Fitch cuts Ukraine's rating to 'Restricted Default'

(Reuters) - Fitch downgraded Ukraine's credit rating to "Restricted Default" from "C" on Tuesday, citing the expiry of the grace period for its 2026 Eurobond payment.

The war-torn country defaulted on its bonds following the invocation of a law permitting the suspension of foreign debt payments until Oct. 1.

Earlier this month, Ukraine began the process to gain bondholder approval to restructure $20 billion of international bonds.

Ukraine, following an invasion by Russia, has been resolutely pushing for wartime debt restructuring as part of its efforts to regain access to international capital markets.

Fitch usually does not assign outlooks to countries with a rating of "CCC+" or below.

(Reporting by Raechel Thankam Job; Editing by Mohammed Safi Shamsi and Anil D'Silva)

The war-torn country defaulted on its bonds following the invocation of a law permitting the suspension of foreign debt payments until Oct. 1.

Earlier this month, Ukraine began the process to gain bondholder approval to restructure $20 billion of international bonds.

Ukraine, following an invasion by Russia, has been resolutely pushing for wartime debt restructuring as part of its efforts to regain access to international capital markets.

- Fitch maintained Ukraine's local-currency (LC) debt rating of "CCC-" over its expectation that LC debt will be excluded from a restructuring deal with external commercial creditors.

Fitch usually does not assign outlooks to countries with a rating of "CCC+" or below.

(Reporting by Raechel Thankam Job; Editing by Mohammed Safi Shamsi and Anil D'Silva)

Ukraine on the brink of defaulting on its debt

On July 18, Ukraine’s Parliament passed a law allowing the Government to suspend foreign debt payments just as it resumed formal talks with bondholders to restructure some 20 billion dollars in debt.

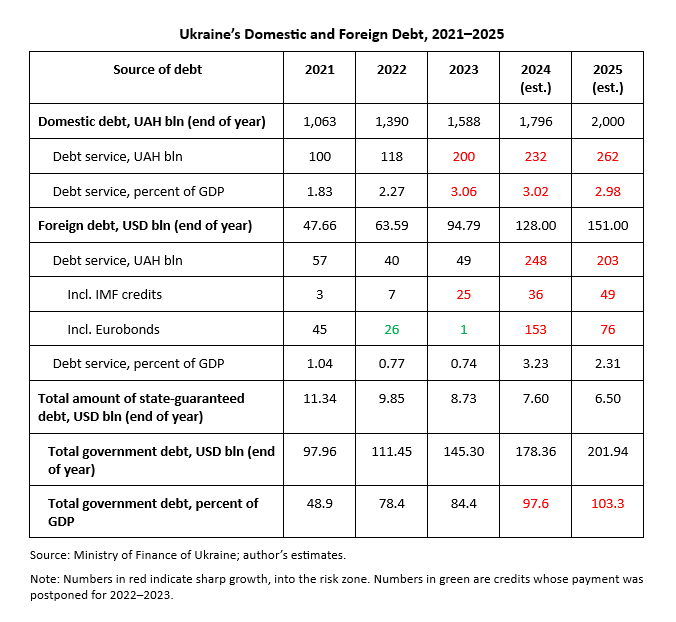

Before the war, Ukraine maintained a relatively healthy debt position, with government debt at 48.9 % of GDP at the end of 2021. However, the war drastically changed this.

- The Ukrainian economy’s decline, coupled with a surge in public spending from 40 % to 75 % of GDP between 2021 and 2023, caused a significant increase in both domestic and foreign debt, reaching 84.4 % of GDP by the end of 2023.

Now, in 2024, Ukraine must pay three years’ worth of interest on these bonds, amounting to nearly 12 billion dollars and pushing public debt service costs to 6.3 % of GDP.

- The public debt is forecasted to reach 97.6 % of GDP by the end of the year.

- Ukraine also faces substantial payments on its 2015 GDP-linked securities, which require payments if economic growth exceeds 3 % of GDP.

To alleviate this burden, Ukraine’s Parliament recently passed a law allowing the Government to suspend foreign debt payments, providing crucial flexibility in ongoing restructuring talks. Successful negotiations could save over 10 billion dollars in debt servicing costs by 2027. However, if an agreement is not reached, a payment moratorium might be invoked, highlighting the urgent need for a resolution to avoid default.

Sources:

Daryna Krasnolutska & Kateryna Chursina, Bloomberg, ,,Ukraine Plans Law Allowing Foreign Debt Payments Suspension“, https://www.bloomberg.com/news/articles/2024-07-18/ukraine-plans-law-allowing-suspension-of-foreign-debt-payments

Daniil Monin, Wilson Centre, ,,Will Ukraine Default on Its Debts?“, https://www.wilsoncenter.org/blog-post/will-ukraine-default-its-debts

Rodrigo Campos, Reuters, ,,Ukraine’s debt woes during wartime“, https://www.reuters.com/world/europe/ukraines-debt-woes-during-wartime-2024-06-18/

Ukraine to temporarily suspend payments on GDP warrants next year, government says

Story by Reuters • 20h

2 WEEKS AGO

Ukraine seeks bondholder sign-off for wartime debt rework

Story by Libby George and Rodrigo Campos • 2w

Ukraine to temporarily suspend payments on GDP warrants next year, government says

Story by Reuters • 20h

(Reuters) - Ukraine will temporarily suspend payments on GDP warrants starting from May 31, 2025, a government decision published on the official website said.

- According to the document, Kyiv will also temporarily suspend payments for loans from Cargill Financial Services International, Inc., starting from Sept. 3, and on government-guaranteed bonds of Ukrainian power firm Ukrenergo starting from Nov. 9.

Ukraine seeks bondholder sign-off for wartime debt rework

Story by Libby George and Rodrigo Campos • 2w

FILE PHOTO: A general view shows the headquarters of Ukraine's foreign ministry behind St. Michael's Golden-Domed Cathedral in central Kyiv, Ukraine February 25, 2022. REUTERS/Valentyn Ogirenko/File Photo© Thomson Reuters

By Libby George and Rodrigo Campos

LONDON/NEW YORK (Reuters) - Ukraine on Friday kicked off the formal creditor approval process of its offer to restructure some $20 billion of international bonds, a key step in the war-torn country's debt rework.

"The Group confirms it is comfortable with the agreement that has been confirmed by the IMF staff as compatible with the debt sustainability objectives," the Group of Creditors of Ukraine (GCU) said in a statement, and encouraged bondholders to "consent to this request in a swift manner."

- Holders of its international bonds have until Aug. 27 to agree to the proposal, which was announced by the government on July 22.

- Ukraine is offering a consent fee to bondholders who consent by Aug. 23.

"The Group confirms it is comfortable with the agreement that has been confirmed by the IMF staff as compatible with the debt sustainability objectives," the Group of Creditors of Ukraine (GCU) said in a statement, and encouraged bondholders to "consent to this request in a swift manner."

IMF head Kristalina Georgieva said "the successful implementation of this agreement will provide significant debt-service relief, creating room for critical spending and supporting growth."

- The consent solicitation also seeks bondholder sign-off on the rework of state-owned road agency Ukravtodor's $700-million bond, under the same terms as the government's debt, raising the total outstanding value of the included bonds to $20.5 billion.

DEAL DURING WARTIME

Ukraine defaulted on its bonds by invoking a law allowing it to skip international debt payments in advance of a coupon payment due on Aug. 1, when a two-year debt moratorium expired.

In a statement, the ad hoc creditor committee, which negotiated the deal with the government and holds roughly 20% of the bonds, urged bondholders to vote in favor.

Ukraine defaulted on its bonds by invoking a law allowing it to skip international debt payments in advance of a coupon payment due on Aug. 1, when a two-year debt moratorium expired.

- The default is expected to be short-lived, much like a similar default in 2015, as it finalizes the restructuring deal.

- The country chose to push for an unprecedented wartime restructuring rather than seek to extend the payment pause.

In a statement, the ad hoc creditor committee, which negotiated the deal with the government and holds roughly 20% of the bonds, urged bondholders to vote in favor.

"The exchange would provide significant debt relief to Ukraine, assist its efforts to regain access to the international capital markets, and support the future reconstruction of the country to the benefit of the Ukrainian people," it said.

Bond investors will see a 37% haircut to the face value of their holding if they consent to the exchange.

Bond investors will see a 37% haircut to the face value of their holding if they consent to the exchange.

- Two-thirds of the overall number of bondholders must sign off, along with a simple majority of 50% on each of the individual series, in order to approve the restructuring.

(Reporting By Libby George and Rodrigo Campos; Editing by William Maclean, Philippa Fletcher and Rod Nickel)

No comments:

Post a Comment