"Black

Holes for Capital Gains" refers to a tax strategy involving ETFs where

investors use appreciated assets to seed an ETF, which then employs a

specific loophole to avoid realizing taxable capital gains on those

assets

. This strategy leverages the unique structure of ETFs and their in-kind creation and redemption mechanisms. Here's how it generally works

- Seeding the ETF: Investors contribute appreciated assets (stocks, bonds, etc.) to a newly formed ETF, often without triggering an immediate capital gains tax event due to a rule known as Section 351 of the tax code.

- In-Kind Redemptions and Rebalancing: ETFs have a unique feature where they can redeem shares "in-kind", meaning they exchange ETF shares for the underlying securities, rather than selling the securities for cash. When an ETF receives a redemption request, particularly from large institutional investors known as Authorized Participants (APs), it can strategically distribute appreciated securities, avoiding the need to sell them and realize a taxable gain. This allows the ETF to rebalance its portfolio, for example, by removing a highly appreciated asset like Nvidia and replacing it with another asset like Apple, without triggering a capital gains tax event for the investor who contributed the initial assets.

- Tax Deferral: This process effectively defers the capital gains tax liability for investors until they eventually sell their ETF shares.

Why it's gaining attention

- Significant Tax Savings: This loophole can result in substantial tax savings, especially for wealthy investors with highly appreciated assets.

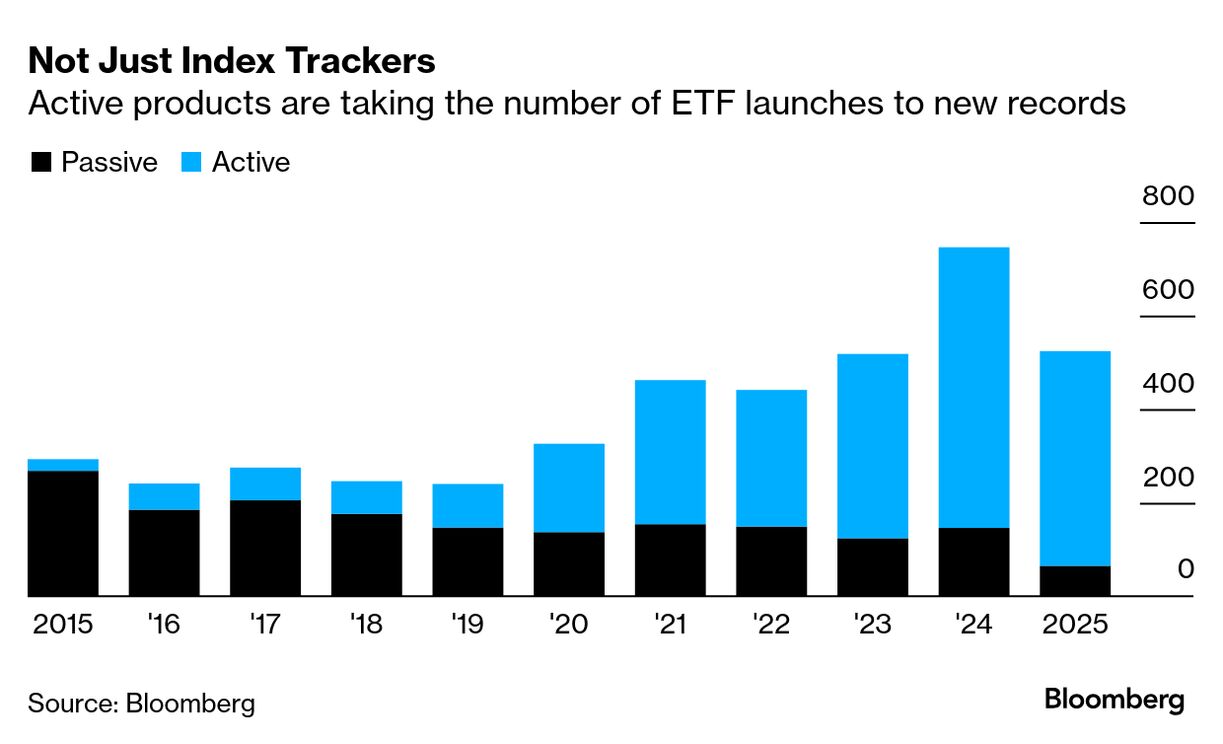

- Increased Use of ETFs: ETFs are becoming increasingly popular for their tax efficiency, leading to a migration of capital from mutual funds to ETFs.

- Potential Policy Changes: The use of this loophole has drawn scrutiny from policymakers, with some proposing legislation to address it

=

No comments:

Post a Comment