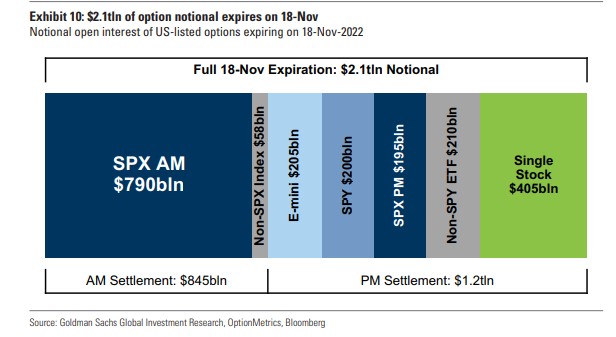

Nowhere better illustrates Wall Street’s febrile sentiment than the stock-derivatives market, where trading volumes are breaking records heading into Friday’s $2.1 trillion options expiration.

The monthly event, known as OpEx, has a reputation for stoking volatility as traders and dealers rebalance their big exposures en masse. Now, with demand for both bullish and bearish index contracts booming while hedging in single stocks explodes in popularity, OpEx comes at a precarious time.

Record Options Trading Shows Jitters Before $2 Trillion ‘OpEx’

- The 4,000 level for S&P 500 is a battlefield for bulls, bears

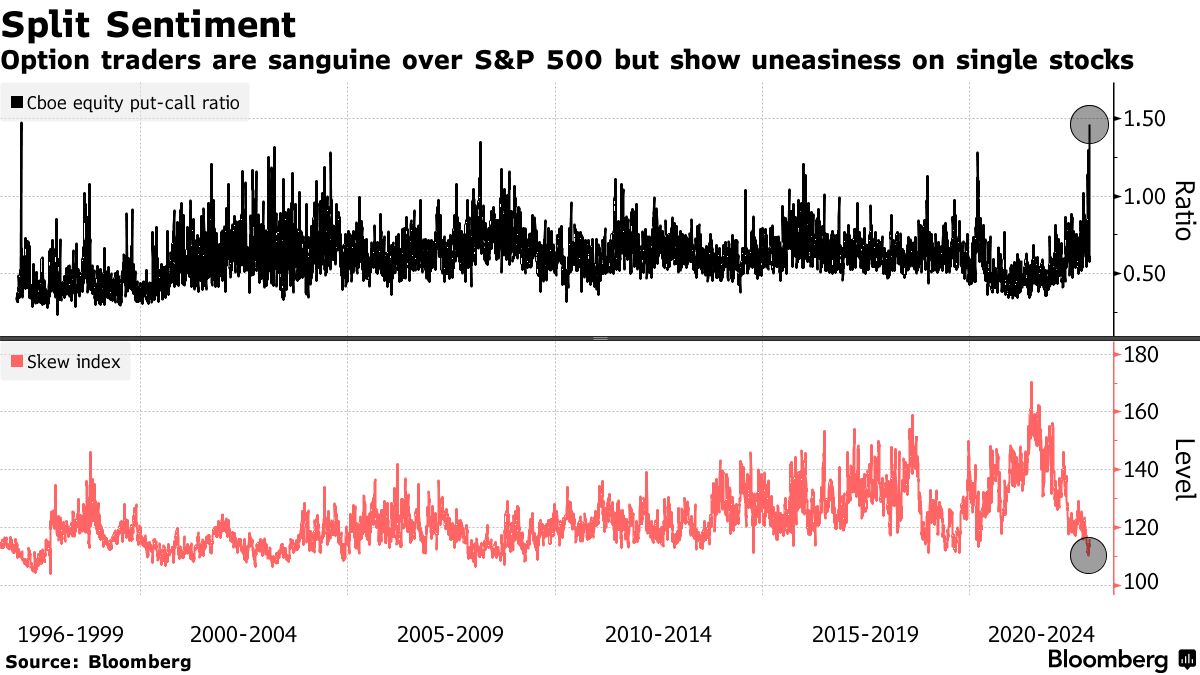

- Cboe put-call ratio for single stocks reaches a 25-year high

Twice this week, the S&P 500 has briefly surpassed 4,000 -- a battleground threshold for traders that has garnering the highest open interest among contracts set to roll out on Friday. The benchmark gauge has fallen in three of the past four sessions, after jumping more than 5% last Thursday on promising inflation data that sparked a wave of short covering and call buying. The index fell 0.3% to close at 3,947 Thursday.

Amateurs and professionals have been flocking to short-dated contracts to cope with the market whiplash of late, an activity that has exerted outsize impact on the underlying equities. That suggests Friday’s options runoff may expose stocks to further price swings.

Not everyone buys into the idea that derivatives wield this kind of power. But to some market watchers, it’s no coincidence that the OpEx week has seen stocks falling in eight out of the last 10 months.

“Option prices and tails have dropped sharply and present a good opportunity” to add protective hedges, said RBC Capital Markets’ strategist Amy Wu Silverman, citing the possibility that entrenched inflation renews pressure on equities.

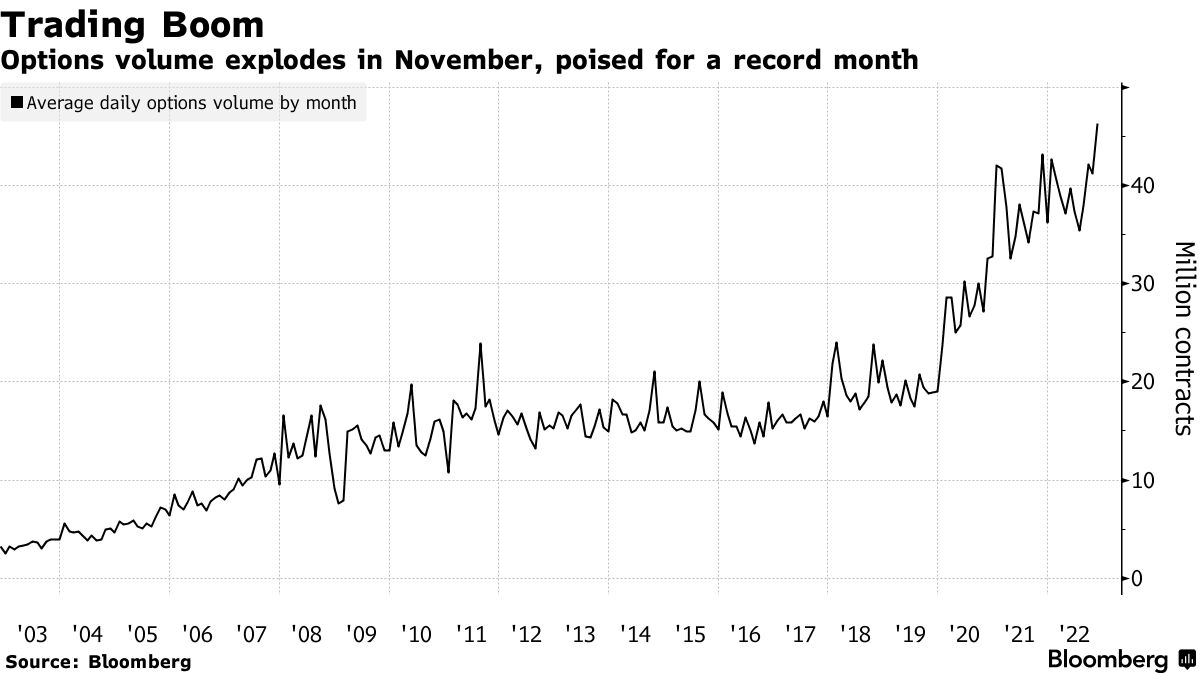

Federal Reserve-induced market gyrations are encouraging investors to go all-in on options to place bullish and bearish bets alike. About 46 million options contracts have changed hands each day in November, poised for the busiest month on record, data compiled by Bloomberg show. That’s up 12% from last month.

The boom was in part driven by derivatives maturing within 24 hours. Such contracts made up a whopping 44% of S&P 500 options trading in the past month, according to an estimate by Goldman Sachs Group Inc. strategists including Rocky Fishman.

Source: Goldman Sachs

At the same time hedging activity in single stocks just exploded. The Cboe equity put-call ratio on Wednesday soared to the highest level since 1997. From earnings blowups at tech giants to the uncertain path of the Federal Reserve’s monetary policy, volatility has been the only certainty in the market.

Still, nothing is ever simple in this corner of Wall Street given mixed signals on investor positioning to glean sentiment. For example, judging by the S&P 500’s skew -- the relative cost of puts versus calls that has hovered near multiyear lows -- traders appear more sanguine.

And thanks to the short shelf-life of options that are currently in demand, open interest in S&P 500 contracts has increased at a much slower pace, rising only 4% from the day before the last OpEx. Though with 20 million contracts outstanding, the open interest was the highest since March 2020.

“We did see a lot of recent interest by call buyers and short-covering,” said Steve Sosnick, chief strategist at Interactive Brokers LLC. “One can argue that leaves us a bit more exposed to a down move, but the mood generally remains hopeful. That’s why Fed governors feel the need to continually remind us of their resolve to fight inflation.”

While it’s not easy to get a clear picture about investor positioning in options, dislocations create opportunities for traders.

Easing interest rate volatility will help the equity market stay contained, according to Goldman’s Fishman. He recommends buying puts on Cboe Volatility Index, or VIX, to bet on potential calm into the yearend. The Cboe VVIX Index, a measure of the cost of VIX options, sat below its 20th percentile of a range in the last decade, an indication of attractive pricing, per Fishman.

“Low skew and vol-of-vol point to diminished concern about tail risk,” he wrote in a note."

Bearish bets are building in the stock market

The market is actually up this month, but bearish bets are building fast.

The big picture: A measure of sentiment from the options markets shows that bets on falling stock prices have sharply outpaced those expecting prices to rise.

- This measure, known as the CBOE U.S. equity put/call ratio, has hit the highest — or most bearish — level on record in recent days.

How it works: The measure is a ratio of bets on falling prices, or "puts," versus bets on rising prices, known as "calls."

- During the zaniest days of the meme stock boom in January 2021, the put/call ratio fell to some of the lowest levels on record.

- That reflected near-manic levels of optimism, especially among retail investors, who were dominating the market.

- Now, the put/call ratio is telegraphing incredibly depressed expectations for the stock market.

Yes, but: That might sound like a reason to run away from stocks. But oddly, market analysts usually see extreme levels of bearishness in investor sentiment as good news for stocks.

- The put/call ratio is often used as a so-called contrarian indicator.

- That means when it hits extreme levels of either glee or gloom, stocks tend to then go in the opposite direction — as all the negative or positive sentiment is already priced into the market.

What we're watching: As fun as it is to read the tea leaves of market sentiment, the only thing that seems to matter for stocks right now is what the Fed does with interest rates.

Three seasonal effects in the stock market begin around Thanksgiving, and this year it's time to buy this asset class

MarketWatch Options Trader

Small-cap stocks tend to outperform large-cap stocks over a six-week period

The stock market started what appeared to be another leg up in the past week, as the benchmark S&P 500 broke out over resistance at 3900 points.

In fact, the index rose to 4020 but then ran into trouble. There is support at 3900, but if that level is violated, the recent jump would be, in reality, a false breakout. So there is a struggle between the bulls and bears for control, right at current levels.

.jpg)

.jpg)

.jpg)

.png)

No comments:

Post a Comment