|

News Release

Personal Income and Outlays, October and November 2025

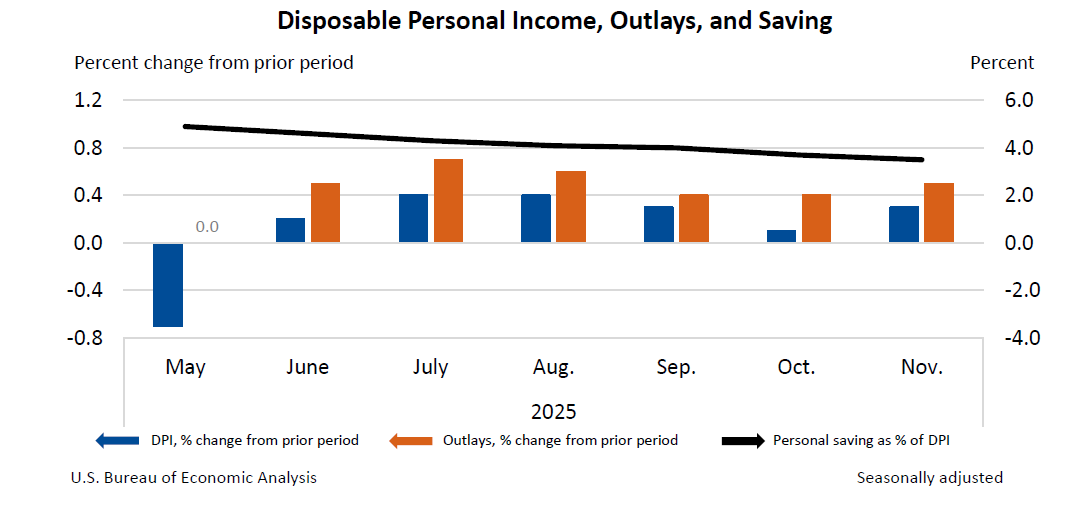

Personal income increased $30.6 billion (0.1 percent at a monthly rate) in October, followed by an increase of $80.0 billion (0.3 percent) in November, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI)—personal income less personal current taxes—increased $12.0 billion (0.1 percent) in October, followed by an increase of $63.7 billion (0.3 percent). Personal consumption expenditures (PCE) increased $98.6 billion (0.5 percent), followed by an increase of $108.7 billion (0.5 percent).

Due to the recent government shutdown, this report for October and November replaces releases originally scheduled for November 26 and December 19, 2025.

Personal outlays—the sum of PCE, personal interest payments, and personal current transfer payments—increased $97.8 billion in October, followed by an increase of $107.9 billion in November. Personal saving was $843.9 billion followed by $799.7 billion. The personal saving rate—personal saving as a percentage of disposable personal income—was 3.7 percent followed by 3.5 percent.

The increase in current-dollar personal income in October primarily reflected increases in compensation and government social benefits that were partly offset by decreases in other current transfer receipts from business, farm proprietors' income, and personal dividend income. In November, the increase primarily reflected increases in compensation and personal dividend income.

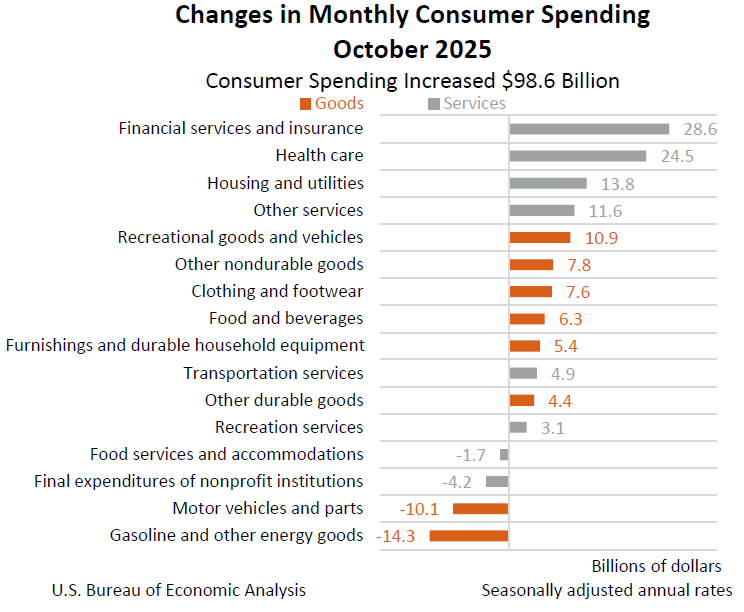

In October, the $98.6 billion increase in current-dollar PCE reflected increases in both services and goods.

- The increase in spending on services was led by financial services and insurance, health care, and housing and utilities.

- The increase in spending on goods was led by recreational goods and vehicles, other nondurable goods, and clothing and footwear.

In November, the $108.7 billion increase in current-dollar PCE reflected increases in both services and goods.

- The increase in spending on services was led by health care, financial services and insurance, and other services.

- The increase in spending on goods was led by gasoline and other energy goods as well as motor vehicles and parts.

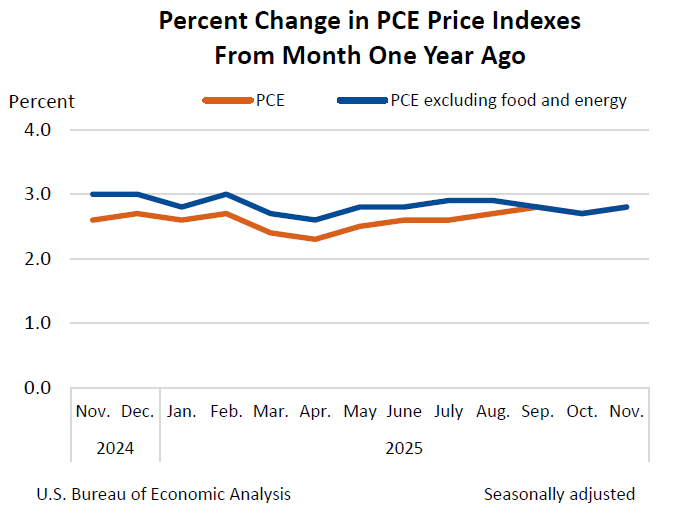

From the preceding month, the PCE price index increased 0.2 percent in both October and November. Excluding food and energy, the PCE price index also increased 0.2 percent in both months. (Refer to “Technical Notes” below for information on how BEA imputed missing BLS October prices.)

From the same month one year ago, the PCE price index increased 2.7 percent in October, followed by an increase of 2.8 percent in November. Excluding food and energy, the PCE price index also increased 2.7 percent followed by an increase of 2.8 percent.

| Personal Income and Related Measures [Percent Change From Preceding Month] | ||||

|---|---|---|---|---|

| October | November | |||

| Current-dollar personal income | 0.1 | 0.3 | ||

| Current-dollar disposable personal income | 0.1 | 0.3 | ||

| Real disposable personal income | -0.1 | 0.1 | ||

| Current-dollar personal consumption expenditures (PCE) | 0.5 | 0.5 | ||

| Real PCE | 0.3 | 0.3 | ||

| PCE price index | 0.2 | 0.2 | ||

| PCE price index, excluding food and energy | 0.2 | 0.2 | ||

| ||||

Next release: February 20, 2026, at 8:30 a.m. EST

Personal Income and Outlays, December 2025

Technical Notes

October Prices

Due to a lapse in federal appropriations, the Bureau of Labor Statistics (BLS) could not collect October 2025 consumer price index (CPI) data. Refer to 2025 federal government shutdown impact on the Consumer Price Index on the BLS website for more details.

To replace the missing CPIs, BEA derived seasonally adjusted price indexes for October using the geometric mean of the September and November CPIs. BEA derived non-seasonally adjusted price indexes by applying seasonal adjustment factors from October 2024 to the imputed seasonally adjusted values for October 2025.

Note that in Table 9.1U. Reconciliation of Percent Change in the CPI with Percent Change in the PCE Price Index, the missing CPI values are indicated with dot leaders.

Changes in Personal Income for October

The October increase in personal income primarily reflected increases in compensation and government social benefits that were partly offset by decreases in other current transfer receipts from business, farm proprietors' income, and personal dividend income.

- Within

compensation, an increase in private wages and salaries was partly

offset by a decrease in government wages and salaries, based on data

from the BLS Current Employment Statistics (CES).

- Private wages and salaries increased $55.8 billion, reflecting increases of $48.0 billion in services‑producing industries and $7.8 billion in goods-producing industries.

- Government wages and salaries decreased $13.0 billion. In March 2025, some federal government employees opted to accept a deferred resignation program offer. Federal workers who accepted the offer with a September 30 separation date were removed as employed by the federal government in the BLS source data in October.

Changes in Personal Income for November

In November, the increase in personal income primarily reflected increases in compensation, personal dividend income, and government social benefits.

- Within compensation, both private and government wages and salaries increased, based on data from the BLS CES.

- Private wages and salaries increased $39.2 billion, reflecting increases of $28.2 billion in services-producing industries and $11.1 billion in goods-producing industries.

- Government wages and salaries increased $8.7 billion.

Revisions to Personal Income

Estimates have been updated for July through September. Revisions to compensation reflected updated BLS CES data on employment, hours, and earnings. Within government social benefits, revisions to Medicaid benefits reflected newly available information from the Centers for Medicare & Medicaid Services.

No comments:

Post a Comment