Tuesday, September 21, 2021

1784 Home for A Pioneer in Agro-Tourism Available For Purchase in Coventry, Connecticut

Sad to see a once-thriving countryside enterprise in the historic town where American Patriot Nathan Hale was born fall into neglect and disrepair after all these years.

CAPRILANDS HERB FARM

Samuel Parker House (c. 1784)

Coventry, 534 Silver Street

Main house of Caprilands Herb Farm, the former home of Adelma Simmons, pioneer in ‘agri-tourism,’ is available for purchase. The house is early Federal style with a center hallway, two chimneys, and timber framing. Must be deconstructed and relocated. Act fast, time is of the essence!

Contact: Steve Bielitz, Glastonbury Restoration Company, 860-212-3750

Email Kristen Hopewood, khopewood@preservationct.org, with questions

BEA News: U.S. International Transactions, 2nd Quarter 2021

BEA News: U.S. International Transactions, 2nd Quarter 2021

The U.S. Bureau of Economic Analysis (BEA) has issued the following news release today:

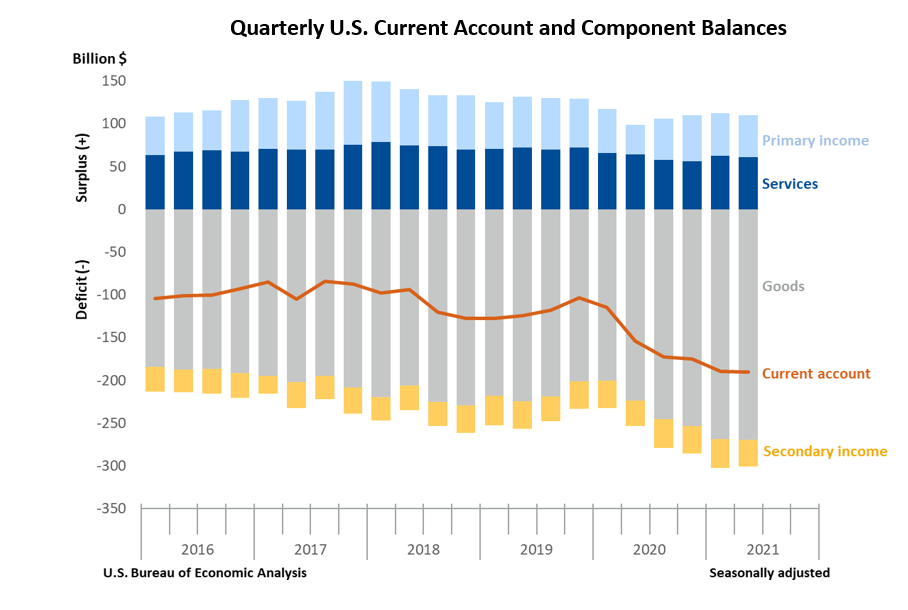

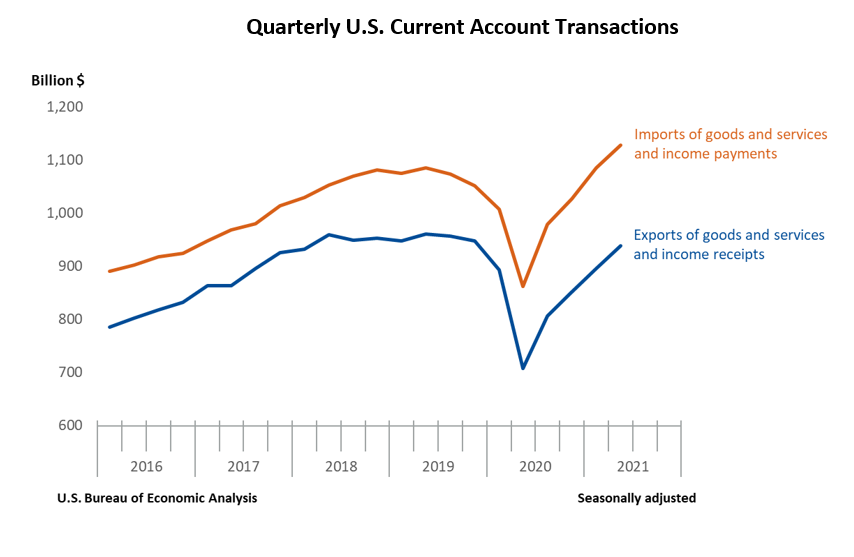

The $0.9 billion widening of the current account deficit in the second quarter mainly reflected reduced surpluses on services and on primary income that were mostly offset by a reduced deficit on secondary income.

Current Account Transactions (tables 1-5)

Exports of goods and services to, and income received from, foreign residents increased $42.7 billion, to $937.9 billion, in the second quarter. Imports of goods and services from, and income paid to, foreign residents increased $43.6 billion, to $1.13 trillion.

Trade in Goods (table 2)

Exports of goods increased $28.3 billion, to $436.6 billion, mostly reflecting increases in industrial supplies and materials, mainly petroleum and products, and in capital goods, mainly civilian aircraft and semiconductors. Imports of goods increased $29.0 billion, to $706.3 billion, primarily reflecting an increase in industrial supplies and materials, mainly petroleum and products and metals and nonmetallic products.

Trade in Services (table 3)

Exports of services increased $7.6 billion, to $189.1 billion, primarily reflecting an increase in travel, mostly other personal travel. Imports of services increased $9.1 billion, to $127.8 billion, mostly reflecting increases in transport, primarily sea freight and air passenger transport, and in travel, primarily other personal travel.

Primary Income (table 4)

Receipts of primary income increased $7.7 billion, to $270.6 billion, and payments of primary income increased $8.8 billion, to $221.5 billion. The increases in both receipts and payments mainly reflected increases in direct investment income, primarily earnings.

Secondary Income (table 5)

Receipts of secondary income decreased $0.9 billion, to $41.6 billion, mainly reflecting a decrease in general government transfers, mostly public sector fines and penalties. Payments of secondary income decreased $3.5 billion, to $72.6 billion, mainly reflecting a decrease in general government transfers, mostly international cooperation.

Capital Account Transactions (table 1)

Capital transfer payments decreased $1.9 billion, to $0.9 billion, in the second quarter, mostly reflecting a decrease in investment grants.

Financial Account Transactions (tables 1, 6, 7, and 8)

Net financial account transactions were −$287.3 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

Financial Assets (tables 1, 6, 7, and 8)

Second quarter transactions increased U.S. residents’ foreign financial assets by $248.2 billion. Transactions increased direct investment assets, primarily equity, by $139.7 billion; portfolio investment assets, primarily equity securities, by $134.8 billion; and reserve assets by $0.5 billion. Transactions decreased other investment assets by $26.7 billion, driven by deposits.

Liabilities (tables 1, 6, 7, and 8)

Second quarter transactions increased U.S. liabilities to foreign residents by $527.0 billion. Transactions increased portfolio investment liabilities, primarily long-term debt securities, by $236.6 billion; other investment liabilities, mostly loans and deposits, by $195.4 billion; and direct investment liabilities, mostly equity, by $95.0 billion.

Financial Derivatives (table 1)

Net transactions in financial derivatives were −$8.6 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

Updates to First Quarter 2021 International Transactions Accounts Balances Billions of dollars, seasonally adjusted | ||

| Preliminary estimate | Revised estimate | |

|---|---|---|

| Current account balance | −195.7 | −189.4 |

| Goods balance | −268.5 | −268.9 |

| Services balance | 55.7 | 62.8 |

| Primary income balance | 50.3 | 50.2 |

| Secondary income balance | −33.3 | −33.5 |

| Net financial account transactions | −175.2 | −180.8 |

Upcoming Releases of New Statistics

With the releases of the U.S. international transactions accounts (ITAs) on December 21, 2021, and the international investment position (IIP) accounts on December 30, 2021, BEA will introduce two new ITA tables (ITA tables 4.6 and 6.3) and two new IIP tables (IIP tables 2.2 and 4.1), respectively. These new tables will be released in December to fulfill commitments to the G-20 Data Gaps Initiative and the International Monetary Fund’s Taskforce on Special Purpose Entities for the release of certain new statistics by yearend 2021. ITA table 4.6 will present primary income on foreign direct investment in U.S. resident special purpose entities (SPEs), which are U.S. legal entities with little or no employment or physical presence, and ITA table 6.3 will present financial transactions for direct investment in U.S. resident SPEs. IIP table 2.2 will present direct investment positions in U.S. resident SPEs, and IIP table 4.1 will present U.S. debt positions by currency, sector, and maturity for U.S. assets and liabilities.

In December, these tables will be released as supplemental Excel files to the respective releases. The SPE-related tables—ITA tables 4.6 and 6.3 and IIP table 2.2—will feature annual statistics for 2020, while IIP table 4.1 will feature quarter-end position statistics for the first quarter of 2020 through the third quarter of 2021. In March 2022, these tables will be updated and published as addenda to the current tables in BEA’s interactive data application. In June 2022, the statistics will be updated and incorporated into the standard presentations of the ITAs and the IIP accounts in the interactive data application and in BEA’s data application programming interface. ITA table templates and IIP table templates are provided with this release to prepare users for the upcoming changes. More information will be available in a preview article of BEA’s annual update of the international economic accounts in the April 2022 issue of the Survey of Current Business.

* * *

Next release: December 21, 2021 at 8:30 A.M. EST

U.S. International Transactions, Third Quarter 2021

* * *

REVISED NOTICE [AGAIN] : SPECIAL OPEN MEETING NOTICE OF THE ARIZONA CORPORATION COMMISSION 09.21.2021

Here it is - Sent Monday September 20, 2021 at 12:17 PM

ARIZONA CORPORATION COMMISSION

EXECUTIVE DIRECTOR SECRETARY | COMMISSIONERS |

REVISEDN O T I C E

SPECIAL OPEN MEETING NOTICE OF THE ARIZONA CORPORATION COMMISSION

Investigation into the Pipeline Safety of Southwest Gas Corporation

In light of Incidents that Occurred in Arizona in 2021

Docket No. G-01551A-21-0305

Tuesday, September 21, 2021

1:00 P.M. OR UPON ADJOURNMENT OF THE 9-21-2021

WATER PREPAREDNESS

WORKSHOP, WHICHEVER IS LATER

Hearing Room One

1200 W. Washington St.

Phoenix, AZ 85007

This shall serve as notice of an open meeting at the above location for consideration and discussion of the items on the agenda and other matters related thereto. Commissioners may attend the proceedings in person, or by telephone, video, or internet conferencing,and may use this open meeting to ask questions about the matters on the agenda. The parties to the matters to be discussed or their legal representatives are requested, though not required, to attend telephonically. The Commissioners may move to executive session, which will not be open to the public, for the purpose of legal advice pursuant to A.R.S. § 38-431.03 (A) (3) on the matters noticed herein.

Because of the Covid-19 pandemic, only essential Commission staff will attend in person. The public is strongly discouraged from attending in person. The public will be able to participate by either watching and listening to the meeting online or listening to the meeting via telephone. Participants will be invited to and may attend by video or internet conferencing. For those wishing to enter an appearance or provide public comment, please use the dial in phone numbers. Once the item for which you are appearing or providing public comment is concluded, please hang up and watch the live stream.

Persons with a disability may request reasonable accommodations by contacting the Commission Secretary listed above at least 48 hours prior to the scheduled commencement of the Open Meeting.

Agendas are also available online at: azcc.gov/agendas

Dial-in Phone Number:1-866-705-2554 Passcode to Speak: 241497

This meeting will be available online at: http://www.azcc.gov/live

NOTE: The Commission may choose to take testimony under oath.

AGENDA

1. Introductions

2. Commissioner Opening Comments

3. SWG Presentation

a. 7th Street Bridge Incident

b. Chandler Incident

c. North Scottsdale Incident

4. Commissioner Questions

5. Public Comment

6. Closing Remarks

NOTE: NO VOTES ON ANY SUBSTANTIVE MATTER WILL BE TAKEN DURING THIS MEETING.

###

Arizona Corporation Commission | 1200 W. Washington Street | Phoenix, AZ 85007

There's Something About Teddy Bears as A Form of Art To Express Moments of Contemporary History

German toy factory reveals teddy bear dedicated to Angela Merkel ahead of her resignation

Hermann-Spielwaren, located in the Bavarian city of Coburg, revealed the 40-centimeter tall toy bearing a certain resemblance to the chancellor.

> The teddy bear is sporting a hairstyle similar to Frau Merkel, while the paws can be folded to replicate the legendary hand gesture known as the ‘Merkel rhombus’.

> “We try to express moments of contemporary history in teddy bears as a form of art,” said Martin Hermann, the managing director of one of the world’s oldest still-existing teddy bear factories, as quoted by Germany's Bild newspaper. . .

The 101-year-old family enterprise will produce 500 limited-edition Merkel teddy bears, priced at €189 with the 16th one to be sent to Merkel as a reference to the number of years she spent at the helm of Germany.

For more stories on economy & finance visit RT's business section

The Economist: Week of Sept 18-24 2021 Cover Art + Cover Stories

Access more stories day-by-day > https://www.economist.com/graphic-detail

____________________________________________________________________________

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...