President Donald Trump late Thursday signed an executive order

authorizing the federal government to stockpile cryptocurrency assets

that it seizes through law enforcement proceedings, a move aimed at

boosting the digital assets industry.

“People were hoping for near-term buy pressure.”

Cryptocurrencies decline as Trump’s U.S. bitcoin reserve plan falls short of expectations

Cryptocurrencies fell Thursday night after President Donald Trump signed an executive order creating a strategic bitcoin reserve for the United States and, separately, a “digital asset stockpile.”

The price of bitcoin was last lower by 3% at $87,586.86, according to Coin Metrics. Shortly after the news broke, it fell to as low as $84,688.13.

Earlier losses in other coins – specifically those that rallied at the

beginning of the week after Trump said they would be included in the

strategy – also eased.

Ether was down 2%

Solana’s SOL token retreated 1% and 3%, respectively

Cardano’s ADA token tumbled 13%.

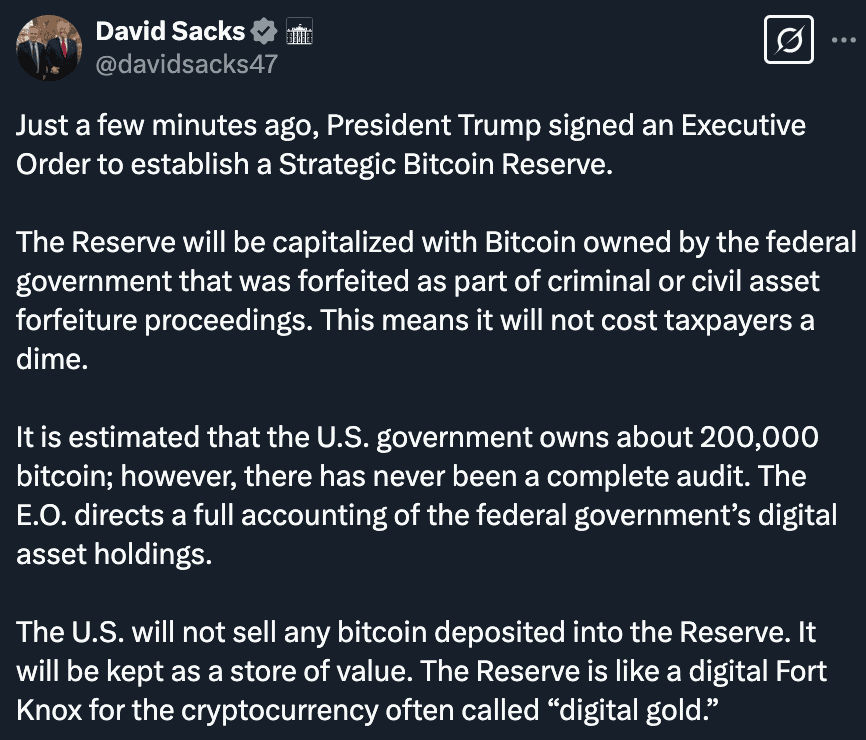

White House crypto and AI czar David Sacks detailed in a post on X

that the bitcoin reserve will include bitcoin already owned by the U.S.

government that it seized from past law enforcement actions – a move,

he emphasized, that will “not cost taxpayers a dime.”

- The U.S. currently owns more than 198,000 bitcoins worth about $17 billion, according to Arkham.

The stockpile of other coins will include “digital assets

other than bitcoin forfeited in criminal or civil proceedings.” Sacks

said the government will not acquire additional assets for it “beyond

those obtained through forfeiture proceedings.”

- Arkham data shows the U.S. government owns about 56 ether tokens worth almost $119 million. It does not list XRP or the Solana or Cardano tokens.

The crypto market has been

rocked this week by the tariff war and inflation concerns, which have

largely overshadowed the speculative excitement around the bitcoin

reserve.

- JPMorgan on Wednesday said it doesn’t expect a big move higher in crypto in the near term, given the broader economic uncertainty and weakening demand.

Bitcoin

briefly returned to the key $90,000 level earlier this week and is now

hovering just below it. Investors and analysts have warned that until

bitcoin can meaningfully hold above it, it’s at risk of a bigger pullback toward $70,000.

No comments:

Post a Comment