TSMC, LG and Samsung are among those intending to bring some operations to the US in the face of Trump’s trade threats

TSMC’s US-investment vow shows Asia a way around

The

announcement that Taiwan Semiconductor Manufacturing Company (TSMC),

the world’s largest contract chipmaker, will invest an additional US$100

billion in the United States – and avoid harmful tariffs

– could inspire other major Asian firms to follow its lead and those of

South Korean giants by making moves that could isolate mainland China,

analysts said on Tuesday.

US

President Donald Trump on Monday announced the TSMC investment in three

new chip-fabrication plants, two packaging facilities, and a research

and development centre, potentially adding 20,000 to 25,000 jobs in the

US state of Arizona.

- The president, who advocates more on-shoring of industry to stimulate the US economy, said that without TSMC’s commitment, tariffs on its chip imports might otherwise reach an eventual 25-50%

- Other major East Asian chipmakers will probably move production to the US, too, as “the Trump administration’s threat of tariffs on imported semiconductors poses a serious challenge for the region’s tech-heavy economies”, said Jeemin Bang, a Taiwan analyst for Moody’s Analytics.

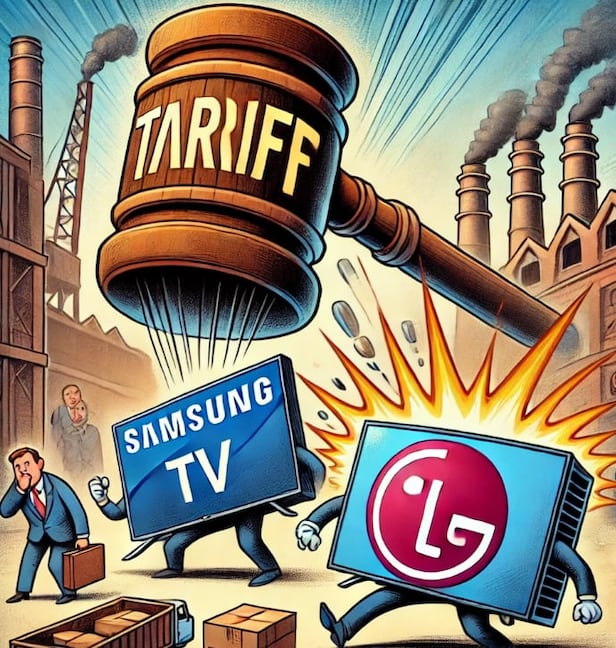

South

Korean electronics giants LG and Samsung, for example, were considering

moving plants to the US, Korean media outlets reported in January. Both

companies develop chips.

The

White House statement said Trump had “secured” nearly US$2 trillion in

US-based investment and that “the best is yet to come”.

Tariffs

are levied against exporter countries or regions rather than companies.

- Taiwan should be extra safe from chip tariffs, as its many smaller fabs do not sell directly to the US, or they lack TSMC’s coveted level of advanced technology, and are therefore not on Trump’s radar, analysts said.

“They’re not Trump’s focus, because the US can already make those chips,” said Liang Kuo-yuan, retired president of a Taipei-based economics think tank, the Yuanta-Polaris Research Institute.

- More chip production in the US gives Washington an advantage in its rivalry with mainland China’s ascendant semiconductor sector, analysts said.

- The US imposes export controls on chips that Washington fears Beijing could use to make advanced weaponry or artificial intelligence (AI) technology.

“In

the short term, China will continue to be impacted by [US]

restrictions, which will further accelerate its push for chip

self-sufficiency as it seeks to reduce reliance on US technology,” said

Cheng Kai-an, a senior industry analyst with the Market Intelligence

& Consulting Institute in Taipei.

Taiwan’s own tech-reliant economy stands to lose nothing, for now, analysts said.

TSMC has enough money to go ahead with plans for new factories in Taiwan even with a combined US$165 billion committed now to Arizona, because “its resources are quite ample”, said Darson Chiu, CEO of the Confederation of Asia-Pacific Chambers of Commerce and Industry in Taiwan.

- The company, which has already begun mass production of its advanced 4-nanometer chips in Arizona – part of its initial US$65 billion in investments – anticipates opening two new fabs in Taiwan’s chief port city this year.

“Even

with additional investment in the US, most of the world’s more advanced

chips will be made in Taiwan for the foreseeable future, reflecting

cost and location advantages,” Moody’s Bang said.

- But the chipmaker must be “careful” with the pace of new domestic investments, Chiu said. “If they get too big in Taiwan, then Trump would see that.”

Taiwan

accounted for 76.8% of the world’s wafer production, packaging

and testing in 2024, according to the Taiwan Semiconductor Industry

Association.

now and stay updated with

related topics

No comments:

Post a Comment