Ukraine May Default as Early as August, UK Publication Writes

"Ukraine has a month to avoid default," British magazine The Economist reported. "The IMF is keen for [Minister of Finance of Ukraine] Mr. [Serhiy] Marchenko to negotiate a write-down, but a deal seems unlikely in the time available."

"The current impasse raises a worrying prospect: that distrust between them [the Western states] and private investors will slow down progress," the Economist wrote, stressing that a significant part of Ukraine's recovery "will never turn a profit" and therefore will have to be shouldered by the country's allies.

1 Jul, 2024 15:24

HomeBusiness News

Ukraine could declare default

– The Economist

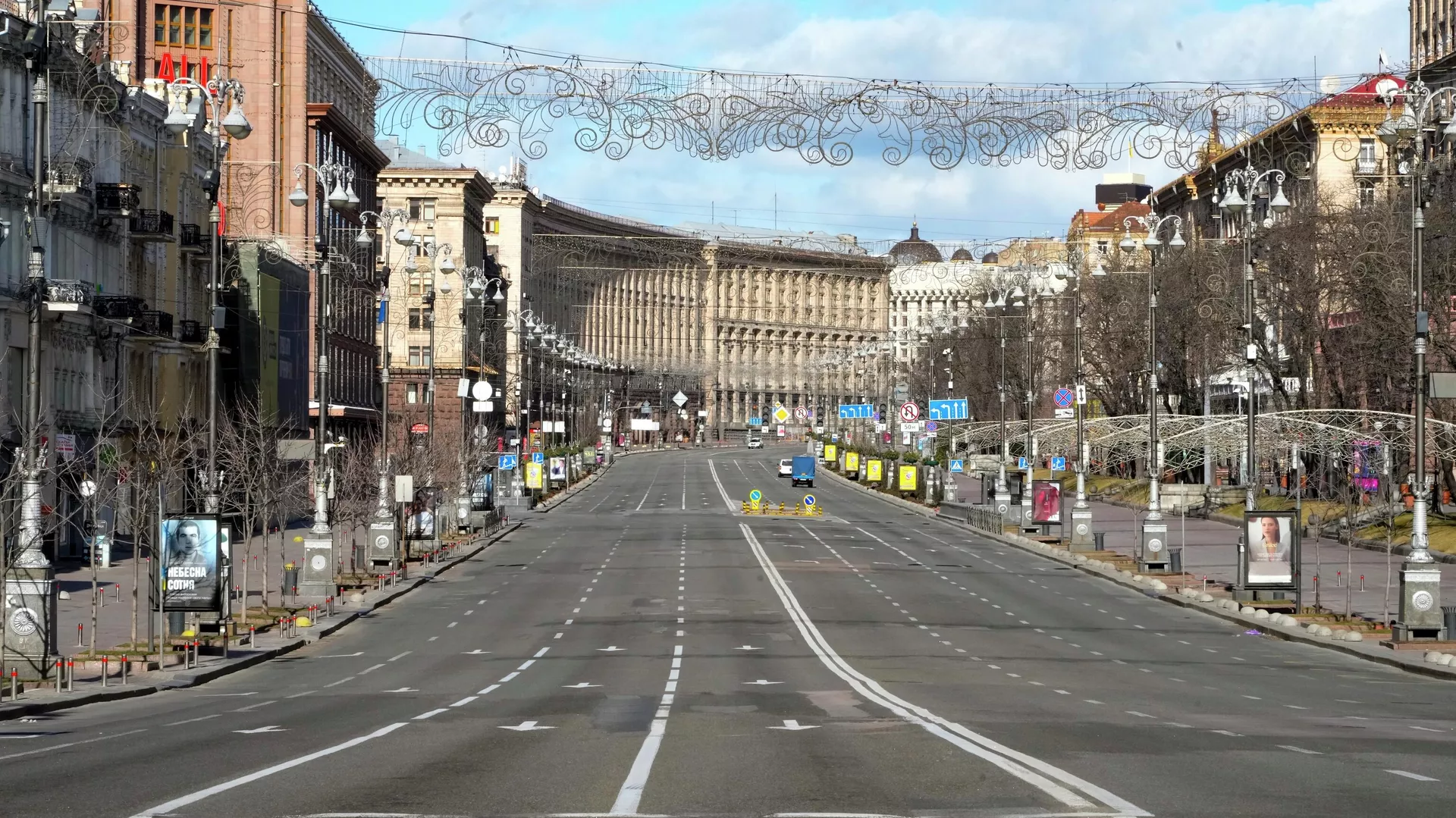

Kiev could default on its enormous debts as early as next month if it fails to negotiate a restructuring deal with its creditors, The Economist reported on Sunday.

According to the outlet, the arrangement is worth 15% of Ukraine’s annual GDP, meaning that if payments had been required, they would have been Kiev’s second-biggest category of expenditure after defense.

The conflict with Russia has dealt a heavy blow to the Ukrainian economy, which has shrunk by a quarter since the outbreak of hostilities, the outlet said. Kiev’s debt-to-GDP ratio will approach 94% by the end of the year, despite “impressive” Western backing, although this largely comes in the form of “artillery, tanks and earmarked funds, rather than cash,” the article noted.

Last month, the Ukrainian government failed to reach agreement with a group of foreign investors on restructuring the country’s $20 billion debt in Eurobonds. Kiev has been urging bondholders to accept a steep debt writedown as it tries to meet IMF demands to restructure and retain access to international markets.

Ukraine sought to reduce its debt by 60% of its current value, while creditors said 22% was “more reasonable.”

Most likely scenarios for Kiev involve an extension on its debt-service freeze until 2027 or the declaration of a default, the outlet said. Either way, Ukraine will not resume payments to its creditors, it added.

No comments:

Post a Comment