Op-Ed: Falling Rates Open an Opportunity in Fixed Income

Not taking action as interest rates start to decline might be one of the greatest risks investors face, Xavier Baraton and Willem Sells write in a guest commentary.

4 minAbout the authors: Xavier Baraton is global chief investment officer, HSBC Asset Management. Willem Sels is global chief investment officer, HSBC Global Private Banking and Wealth.

Inflation has been top of mind for investors over the past two years. We’ve now reached an inflection point, and investors who fail to update their thinking risk missing out.

It helps to recall how we got here. In the wake of the pandemic, national governments and central banks engaged in unprecedented fiscal and monetary accommodation. Their efforts spurred an extraordinary economic recovery, boosting employment and generating strong demand from consumers and businesses. However, continuous supply-chain disruptions meant demand could not be met. This pushed prices higher across goods and services, moving inflation far above global central banks’ targets. Central banks aggressively raised their policy rates to slow their economies and get inflation back under control.

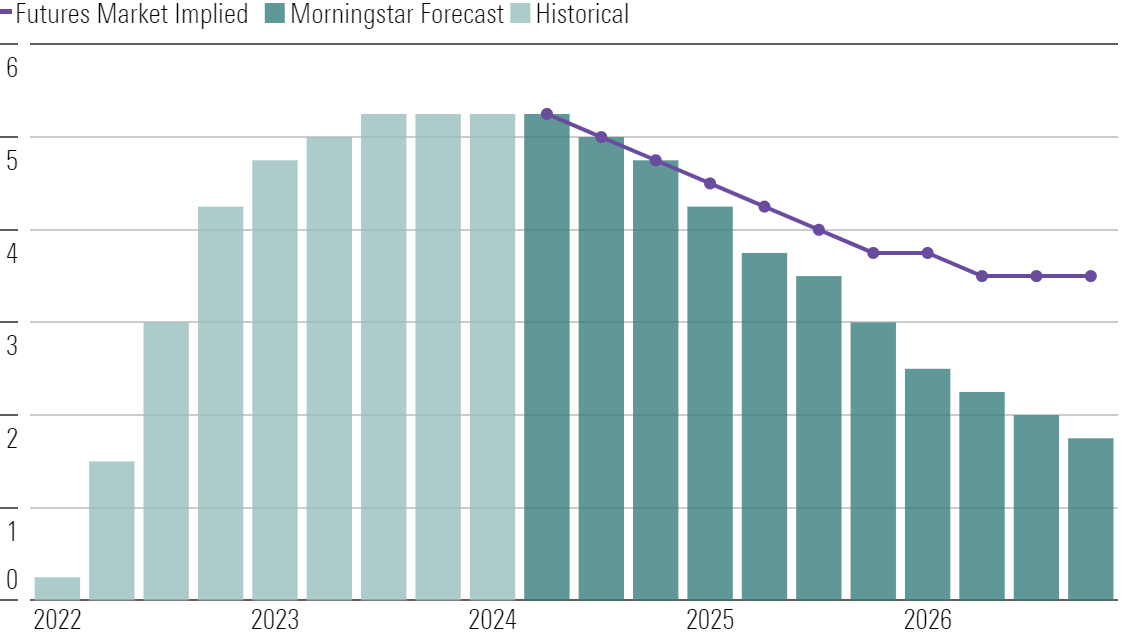

The upshift in interest rates had other consequences. It created not only the highest yields in over 15 years but also an inverted yield curve, whereby short-term yields are higher than longer-term yields. The curve has remained inverted since July 2022. . .

Events in the Middle East, Europe, and Asia signal a change in the global architecture, Abishur Prakash writes in a guest commentary.

About the author: Abishur Prakash is a geopolitical strategist at t he Geopolitical Business, a strategic advisory firm.

Israel and Hezbollah may avoid war. But if not, a conflict between them could unleash a wider, regional war in the Middle East with no limits.

If it comes to the worst, the Israel-Hezbollah flare-up may be just one of several wars that begin over the coming summer months. As multiple flashpoints reach or cross the point of no return, the world is moving into uncharted waters. . .

Slowing inflation and a balanced jobs market are setting the Fed up for a September rate cut, Gregory Daco writes in a guest commentary.

About the author: Gregory Daco is the chief economist at EY and former chief U.S. economist at Oxford Economics. Views expressed in this article are those of the author and don’t necessarily represent the views of Ernst & Young LLP or other members of the global EY organization.

Powell delivered the Fed’s semiannual Monetary Policy Report to the Congress this week. Much of his message was largely unchanged from recent Fed communication, but Powell inserted a key phrase in his testimony: “Elevated inflation is not the only risk we face.”

While this might seem like an innocuous statement given the broad range of risks to the economic outlook, it is significant coming from the Fed chair. Indeed, it confirms a gradual policy turn, where some policymakers are putting more emphasis on the second tenet of the Fed’s dual mandate: maximum employment. . .

No comments:

Post a Comment