Analysis: Germany's potential $85B defense plan with new warships, jets, and missile upgrades.

Germany has proposed an $85 billion defense package prioritizing new warships, Eurofighter jets, and long-range missile upgrades. The plan strengthens NATO’s northern defenses while signaling reduced reliance on U.S. weapons systems.

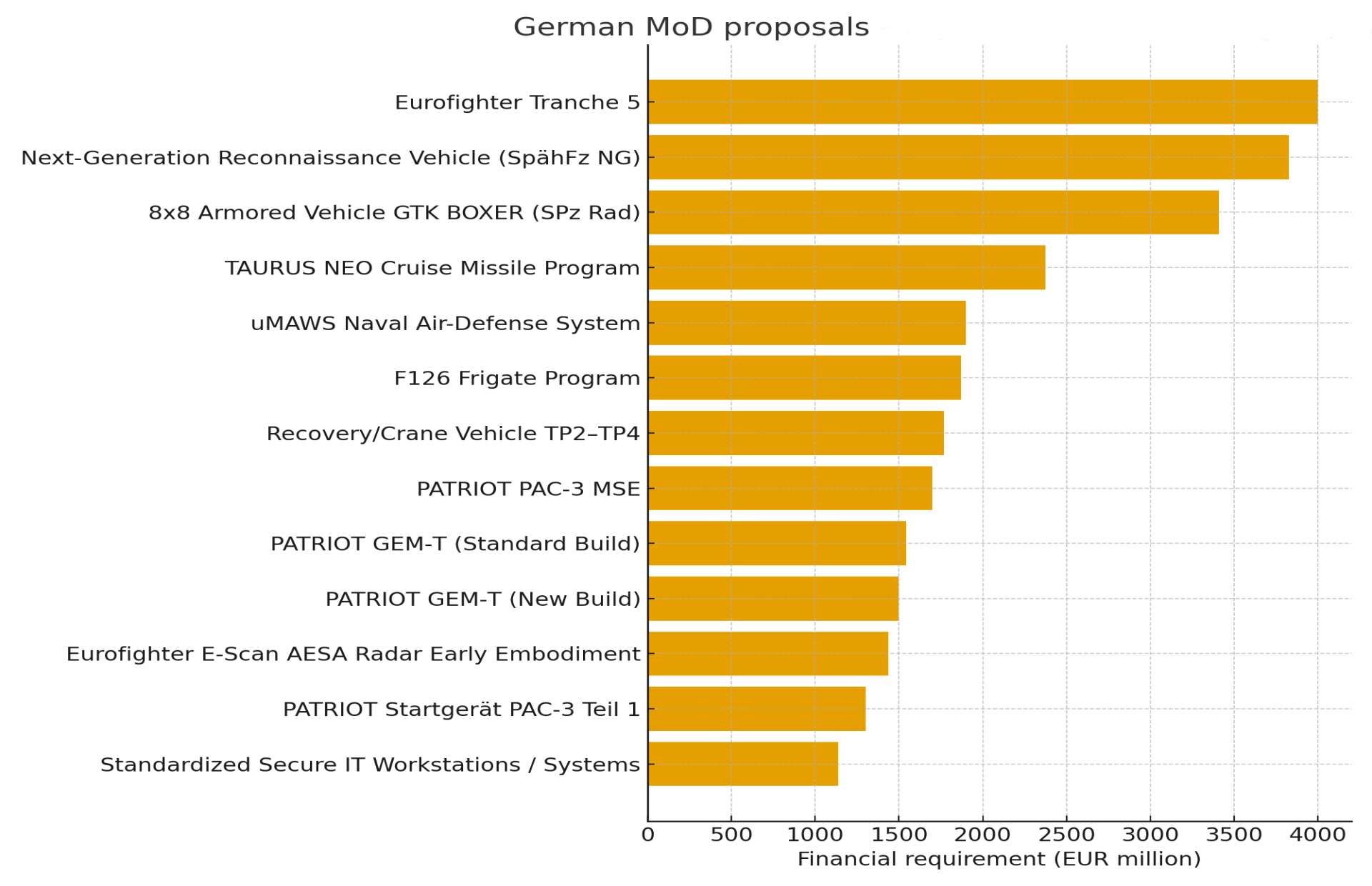

According to information published by Politico, on September 23, 2025, Berlin has drawn up a procurement slate worth around 80 billion euros that would steer most of Germany’s near-term defense spending to European industry and move the Bundeswehr from crisis buys to a sustained rearmament track. The list, prepared for the Bundestag’s budget committee, puts exceptional weight on the Navy’s F127 next-generation air and missile defense frigate, new Eurofighter Tranche 5 aircraft and upgrades to the long-range TAURUS cruise missile, alongside additional Patriot interceptors and a large refresh of wheeled armored vehicles. The package, which lays out projects slated for approval through late 2026, gives the clearest view yet of how Germany intends to rebuild combat power and harden NATO’s northern flank in the Baltic and North Seas.

Follow Army Recognition on Google News at this link

oGermany has unveiled an €80 billion defense procurement plan centered on the €26 billion F127 next-generation frigate program, alongside Eurofighter upgrades, TAURUS cruise missile modernization, Patriot air defense interceptors, and new armored vehicles, marking a decisive shift toward European-made systems to strengthen NATO’s psture in the Baltic and North Seas (Picture source: German Navy).

- German naval planners have signaled a fleet objective larger than previously expected, with planning figures now pointing to as many as eight ships rather than the five or six often discussed earlier.

- While final design choices remain to be approved, the F127 is conceived as a high-end sensor and missile platform able to provide long-range surveillance, cueing and engagement against advanced cruise missiles and limited ballistic threats in the North Atlantic operating picture.

- Program momentum reflects a broader conclusion inside the MoD that Germany must field a maritime layer capable of protecting reinforcement routes into Europe under contested conditions.

- Reporting points to roughly 20 additional aircraft coupled with an E-Scan AESA radar package and related avionics enhancements, boosting the Eurofighter’s sensor reach, track fidelity and survivability in dense electronic attack.

- Germany is also preparing a separate package with Saab and Northrop Grumman valued around 1.2 billion euros to enable employment of next-generation suppression-of-enemy-air-defense weapons, a capability gap highlighted by the air war over Ukraine.

- TAURUS is a low-observable, terrain-following cruise missile with a range beyond 500 kilometers and a two-stage penetrator warhead tailored to defeat hardened infrastructure.

- Germany holds several hundred legacy rounds; the new effort would update guidance, propulsion and seeker components while establishing a modern production base to replenish stocks at scale.

- Pairing a rebaselined TAURUS with upgraded Eurofighters would give the Luftwaffe a more credible long-range conventional deterrent able to hold high-value nodes at risk without exposing crews to integrated air defenses.

The Bundeswehr intends to deepen stocks of Patriot interceptors, combining PAC-3 MSE for ballistic and high-end cruise threats with GEM-T for aircraft and legacy cruise targets. Additional IRIS-T SLM batteries, already combat-proven in Ukraine, remain in demand to expand layered coverage over maneuver forces and critical infrastructure. In the naval arena, Berlin is also maturing the uMAWS concept that ties shipboard sensors, cooperative engagement networks and multi-role interceptors into a distributed maritime shield. The cumulative logic is straightforward. Germany wants more shooters, more magazines and more networked sensors on land and at sea, so that sustained salvos can be met with sustained defense rather than ad hoc scarcity.

The plan earmarks substantial sums for thousands of 8x8 Boxer vehicles across mission variants and for recovery and engineering platforms to keep heavy brigades moving. These buys dovetail with earlier approvals for Puma IFVs, Patria 6x6 vehicles, Heron TP unmanned aircraft and training systems that sharpen readiness for high-intensity combat. The Army’s goal is to generate well-equipped, high-availability brigades for NATO’s new regional defense plans while easing maintenance bottlenecks that have dogged deployments to Lithuania and exercises on the alliance’s eastern flank

The F127–Eurofighter–Patriot axis is about creating an integrated air and maritime umbrella that closes gaps across altitude, range and domain seams. A stabilized layer of IRIS-T SLM batteries protects maneuver forces and bases against drones and cruise missiles. PAC-3 MSE extends that shield to short-range ballistic threats.

At sea, F127 provides long-range surveillance and fire control while escorting logistics convoys and amphibious groups under threat of precision strike.

Overhead, Tranche 5 Eurofighters fuse AESA radar picture with ground-based sensors, prosecute stand-off targets with TAURUS and coordinate suppression packages to thin enemy air defenses.

Germany’s electronics sector is investing heavily to ramp production of advanced sensors, jammers and mission systems, which will be essential if the Bundeswehr is to sustain tempo against a peer adversary rather than simply surge for episodic missions.

Berlin’s defense plan arrives as NATO moves from trip-wire deterrence to forward defense, with Germany designated as the backbone of reinforcement routes to the Baltic states and as the framework nation for a heavy division in Lithuania. By clustering spending in European yards and factories, the government also signals a strategic intention to bolster continental industrial capacity after decades of under-investment and reliance on U.S. inventories. That does not negate transatlantic projects. The balance of this package tilts toward European primes in shipbuilding, missiles, sensors and vehicles, which will shape alliance supply chains and political leverage in the next crisis. For Washington, the message is nuanced. German forces that can fight and sustain at scale are good for NATO, but a procurement map that largely bypasses U.S. vendors will inevitably invite debate on burden sharing, tech cooperation and export controls inside the alliance.

Under German law, every contract over 25 million euros goes before the budget committee, and the defense ministry aims to push a rolling wave of approvals through the end of 2026. If executed, the result would be a measurable lift in NATO’s northern deterrent, more magazines and better sensors for Germany’s air defenders, and a navy equipped to keep reinforcement routes open under attack. If delayed, the gap between ambition and fielded combat power will widen at the moment Europe most needs credible hard power.

Written by Evan Lerouvillois, Defense Analyst, Army Recognition Group.

Evan studied International Relations, and quickly specialized in defense and security. He is particularly interested in the influence of the defense sector on global geopolitics, and analyzes how technological innovations in defense, arms export contracts, and military strategies influence the international geopolitical scene.

No comments:

Post a Comment