Paramount's investor relations page claims its portfolio of network, studio, and streaming brands are the leader in key U.S. target consumer segments -- including total audience, kids, adults, African-Americans and Hispanics -- along with a global reach of over 4.3 billion subscribers in more than 180 countries

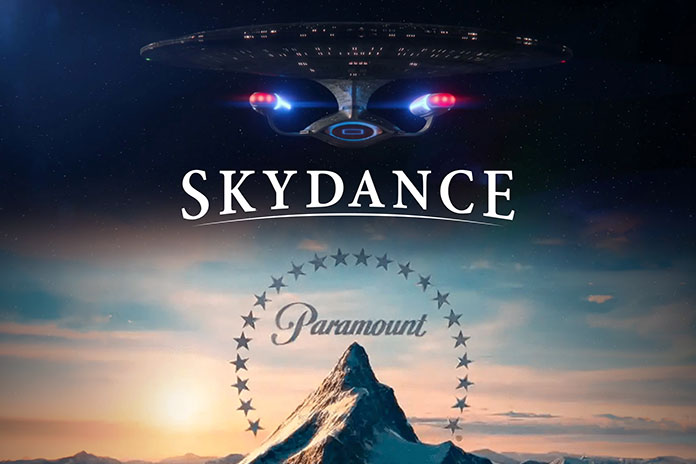

Paramount to merge with Skydance to create new $28B media, tech conglomerate

- A special committee of the Board of Directors of the NASDAQ-listed Paramount Global confirmed that after a six-month search for a buyer, it had unanimously approved a merger agreement between Paramount and Santa Monica, Calif.,-based Skydance Media, Paramount said in a news release.

- The all-stock deal will see holders of Paramount class A shares receive $23 per share in cash or stock, or a combination of both, and class B shareholders receive $15 per share in cash or stock, with the total cash amount capped at $4.5 billion.

- Skydance equity holders will receive 317 million class B shares valued at $15 per share.

- "Upon closing, it will deliver immediate cash consideration at a premium to both the minority Class A and Class B stockholders, who will also benefit from what we believe to be considerable upside through continued equity participation in New Paramount."

- "New Paramount will be a creative-driven destination for storytellers dedicated to delivering top-quality content," said the company.

- "Paramount's premier content platform to be enhanced and powered by best-in-class technology and modernized infrastructure offering scalability and ingenuity focused on delivering content through wholly-owned DTC platforms of Paramount+ and Pluto while enhancing CBS and Paramount's linear networks."

RELATED CONTENT UPLOADED ON THIS BLOG:

07 July 2024

Skydance-Paramount Merger Deal

After months of talks, Paramount Global and Skydance Media officially announced a deal to merge Sunday night.

Shari Redstone Tells Paramount Employees Skydance ‘Has a Clear Strategic Vision for the Future’; Co-CEOs Say in Memo ‘It’s Business as Usual’ for Now

Cheeks, McCarthy and Robbins say they will continue carrying out their restructuring plan, including layoffs and asset sales

Shari Redstone, non-executive chair of Paramount Global and its controlling shareholder through National Amusements Inc., addressed the pact in a memo to employees, as did the trio of co-CEOs currently leading the company: George Cheeks, president and CEO of CBS; Chris McCarthy, president and CEO, Showtime/MTV Entertainment Studios and Paramount Media Networks; and Brian Robbins, president and CEO of Paramount Pictures and Nickelodeon. (Read the memos below.)

In her memo, Redstone referred to her late father, Sumner Redstone, who assembled the pieces of what became Viacom and Paramount Global:

The current plan under Cheeks, McCarthy and Robbins includes layoffs and other measures aimed at achieving upwards of $500 million in annualized costs; selling assets to pay down debt; and pursuing a joint venture to scale up Paramount+ and accelerate its turn to profitability.

-----------------------------------------------------------------------------------------------------------------------------

v

.jfif)

No comments:

Post a Comment