Thursday, November 13, 2025

Budget Blow for Reeves

Experts predicted GDP (gross domestic product) figures would report 0.2 per cent growth, a slowdown from the 0.3 per cent in the previous quarter, continuing a notable drop-off after a 0.7 per cent rise in the first three months of the year

ONS director of economic statistics Liz McKeown linked slow growth to the impact of the JLR cyber attack on the manufacturing sector.

Budget blow for Reeves after latest UK growth figures announced: Live updates

UK economic growth has slowed further to 0.1 per cent over the third quarter of 2025 ahead of the autumn Budget

SEE THIS > 49 minutes ago

“At my Budget later this month, I will take the fair decisions to build a strong economy that helps us to continue to cut waiting lists, cut the national debt and cut the cost of living.”

“Across the quarter as a whole manufacturing drove the weakness in production,” she said. “There was a particularly marked fall in car production in September, reflecting the impact of a cyber incident, as well as a decline in the often-erratic pharmaceutical industry.”

Chancellor Rachel Reeves is set to deliver her crucial Budget on 26 November.

The government has been hopeful that stronger economic growth can help increase tax revenues and support spending plans.

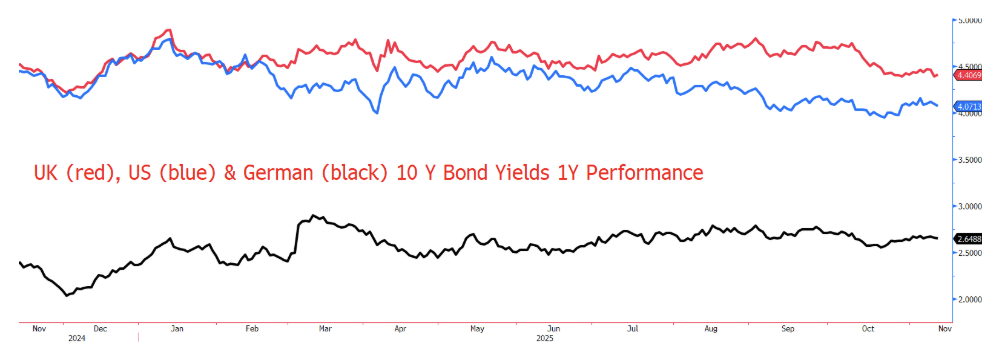

Analysis: Interest rate cuts certain for December

Business Editor Karl Matchett reflects on the GDP figures:

So the latest GDP figures confirm the economy remains growing, but in the same way that snails move: in imperceptible fashion. 0.1 per cent growth over three months to September reinforces what many business leaders and public organisations have been saying: firms have put plans on hold until the environment is more favourable, and people have held off major plans due to uncertainty around the upcoming Budget.

Production output falling is a real issue for the government to face, especially on the back of last week's data showing employment at record post-Covid levels. Even more worrying, any 'growth' was front-loaded in this quarter, with August's figures revised down to no growth and monthly GDP falling 0.1 per cent in September itself. One outcome of all this?

PM will 'get rid' of person behind briefing that unleashed leadership row

The prime minister will “get rid” of the person behind a briefing that unleashed a leadership row if he finds them, energy secretary Ed Miliband has said.

“I’ve talked to Keir before about this kind of briefing that happens. As he always says, if he finds the person, he’ll get rid of them, and I absolutely believe he would do that,” he told Sky News.

Asked if he thought Sir Keir Starmer would sack the person, he said, “Sure, yeah.”

He also noted that briefing is a “longstanding aspect” of politics and pointed back to there being “lots and lots of briefing” under Sir Tony Blair and Gordon Brown.

“Look, I think the briefing has been bad, no question. But my message to the Labour Party, though, is quite simple today, which is, we need to focus on the country, not ourselves,” he told Sky News.

He added: “Turbulence is part of the gig, is part of the DNA of being in government.”

- This slowdown, driven in part by a cyber-attack on Jaguar Land Rover (JLR) that negatively impacted manufacturing and car production, means less tax revenue to fund government plans and increases pressure on Reeves to find money for spending commitments.

- Some economists predict this weak growth will put more pressure on the government, potentially leading to higher taxes or spending cuts

Wednesday, November 12, 2025

NeoLabs AI: Hire Prompt Engineers / Prompt Engineering is The Skill of the 21st Century

Investors Chase Neolabs to Outflank OpenAI, Anthropic

Neolabs: Investors’ Stealth Play to Disrupt the AI Titans

In the high-stakes world of artificial intelligence, where OpenAI and Anthropic dominate headlines with billion-dollar valuations and groundbreaking models, a new contender is quietly drawing investor attention. Neolabs, a secretive AI startup, is positioning itself as the agile challenger ready to outmaneuver the giants. According to a recent report by The Information, investors are flocking to Neolabs in hopes of creating a formidable rival that could redefine the competitive landscape.

Drawing from the latest funding frenzy, Neolabs has reportedly secured early-stage commitments that value it at over $10 billion, sources familiar with the matter told The Information. This move comes amid a broader AI investment boom, where backers are seeking alternatives to the established players amid concerns over market concentration and escalating costs.

The Funding Frenzy in AI

Anthropic, one of the key incumbents, recently raised its valuation to $183 billion with a $13 billion infusion, as reported by The New York Times. This marks a nearly threefold increase from $61.5 billion earlier in the year, fueled by a technology frenzy. Meanwhile, OpenAI is navigating its own path, with projections of $74 billion in operating losses by 2028 before turning profitable in 2030, according to documents cited by Investing.com and The Wall Street Journal.

Investors see Neolabs as a way to hedge against these giants’ dominance. Unlike OpenAI’s aggressive scaling, which includes a multi-year $38 billion partnership with AWS for cloud infrastructure as posted on X by industry observers, Neolabs is focusing on efficient, specialized AI models for enterprise applications, potentially avoiding the massive cash burn plaguing its rivals.

Neolabs’ Strategic Edge

The startup’s approach emphasizes hardware diversification and innovative architectures, echoing Anthropic’s efficiency edge. A report from WebProNews highlights how Anthropic plans to spend less than a third on compute through 2028 while aiming for $70 billion in revenue, a model Neolabs is said to emulate. Insiders note that Neolabs has already partnered with non-traditional chip providers to cut costs.

Google’s involvement adds another layer. The tech giant is in talks for a major investment in Anthropic, potentially valuing it at over $350 billion, per posts on X and a report from The Times of India. Yet, some investors are diverting funds to Neolabs to avoid over-reliance on Google-backed entities, fearing antitrust scrutiny as mentioned in X discussions about Meta and OpenAI’s stakes in data-labeling firms.

Profitability Projections and Market Shifts

Anthropic is on track to break even in 2028, far ahead of OpenAI, which anticipates $74 billion losses that year, as detailed in a Gizmodo article citing The Wall Street Journal. This divergence stems from Anthropic’s focus on corporate clients, boasting over 300,000 customers and 80% revenue from businesses.

Neolabs aims to capitalize on this by targeting underserved niches like AI for sustainable energy and healthcare, areas where OpenAI’s broad consumer focus leaves gaps. Recent X posts from AI analysts, such as those recapping weekly updates, underscore the industry’s rapid evolution, with Anthropic’s Claude Code nearing $1 billion in annualized revenue.

Investor Motivations and Risks

The chase for Neolabs reflects broader investor strategies to outflank market leaders. As Financial Times reported, AI companies like OpenAI and Anthropic are clamping down on investment vehicles to control access to their rounds, pushing backers toward emerging players like Neolabs.

However, risks abound. OpenAI’s leadership shuffles and projected losses, as noted in X recaps, highlight the volatility. Neolabs must navigate similar pitfalls, but its lean operations—burning cash at just 9% of revenue by 2027, per modeled projections inspired by Anthropic’s path—offer a compelling narrative.

Competitive Dynamics in the AI Arena

Elon Musk’s xAI and other rivals are also raising funds, with OpenAI valued at $300 billion in recent deals, according to The New York Times. Neolabs’ entry could fragment the market further, especially as Google’s $1 billion investment in Anthropic, reported by Reuters, intensifies the race.

Industry insiders on X, including posts from AI news accounts, speculate that Neolabs’ ‘frontier model’ could rival Claude-Next, Anthropic’s planned advancement that’s 10 times more capable than current GPT models, as originally outlined in 2023 reports.

The Broader Investment Landscape

Amid bubble fears, as discussed in CXOToday, mega deals like SoftBank’s $500 billion funding for OpenAI’s infrastructure are fueling concerns. Neolabs positions itself outside this cycle, attracting venture firms like Menlo’s Anthology Fund, which has invested in AI startups as shared on X.

Google Cloud’s updates to Vertex AI and partnerships signal a maturing ecosystem, per X posts, where Neolabs could thrive by offering open-source alternatives, reducing dependency on proprietary tech from OpenAI and Anthropic.

Future Implications for AI Dominance

As Anthropic faces off with U.S. government critics like David Sacks, as covered by CNBC, Neolabs’ low-profile strategy might shield it from similar scrutiny. Quotes from Anthropic CEO Dario Amodei, ‘We build sustainably, not on hype,’ shared on X, resonate with Neolabs’ ethos.

Ultimately, the investor chase for Neolabs underscores a pivotal shift: the AI race is no longer a duopoly. With projections from BizToc showing stark contrasts in profitability timelines, Neolabs could emerge as the disruptor that rebalances the field.

WebProNews is a leading publisher of business and technology email newsletters and websites

Kaspersky’s Linux Leap: Antivirus Enters Home Turf Amid Global Tensions

- Advertising & Marketing

- Retail & eCommerce

Subscribe to WebProNews for top tech news, trends, analysis and more...

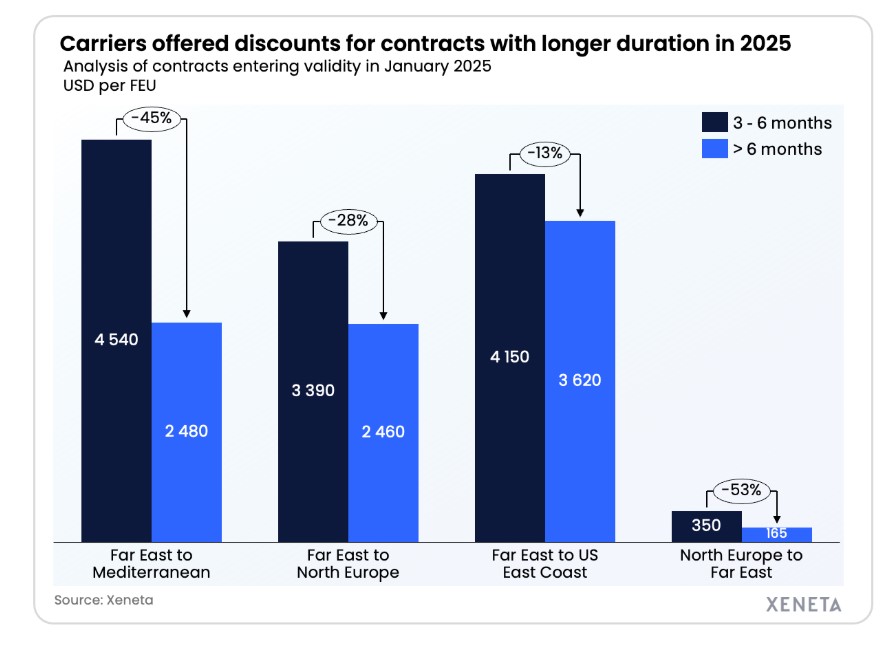

Are U.S. Container Imports Cratering? | What's Going on With Global Contai... | #supplychain #containerships #container #imports

Liner sector defies disruption as box numbers surge to quarterly highs

- Global container volumes rose 4.7% in the first nine months of 2025 against last year

- Q3 traffic hit a record 49.2m teu, up 1.5% on Q2, with August now the busiest month on record

- China’s export pivot continues to fuel volume gains across global south

- CTS freight index falls to lowest level since 2023 as carriers brace for end-of-year demand slowdown

Global container volumes reached record highs in Q325, despite geopolitical disruption and uneven regional demand. While North American imports continue to falter, robust growth across Europe, the Indian subcontinent, and South America buoyed overall performance. Chinese exports to emerging markets surged, helping offset transpacific declines as the ongoing trade war pegged back US trade

Imperialst Rhetoric, Tom Horn to Defuse Tensions, Gold Tops $5,000 in Demand Frenzy, . . .Japan Bond Crash

Stephen Maturen/Getty Images Trump, Democrats Hurtle Toward Shutdown After Minnesota Killing A fatal shooting by Border Patrol agen...

-

Flash News: Ukraine Intercepts Russian Kh-59 Cruise Missile Using US VAMPIRE Air Defense System Mounted on Boat. Ukrainian forces have made ...