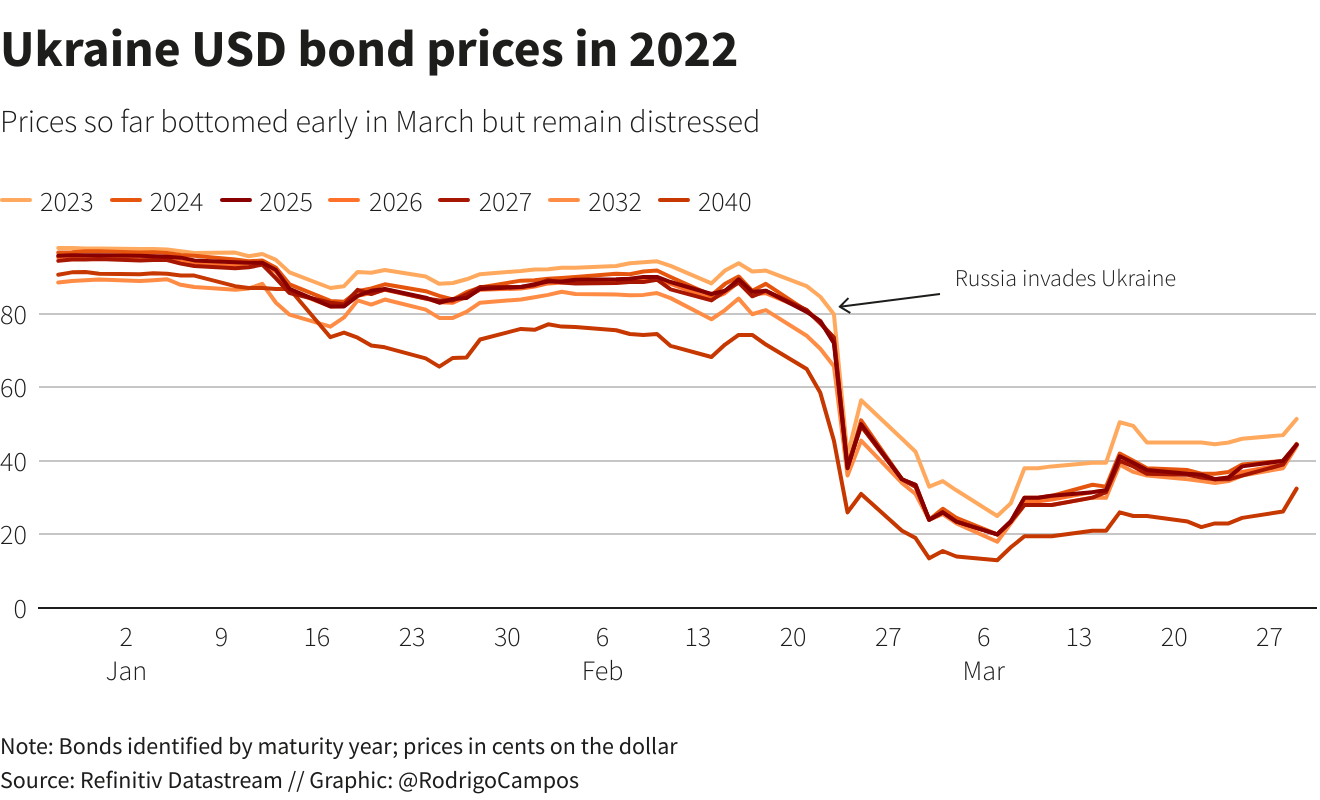

Ukraine international bonds.

This content was published onJune 18, 2024 - 06:22

4 minutes

By Rodrigo Campos

Here is a timeline of events related to the debt impact of Russia’s wars with Ukraine.

2014

February – Russia invades Ukraine’s Crimean peninsula. The invasion, as well as the war in Donbass, trigger an economic crisis that makes debt payments unaffordable, forcing a restructuring.

Earmarked for restructuring are all international bonds issued before February of 2014 – including a $3 billion Eurobond that was issued under English law and is owed to Russia, and still subject to court proceedings.

2015

November – Ukraine completes its debt restructuring which results in 13 bonds in dollars and euros being issued that currently have around $20 billion outstanding as well as a $2.7 billion GDP-warrant – all of which are in scope for the current restructuring.

2022

February – Russia invades Ukraine, setting off the deadliest war on European soil in more than 70 years. Ukraine’s economy and finances implode, driving the country to request a freeze in its debt payments to avoid a full-out sovereign default.

March – Ukraine begins issuing domestic market wartime bonds.

July – Naftogaz becomes the first Ukrainian government entity to default since the start of the Russian invasion after creditors did not support a two-year deferral. Kyiv asks holders of $1.5 billion in bonds from state agencies Ukravtodor and Ukrenergo to defer payments -and they agree.

August – Ukraine’s overseas private creditors back the country’s request for a two-year freeze on payments on almost $20 billion in international bonds. Global rating agencies S&P and Fitch consider the exchange “distressed,” triggering a short-lived downgrade to default. The country now owes nearly $24 billion on those bonds, including interest.

September – Ukraine and its bilateral partners finalize a memorandum of understanding to implement a two-year debt service suspension announced two months earlier, which was later extended.

2023

March – The Group of Creditors of Ukraine (GCU) including Canada, France, Germany, Japan, Britain and the U.S. provides financing assurances in support of an expected loan from the International Monetary Fund. This includes the extension until 2027 of a previously-agreed payment moratorium.

March – The IMF board approves a four-year $15.6 billion loan program for Ukraine to support the country’s economy.

November – In its 2024 budget, Ukraine details an expected $44 billion deficit.

2024

March – Reuters reports Ukraine’s overseas bondholders are in talks to form a creditor committee ahead of debt rework talks. The formation of the group is made official in April.

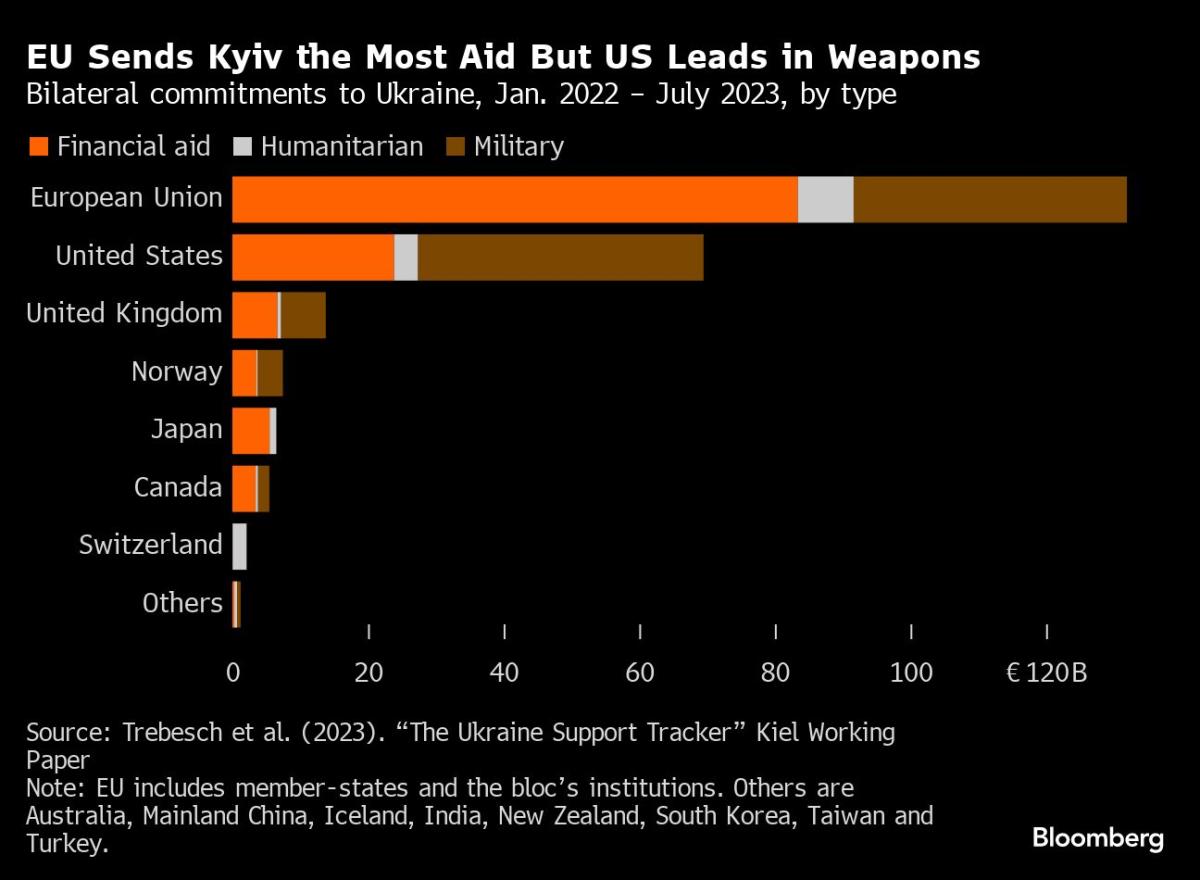

April – A sweeping foreign aid package passes in the U.S. Congress after months of delay, clearing the way for $61 billion in funding for Ukraine.

May – Ukraine pushes to agree on a restructuring with its private creditors ahead of expiration of a payment freeze.

June – The Group of Seven agrees to provide Ukraine with $50 billion in loans by using interest earned on frozen Russian assets.

June – Ukraine says it was unable to reach an agreement during formal talks with a group of bondholders over restructuring its commercial debt, pushing the country closer to default. Finance Minister Serhiy Marchenko says talks will continue and he expects the government to reach an agreement by Aug. 1

.

Ukraine’s debt woes during wartime

Ukraine’s international bond rework derailed as deadline nears

Euractiv.com with ReutersJun 17, 2024

Content-Type:

News Service

Ukraine has not been able to reach an agreement with a group of bondholders over restructuring some $20 billion of international debt during formal talks, it said on Monday (17 June), raising the spectre that the war-torn country might slip into default.

An agreement with holders of international bonds that allowed Ukraine to suspend payments after Russia’s invasion of the country in 2022 ends in August.

Ukraine’s Finance Minister Serhiy Marchenko said talks would continue and he expected the government to reach an agreement by 1 August.

Ukraine’s budget in May 2024. What worked, what didn’t, and how much external financial assistance was received — KSE analytical review

20 June 2024

This is stated in the May 2024 monthly Budget Barometer from the Center of Public Finance and Governance at the Kyiv School of Economics (KSE).

- This is likely due to the increased tax rate for banks to 25% last year and improved financial results of some state-owned enterprises, such as Naftogaz Group companies, which improved their performance by 40% in 2023.

In addition, revenues from excise tax (+4.9%), taxes on international trade (+5.4%), and import VAT (+13.2%) exceeded the plan.

- At the same time, revenues from domestic VAT (-6.9%) and external financial assistance ($20 million) were lower than expected.

- However, on June 13, 2024, the G7 countries decided to provide Ukraine with a $50 billion loan secured by frozen Russian assets, which will significantly strengthen the country’s financial stability in 2024.

In total, in the first five months of 2024, the state budget received $11.8 billion in foreign aid, including $10.7 billion in external loans and more than $1 billion in grants.

In May, the deficit of the state budget’s general fund was planned at UAH 200.2 billion, while the actual deficit amounted to UAH 157.9 billion, which is 1.3 times less than the planned figure.

- This was possible due to higher tax revenues and lower expenditures.

In addition, in May, the Ministry of Finance raised UAH 46.2 billion from the placement of domestic government bonds, of which 17.4% (UAH 8.4 billion) were bonds.

UAH 4.9 billion (€113.6 million) was raised from bonds denominated in foreign currency.

Experts at the KSE’s Center for Public Finance Analysis note that significant damage to energy infrastructure could negatively affect tax revenues from the most energy-intensive industries.

RELATED

2 hours ago

.gif)

No comments:

Post a Comment