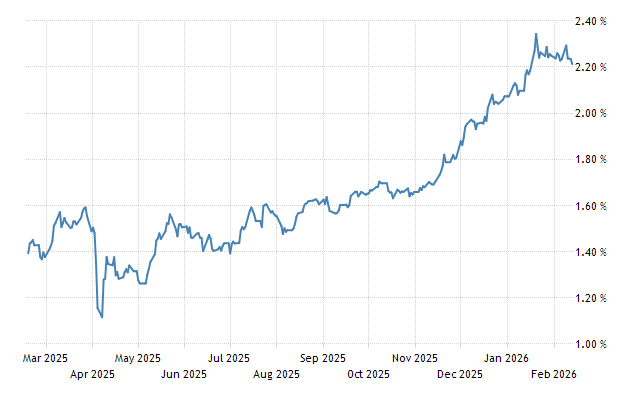

Japan 10Y Bond Yield was 0.77 percent on Friday April 5, according to over-the-counter interbank yield quotes for this government bond maturity. Historically, the Japan 10 Year Government Bond Yield reached an all time high of 7.59 in June of 1984. Japan 10 Year Government Bond Yield - data, forecasts, historical chart - was last updated on April 5 of 2024.

FORECAST: Japan 10Y Bond Yield was 0.77 percent on Friday April 5, according to over-the-counter interbank yield quotes for this government bond maturity. The Japan 10 Year Government Bond Yield is expected to trade at 0.70 percent by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking forward, we estimate it to trade at 0.59 in 12 months time.

Japan’s 10-year government bond yield stabilized around 0.77% as investors continued to assess the outlook for Bank of Japan monetary policy. Earlier this week, an auction for the 30-year bond saw firm demand, while the BOJ’s first bond purchase of the fiscal year resulted in same offer amounts. Analysts previously anticipated the central bank to maintain the same amount of monthly bond purchases, but are speculating that it could gradually set the purchasing amount toward the lower end of its offer range in the April-June period and decrease monthly purchases in the following months. During its March meeting, the BOJ raised rates from -0.1% to 0%, hiking for the first time since 2007 and ending eight years of negative rates amid rising wages and high inflation. The BOJ also abandoned its yield curve control policy and ended ETF and J-REIT purchases. Moreover, BOJ Governor Kazuo Ueda said the central bank will eventually scale back bond purchases.

Generally, a government bond is issued by a national government and is denominated in the country`s own currency. Bonds issued by national governments in foreign currencies are normally referred to as sovereign bonds. The yield required by investors to loan funds to governments reflects inflation expectations and the likelihood that the debt will be repaid.

x