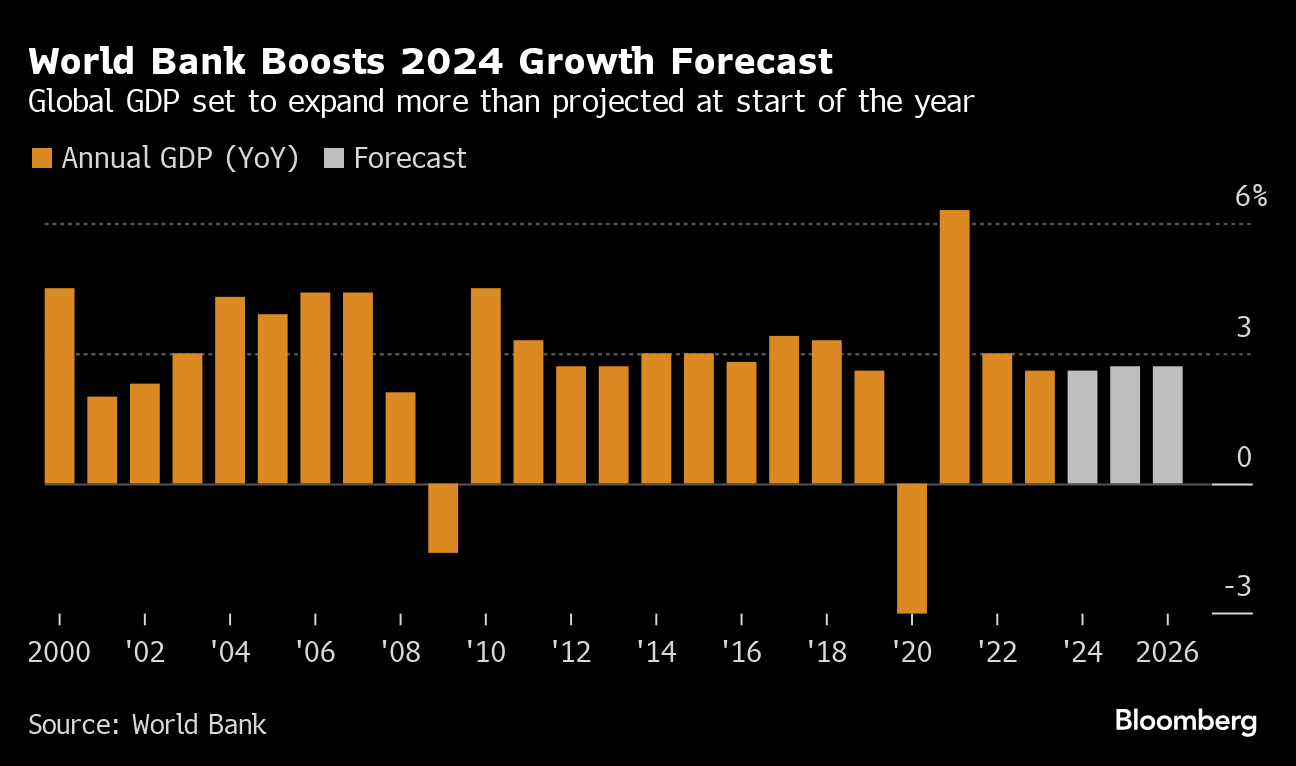

The global economy appears to be in final approach for a “soft landing” in 2024, indicating that a global recession has been avoided despite the steepest rise in global interest rates since the 1980s. Yet policymakers “would be wise to keep their eye on the ball,” Gill writes.

World Bank raises estimate for Russian economic growth

The country’s GDP is projected to expand 2.9% this year, according to the institution’s latest report

The World Bank has raised its growth forecast for the Russian economy based on revised figures published on Tuesday.

According to Global Economic Prospects 2024, Russia’s GDP will grow 2.9% this year and 1.4% in 2025. This is an upward revision from its previous projection of 2.2% and 1.1% growth, respectively.

The World Bank added that the Russian economy outperformed expectations in 2023, with growth picking up to 3.6% last year, a sharp increase from its January prediction of 2.6% and October projection of 1.6%.

“The upgrade largely reflects stronger-than-expected private demand, supported by subsidized mortgages, fiscal measures, and a tight labor market,” the institution wrote, noting that increased military expenditures have also boosted activity.

It further stated that “while the carry-over from strong growth in late 2023 and the beginning of 2024 is expected to boost activity throughout 2024, the anticipated tightening of macroprudential measures and the scaling back of the provision of subsidized mortgages are set to temper private demand.”

The report also pointed out that Russia’s trade ties with China have grown; more transactions are being conducted in the Chinese yuan amid Moscow’s ongoing ‘pivot’ to the East.

According to Russian President Vladimir Putin, the country’s economic growth exceeds the global average. In an address to the St. Petersburg International Economic Forum (SPIEF) last week, Putin said that Russian GDP expanded by 3.6% last year, bouncing back from a 1.2% downturn amid Ukraine-related sanctions in 2022. This year, the economy has continued to expand, he stated, adding that the growth has largely been driven by non-resource sectors.

The World Bank added that the Russian economy outperformed expectations in 2023, with growth picking up to 3.6% last year, a sharp increase from its January prediction of 2.6% and October projection of 1.6%.

“The upgrade largely reflects stronger-than-expected private demand, supported by subsidized mortgages, fiscal measures, and a tight labor market,” the institution wrote, noting that increased military expenditures have also boosted activity.

It further stated that “while the carry-over from strong growth in late 2023 and the beginning of 2024 is expected to boost activity throughout 2024, the anticipated tightening of macroprudential measures and the scaling back of the provision of subsidized mortgages are set to temper private demand.”

The report also pointed out that Russia’s trade ties with China have grown; more transactions are being conducted in the Chinese yuan amid Moscow’s ongoing ‘pivot’ to the East.

According to Russian President Vladimir Putin, the country’s economic growth exceeds the global average. In an address to the St. Petersburg International Economic Forum (SPIEF) last week, Putin said that Russian GDP expanded by 3.6% last year, bouncing back from a 1.2% downturn amid Ukraine-related sanctions in 2022. This year, the economy has continued to expand, he stated, adding that the growth has largely been driven by non-resource sectors.

- In April, the International Monetary Fund (IMF) said it expects the Russian economy to grow faster than all advanced economies in 2024.

Russian Finance Minister Anton Siluanov earlier said he expects GDP growth in 2024 to equal that of last year, while the Bank of Russia has put it at 2.5–3.5%.

Upgrade comes with warning on outlook for developing nations

Countries in Sub-Saharan Africa, Middle East

Countries in Sub-Saharan Africa, Middle East

June 11, 2024 at 6:30 AM PDT

The World Bank raised its forecast for global growth this year on strong US expansion, while warning that climate change, wars and high debt will hurt the poorer countries where most of the world’s population lives.

Growth Stabilizing But at a Weak Pace

Despite an improvement in near-term prospects, the global outlook remains subdued by historical standards. In 2024-25, growth is set to underperform its 2010s average in nearly 60 percent of economies, comprising over 80 percent of the global population.

Downside risks predominate, including geopolitical tensions, trade fragmentation, higher-for-longer interest rates, and climate-related disasters. - Global cooperation is needed to safeguard trade, support green and digital transitions, deliver debt relief, and improve food security.

- In EMDEs, public investment can boost productivity and catalyze private investment, promoting long-run growth.

- Comprehensive fiscal reforms are essential to address ongoing fiscal challenges in small states, including those arising from heightened exposure to external shocks.

- Global cooperation is needed to safeguard trade, support green and digital transitions, deliver debt relief, and improve food security.

- In EMDEs, public investment can boost productivity and catalyze private investment, promoting long-run growth.

- Comprehensive fiscal reforms are essential to address ongoing fiscal challenges in small states, including those arising from heightened exposure to external shocks.

Growth Is Proving Surprisingly Resilient in the Face of High Interest Rates and Geopolitical Risks, Says EIU Report

This article was originally published on GT Perspectives.

In its latest global economic outlook report, the Economist Intelligence Unit (EIU) "forecasts more fragmentation and regionalization in the world economy in 2024-28 as alliances tighten and competing blocs form."

What is more,

"The return of industrial policy, including sanctions and the provision of new incentives, will push firms to adopt more inefficient supply chains, stoke trade tensions in strategic sectors and make it difficult to compete across the global marketplace.

These developments will drag on growth potential."

The EIU expects "global real GDP will expand by 2.8% a year on average over the next five years—below the 3% of the 2010s, which was hardly a stellar decade for the global economy."

The UK-based organization adds that "In the near term, however, the global economy is showing resilience in the face of international conflict and higher interest rates.

The UK-based organization adds that "In the near term, however, the global economy is showing resilience in the face of international conflict and higher interest rates.

This mainly reflects the remarkable strength of the US economy, which is driven by strong household finances, a rising trend in manufacturing investment and a booming technology sector. Elsewhere, the picture is less dynamic but short of a downturn." Moreover, "Momentum in Europe will build gradually in 2024. Modest government stimulus in China is helping the economy to in the Middle East as the conflict in Gaza continues. Russia's invasion of Ukraine, now in its third year, shows no sign of resolution. Flash points in Asia, such as in relation to the South China Sea and Taiwan, will pose a persistent threat to the fragile stability that has developed in US-China relations. The diffusion of global power and uncertainty over the direction of US foreign policy underpins this rise in geopolitical risk."

Other key findings from the report include:

2.5% global real GDP growth in 2024 (compared with 2.4% previously), meaning growth will be unchanged rather than slowing from 2023.

Growth is proving surprisingly resilient in the face of high interest rates and geopolitical risks.

The change in global growth reflects

- another upward revision for US growth in 2024 to 2.2% (from 2% previously),

- upward revisions for several European economies that have pushed euro area growth to 1% (from 0.8%) and

- an upward revision for Brazil to 2.1% (from 1.8%)

In contrast, the EIU now expects the Bank of England (the UK central bank) to cut quicker than previously forecast, lowering its rate to 3.5% by end-2025 (compared with 4.25% previously).

The US dollar effective exchange rate is now forecast to appreciate for a third consecutive year in 2024—the EIU previously expected a mild depreciation.

- This reflects a stronger depreciation in the yen's value than previously forecast and the fact that the EIU is no longer forecasting euro appreciation.

The green transition and technological change will be among the major trends shaping global economic prospects over the next five years.

- In both cases, they seem set to diminish convergence prospects for developing economies.

- Poorer countries will be disproportionately affected by climate change and will struggle to secure financing to mitigate its impact.

.png)

.jpg)

No comments:

Post a Comment