An economist warned

Monday that the U.S. is “gagging” on uncertainty around the Trump

administration’s economic policy-making, and that the situation could get

worse.

Uploaded: Mar 3, 2025

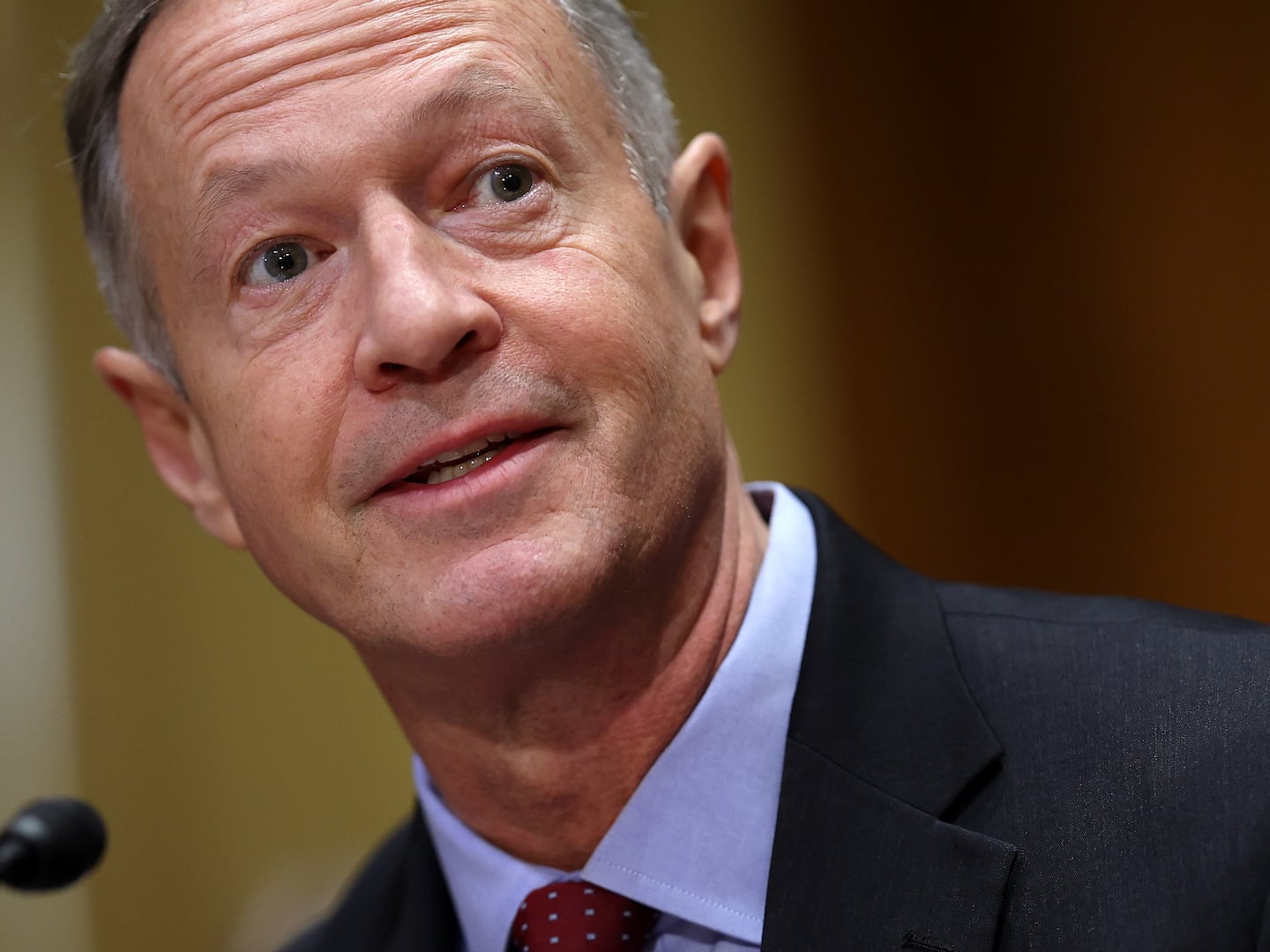

Mark Zandi,

Moody’s Analytics chief economist, gave the dire assessment during an

interview with CNN in which he was asked about comments made by Treasury

Secretary Scott Bessent over the weekend about the potential impact of

the tariffs Trump is threatening to impose on China, Canada, and Mexico.

On Face the Nation, Bessent dismissed as “alarmist” an analysis from the Peterson Institute which found that the tariffs would cost the typical U.S. household over $1,200 a year.

“We have the experience of President Trump’s first term, where the tariffs did not affect prices,” Bessent said. “And it’s a holistic approach, that there will be tariffs, there will be cuts in regulation, there will be cheaper energy. So I would expect that very quickly we will be down to the Fed’s 2 percent [inflation] target. So I’m expecting inflation to continue dropping over the year.”

CNN News Central : CNNW : March 3, 2025 6:00am-7:00am PST : Free Borrow & Streaming : Internet Archive

CNN

host Kate Bolduan asked Zandi if he agrees with Bessent’s conclusions

that the tariffs—which are scheduled to go into effect on Tuesday—won’t

drive up prices for American consumers.

- “I think they’re going to raise prices,” Zandi answered.

- “They’re a tax on American consumers.

- If you add up all of the tariffs that are now in play, those that have already been imposed—like the 10 percent on China—and those that are being discussed, like the 25 percent on Canadian and Mexican imports… That’ll add about $1,250 to the typical American’s bill over a period of a year.”

MSN

Central banks in Asia have long been the most reliable hoarders of U.S. Treasury securities. Japan alone holds about $1.06 trillion of Washington’s IOUs, while China sits on roughly $759 billion. Put together, Asia’s top dollar stockpilers hold nearly $3 trillion worth of U.S. debt.

Yet these holdings are dwindling—in China’s case, to the lowest level since 2009

19 hours ago

Central banks in Asia have long been the most reliable hoarders of U.S. Treasury securities. Japan alone holds about $1.06 trillion of Washington’s IOUs, while China sits on roughly $759 billion. Put together, Asia’s top dollar stockpilers hold nearly $3 trillion worth of U.S. debt.

Yet these holdings are dwindling—in China’s case, to the lowest level since 2009

No comments:

Post a Comment