- Bessent had a combative exchange with the New York Times’s Andrew Ross Sorkin last week.

- Breitbart’s John Carney offered Cliffs Notes on a major Bessent speech this spring, arguing that his goal is to “re-privatize” the American economy.

- Bessent offered his views on China talks in an interview with the FT.

- Bessent is the “most powerful” of the alpha gay men who play big roles in Trump’s Washington, The New York Times wrote.

In this article:

The News

Know More

Ben’s view

Room for Disagreement

Notable

Architects of the New Economy

The News

The day after Politico reported that Scott Bessent had threatened to punch a bumptious housing official in the face, the secretary of the Treasury addressed Republican luminaries gathered to celebrate the 50th anniversary of the Laffer curve under the big chandelier in his department’s Cash Room.

Bessent drew laughs with a remark that he’d been “fighting” for the American people every day, a guest recalled. Then Jamieson Greer, the US trade representative, took it a little further, quipping that he’d overheard Bessent helping to pass the White House’s tax cut package with joking threats to punch members of Congress in the face.

Some members of the audience laughed so hard they spilled their drinks, an attendee recounted.

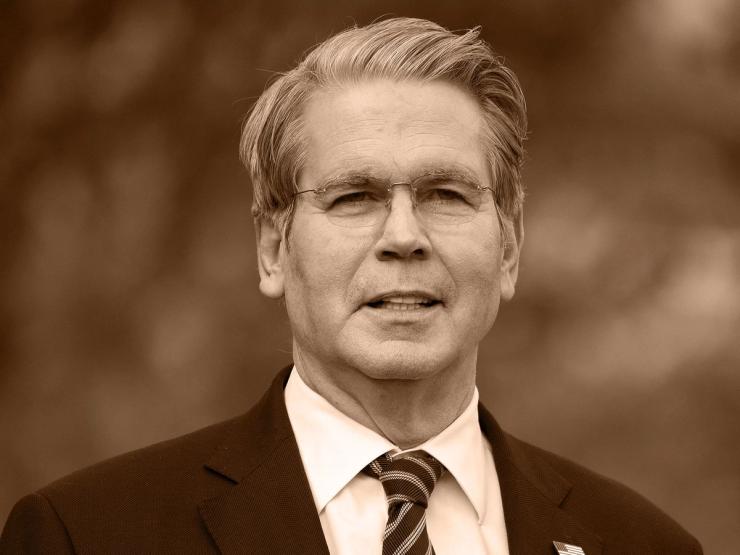

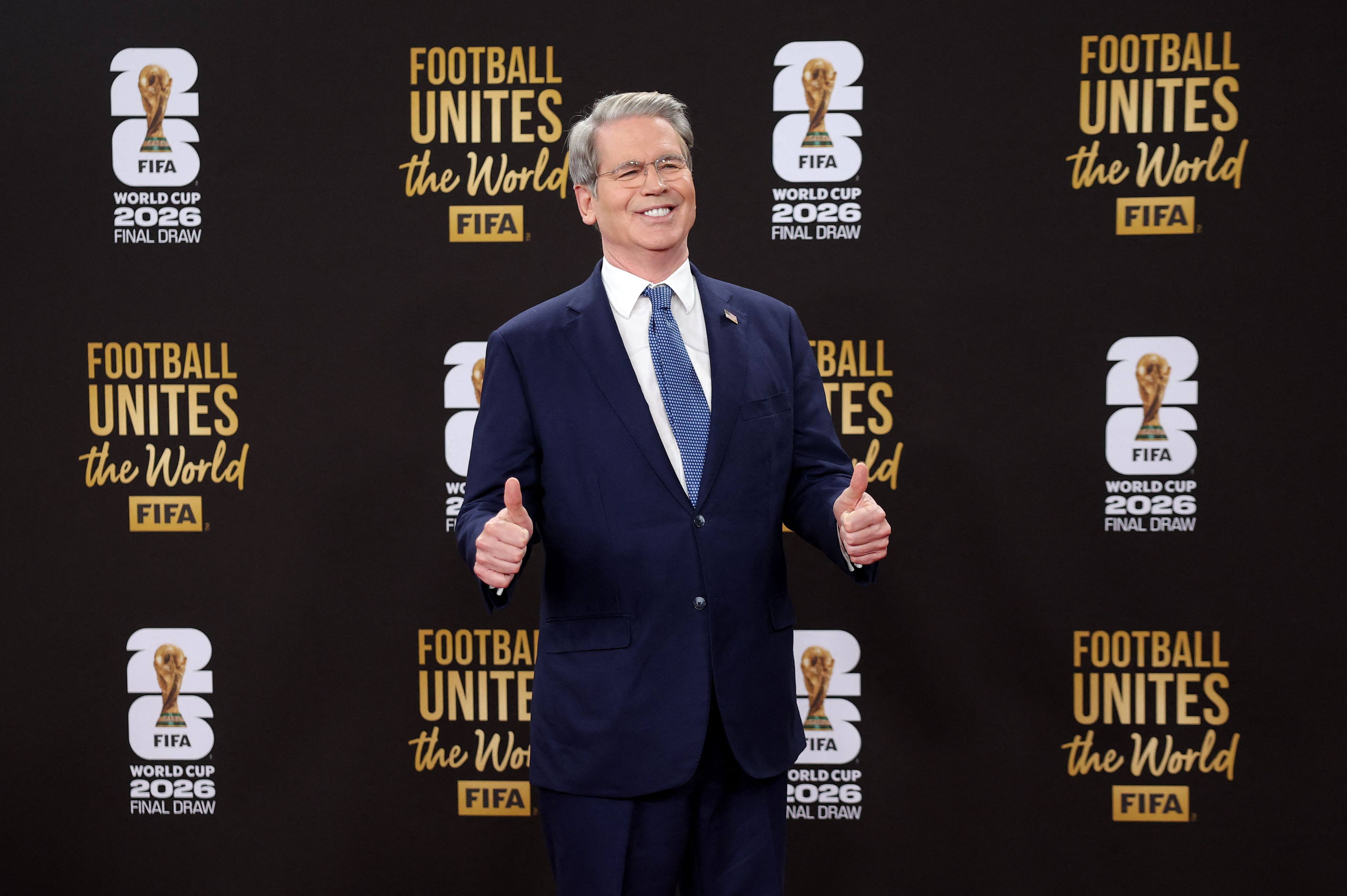

And they may have wondered: How exactly did this guy, a courtly 63-year-old hedge fund manager, alpha his way past figures like Elon Musk and Howard Lutnick to emerge as the MAGA Bob Rubin?

- he’s leading the search for the next Federal Reserve chair;

- playing point on Trump’s trade agenda;

- pulling new regulatory powers into his department,

- most recently as he finalizes a host of new capital requirements; and

- overseeing new retirement investments known as “Trump Accounts.”

Bessent's brag

Was Scott Bessent the real brain behind Soros’s billion-dollar bet against the British Pound?

Uploaded: Dec 8, 2025

♦ In 1992, the British Pound crisis changed global finance forever —

BEN'S VIEW

Bessent is, so far, the defining economic figure of Trump’s dramatic, zig-zag second term. More than anyone else, he has given an intellectual scaffolding to Trump’s longstanding drive to reshape the global economic order to favor American exports.

Bessent also appears to have figured out more clearly than any other Washington newcomer how to operate in Trump’s orbit. He has developed the sometimes bombastic television persona required for an administration spokesperson, but also the deferential professionalism in the West Wing favored by Chief of Staff Susie Wiles, and common to other successful inside players like crypto and AI czar David Sacks and Deputy Secretary of Defense Stephen Feinberg.

Bessent has at times had to clean up after the president. The Treasury secretary acknowledged last week that he’d opposed the Liberation Day tariff assault — but said he’d “evolved” on the issue, after seeing how eager trading partners were to do deals.

- Trump’s first Treasury secretary, Stephen Mnuchin, surprised even his critics with his deft handling of the job and his reaction to the COVID-19 pandemic.

- The financial crises of Trump’s second term have so far been self-inflicted.

- But investors are increasingly wary of a crash — whether from a dark corner of private credit, the overheated AI bubble, or some other unanticipated source.

Bessent has built the credibility inside the White House, on Wall Street, and around the world that he’ll need if and when the crisis comes. Now his reputation, and the endurance of his ideas, will depend on how he handles it.

- Hence the fact that he willingly smears the Fed by invoking conspiracy-laden tropes and re-writing facts is a window into his character, showing that he isn’t, and never was, worthy of Americans’ trust.”

Notable

- Bessent had a combative exchange with the New York Times’s Andrew Ross Sorkin last week.

- Breitbart’s John Carney offered Cliffs Notes on a major Bessent speech this spring, arguing that his goal is to “re-privatize” the American economy.

- Bessent offered his views on China talks in an interview with the FT.

- Bessent is the “most powerful” of the alpha gay men who play big