Listen, Watch and Catch Up

Most Active US Stocks

Your News

Bloomberg Businessweek

Choose up to 12 topics to see the latest stories on your homepage.

Recommended

Regions

Sectors

New York Federal Reserve President John Williams said Friday that “technical factors” likely distorted November’s inflation data, pushing the headline reading lower than it otherwise would have been.

“There were some special factors or practical factors that really are related to the fact that they weren’t able to collect data in October and not in the first half of November. And because of that, I think the data were distorted in some of the categories, and that pushed down the CPI reading, probably by a tenth or so,” Williams said on CNBC’s “Squawk Box.”

“It’s hard to know, we’ll get some when we’ll get to December data, I think we’ll get a better reading of how much that distortion, how big the effect was, but I do think that that was pushed down a bit by these technical factors,” he added.

As a result, economists may be cautious about interpreting the report as clear evidence that inflation is on a sustained downward path, given the absence of an October comparison.

Economists believe some some inputs to the owners’ equivalent rent calculation for the canceled October month were estimated by the BLS to have zero inflation, distorting that calculation downward.

)

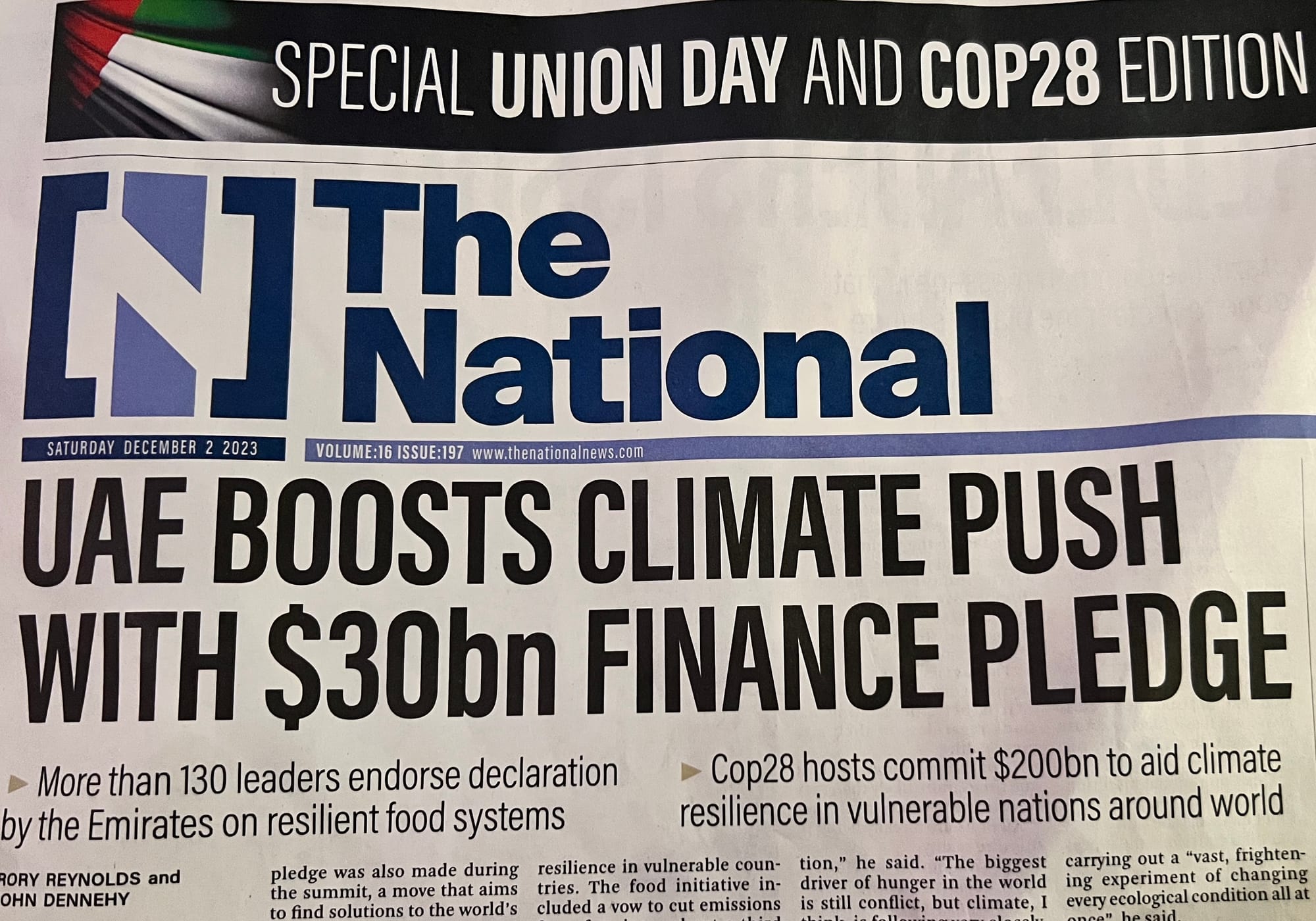

CIPGMF II is set to be one of the 'world’s largest greenfield-focused renewable energy funds'

CIPGMF II is set to be one of the 'world’s largest greenfield-focused renewable energy funds' The UAE’s Altérra will invest in a fund managed by Denmark-headquartered Copenhagen Infrastructure Partners to support development of large-scale renewable projects globally.

The $30-billion Abu Dhabi-based climate-focused fund will back CIP’s growth markets fund II (GMF II), which invests in greenfield renewable projects across Asia, Latin America, Europe, the Middle East and Africa, Altérra said in a statement.