The Rate Cuts Powell Dangled in Front of Markets May Slam into Inflationary Fiscal & Economic Policies of Whoever Is in the White House Next Year

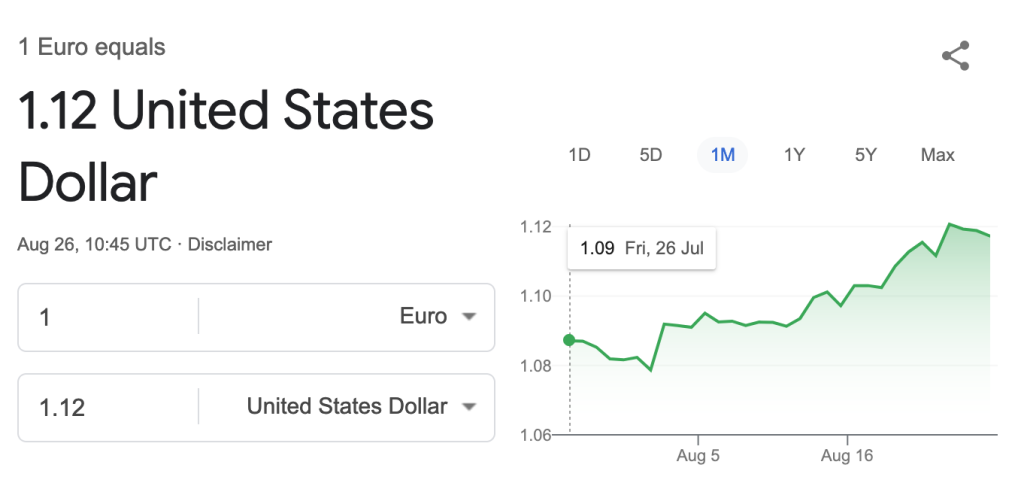

Yves here. I have to quibble a bit with Wolf’s claim that Powell saying a rate cut was finally on was a “nothing burger” although in fairness he limited his comment to the Treasury market. Currencies were slower to become believers. Look at the Euro to dollar since early August, when Wolf depicts the Treasury market as having baked in the rate reduction. There was a move on August 2, but the bigger cumulative increase was later:

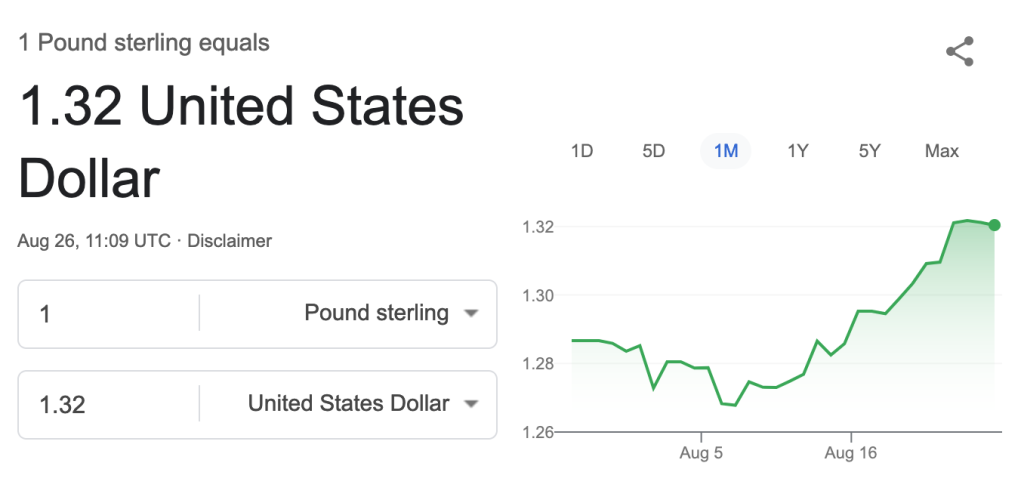

The Bank of England announced a rate cut from 5.25% to 5.0%, hence the action below:

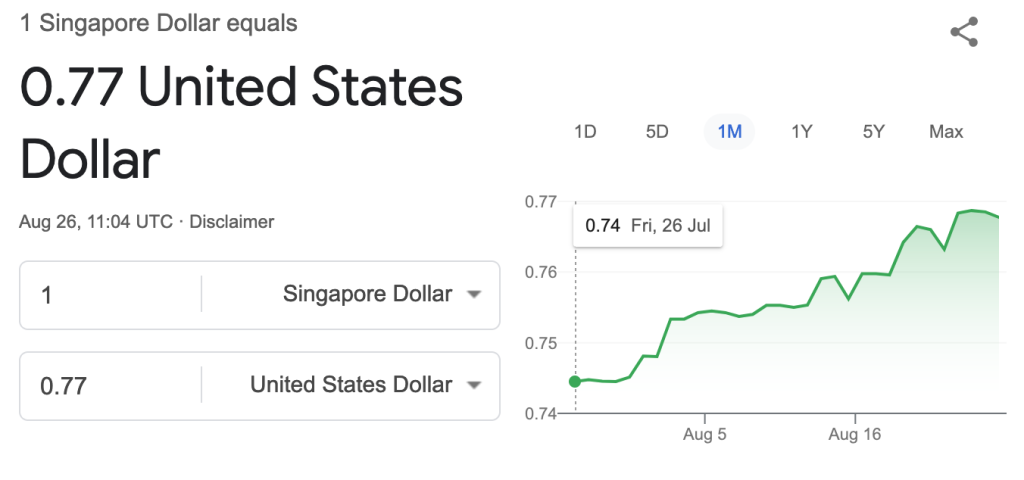

An emerging-ish economy currency:

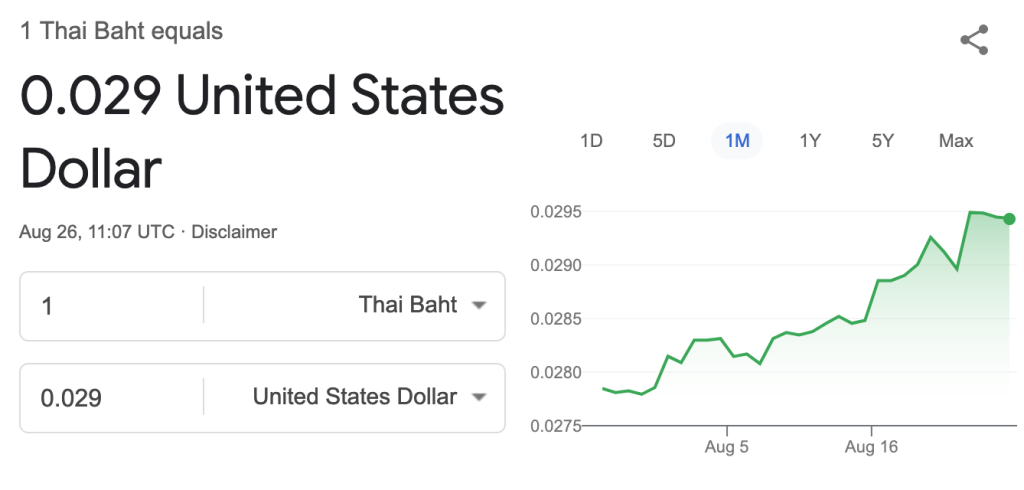

And a local fave:

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

For the Treasury market, Powell’s speech was a nothingburger. A Sep rate cut has been priced in since the Aug 2 jobs report.

Powell re-confirmed at his Jackson Hole speech on Friday that rate cuts are coming but didn’t mention “September.” He said, “The time has come for policy to adjust. The direction of travel is clear…”

But “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Powell presented a balanced message. There was no panic. The two sides of the Fed’s dual mandate (low inflation and full employment) have come roughly into balance.

The Fed has been talking about rate cuts since its December 2023 meeting when it put three rate cuts on the table for 2024, which markets instantly turned this into six rate cuts. Now it’s August 2024, and we’re still waiting for our rate cuts. But we’re getting closer.

At its September meeting, after nine months of wait-and-see, the Fed is likely to cut. That has become increasingly clear recently, including in the FOMC minutes of the July meeting, released on Wednesday, where “September” cropped up in terms of markets expecting a cut in “September,” and there was nothing in the minutes to dissuade markets from it.

Powell pointed out that inflation has dropped a lot. Policy rates have not dropped at all since July 2023 and are high compared to inflation – “restrictive” came up three times in his speech. The upside risk of inflation heading higher from here has diminished. His “confidence has grown that inflation is on a sustainable path back to 2%.” Inflation is just much less of an issue than it had been.

The labor market has cooled from its red-hot pace, and risks to employment have risen, etc. etc., and “we do not seek or welcome further cooling in labor market conditions,” he said.

But no panic: “So far, rising unemployment has not been the result of elevated layoffs, as is typically the case in an economic downturn. Rather, the increase mainly reflects a substantial increase in the supply of workers [from the huge wave of immigration] and a slowdown from the previously frantic pace of hiring.”

“With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2% inflation while maintaining a strong labor market,” he said.

So no panic. Gradualism. If the economy plays out that way, a series of 25-basis point cuts.

If the labor market suddenly tanks, the Fed would step in with bigger cuts: “The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.”

Everyone will be looking for inspiration at the August jobs report, to be released on September 6 – whether nonfarm job creation will bounce back from its moderate pace in July, which was likely the effects of Hurricane Beryl that hit Texas during the survey reference period. If nonfarm job creation bounces, rate-cut gradualism will prevail. If it tanks and turns negative – meaning the first job losses – then, bigger cuts.

Before the September meeting, there will also be a PCE price index report for July (which won’t be a big surprise, given that we’ve already had the July CPI report) and a CPI report for August.

The Fed will likely “look through” a bad CPI report for August. If inflation accelerates further month-to-month from the month-to-month acceleration in July, combined with a strong bounce of nonfarm jobs in August, then the Fed can decide to “look through” that acceleration of inflation, as it had “looked through” the spike of inflation in early 2021. With regards to the 2021 episode, Powell said, “it can be appropriate for central banks to look through a temporary rise in inflation.” So this time around, if the CPI report is bad, the Fed will likely cut anyway in September, perhaps with some dissenting votes.

Markets are already lining up a bunch of rate cuts. The federal funds futures market on Friday saw a 77% probability of at least 200 basis points in cuts by the end of 2025, which would be 8 cuts of 25 basis points spread over 11 meetings, similar to December 2023, when they expected 150 basis points in cuts spread over 8 meetings in 2024.

But this rate-cut trajectory might not happen as envisioned because of the inflationary effects of the economic and fiscal policies to be sought by whoever ends up in the White House – that’s what the president of the Peterson Institute for International Economics, Adam Posen, told MarketWatch.

There is a good chance that the inflationary policies promised by both candidates – on top of the current fiscal fiasco – will reignite inflation, and then the Fed has the next problem on its hands and end up having to deal with it.

Powell’s speech focused too much on the short-term and gave no thought of what will happen in six months, Posen told MarketWatch. This was a mistake, he said.

“My view is that if Harris becomes president, it is 60% to 65% likely that you won’t see the cuts” the market envisions, Posen said. “If Trump gets in, I put it at 80%-90% they are going to be hiking a year from now.”

There’s never a dull moment in economics. The WSJ lamented that “the candidates haven’t just demoted economic principles this year; they’ve jettisoned them altogether. It’s as if they wanted to flip the bird at the economic establishment.”

Glenn Hubbard, who chaired President George W. Bush’s Council of Economic Advisers, told the WSJ: “Doesn’t anyone listen to economists anymore?” That was a rhetorical question. “Economists don’t seem very involved in either campaign or in internal decisions in recent administrations,” he said.

Meanwhile in the Treasury Market…

The big moves were triggered after the August 2 jobs report. Since then, yields have ticked up a hair, and Powell’s speech didn’t change much since the Treasury market had already priced in a September rate cut, and further rate cuts in the future.

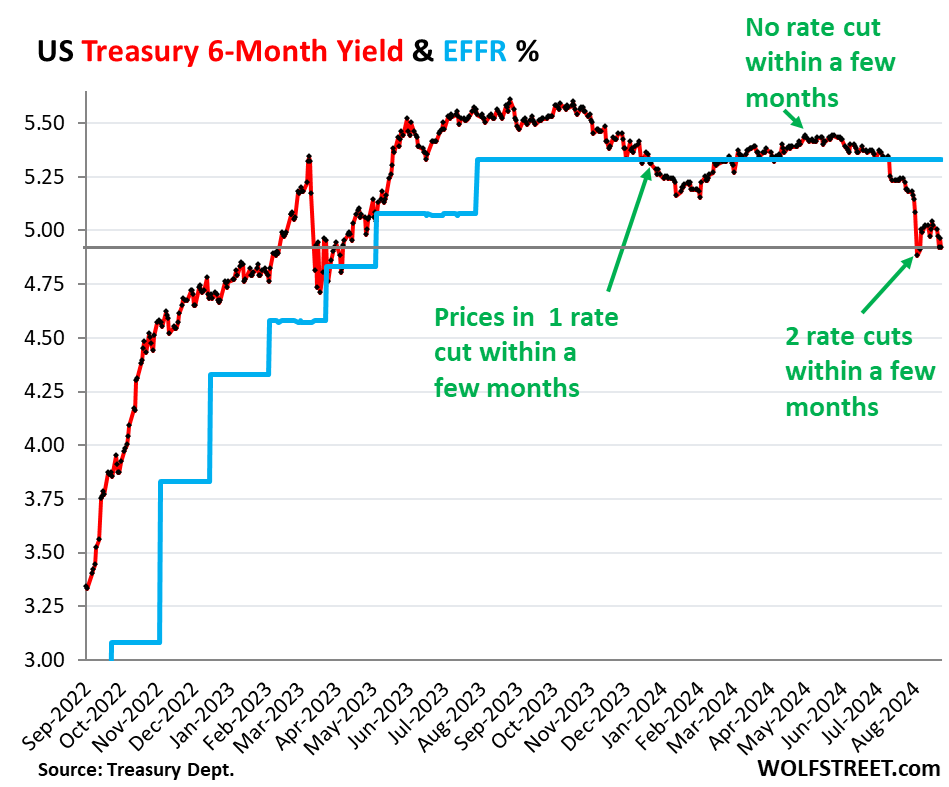

The six-month Treasury yield, which is an indicator of market expectations of Fed policy rates over the next several months, ticked down 4 basis points on Friday to 4.92%, back where it had been on Wednesday, but above the post-jobs-report plunge to 4.88% on August 2.

Note that the six-month yield falsely started pricing in rate cuts in early 2024 that didn’t come. In April-May, it rose again to the no-rate-cut scenario within its six-month window.

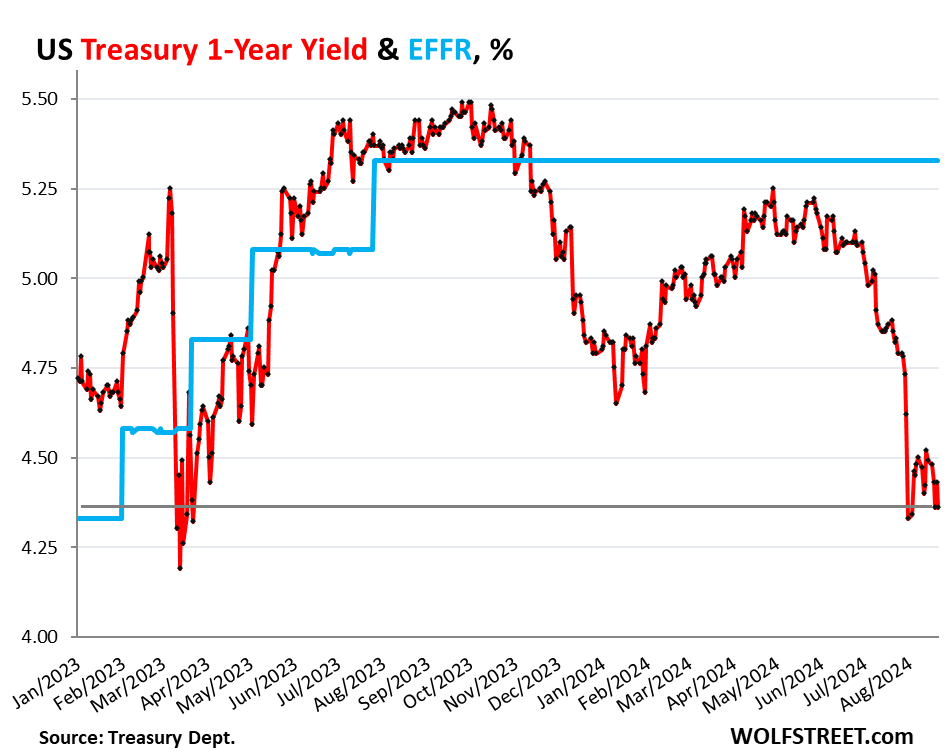

The one-year Treasury yield, which looks into the future through mid-2025 ended on Friday where it had been on Wednesday, at 4.36%, and up from the August 2 low of 4.33%. It’s beginning to price in four rate cuts in the early portion of its one-year window.

.jfif)

Thank you. Presumably, if there is an escalation in the Middle East (of which we may have received a mild foretaste yesterday), interest rates may well spike, rather than subside. There seems to be a massive degree of cognitive dissonance on the part of the two candidates who claim to be in favour of lower prices whilst simultaneously fomenting escalation in the Middle East which risks guaranteeing higher prices, after the manner of 1973.