CoinGeek · CoinGeek · 17 hours agointech

China’s central bank digital currency takes a bigger place on WeChat’s platform

For the last few years, China’s central bank has been trying to ramp up the adoption of digital yuan, or e-CNY, which forms part of the country’s monetary base, M0. The bank has a designated app for e-CNY that crossed 261 million individual users in early 2022, but it’s also enlisting help from the private sector to take its official digital money to a broader user base.

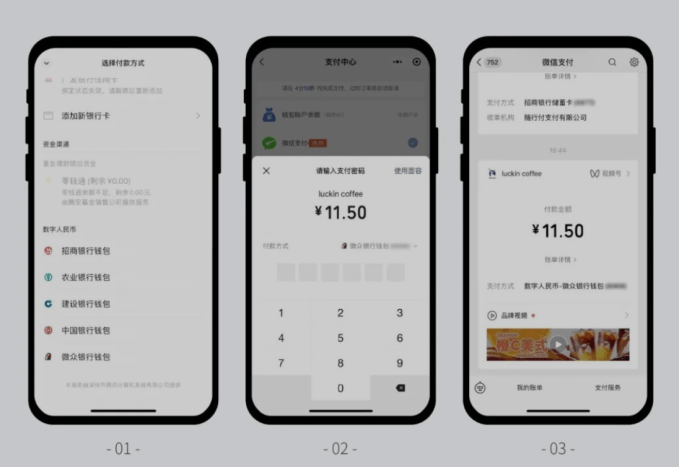

China’s biggest messager WeChat said Wednesday that it’s extended the use of e-CNY payments to transactions happening through its short video and mini-app platforms, which together cover merchants from small influencers to brands touting products on WeChat.

For those unfamiliar with WeChat, the Tencent-owned messenger is a sprawling empire that far exceeds what WhatsApp or Messenger can do. It comes with its own payments system, WeChat Pay; supports millions of third-party lite apps, making it a rival to the App Store; has a short video network that competes with Douyin, TikTok’s Chinese version, for eyeball time; and a host of other features that can easily be standalone apps — but Asia loves super apps.

In 2022, WeChat mini apps generated several trillion RMB ($1 = RMB6.9) of transaction value, according to Tencent. Clearly, that sea of microtransactions are potential targets of the digital yuan.

Today’s update is an expansion of the e-CNY payments option that WeChat already supports since early last year. Only merchants that accept e-CNY will be taking payments in the central bank digital currency, according to WeChat’s announcement.

Image: WeChat

While the central bank has set up a network of e-CNY payment gateways at online and offline retailers across China, WeChat Pay and its rival Alipay, Alibaba’s affiliated payments method, are still by far the most ubiquitous digital payment methods.

The central bank regulator made it clear that digital yuan isn’t meant to compete with the two payments giants. Rather, it’s supposed to play a complementary role. As we reported previously:

For instance, it could support anonymity for small-value transactions just like physical cash. In other cases, large amounts of funds sent from a provincial government to a town could be paid in e-CNY to prevent corruption using the digital currency’s traceable capabilities. .."

READ MORE

BEIJING (Reuters) -E-commerce and tech giant Alibaba's cloud computing division will cut prices for its products and services by up to 50% starting Wednesday, stepping up efforts to fight for a bigger slice of China's cloud market amid rising competition.

According to Alibaba Cloud's website, prices for elastic computing services - the ability to quickly expand or decrease processing - using Arm and Intel-based chips will drop by 15% to 20%, while services using Nvidia's V100 and T4 graphics processing units will drop between 41% to 47%.

The price cuts are one way for the company to attract more customers, said Zhang Yi, who tracks China's cloud computing sector at research firm Canalys, though their actual impact will depend on the specific services clients buy.

Alibaba Cloud was one of China's earliest domestic entrants into cloud computing, and currently supplies more than one-third of the sector in China.

However, in recent years the company has faced intensifying competition from Chinese carriers including China Unicom and China Telecom.

In late March Alibaba Group Holding Ltd announced a six-way breakup for its business divisions that would allow Alibaba Cloud and other units to raise funding independently.

Separately, Alibaba stated on Wednesday that more than 200,000 enterprises have requested beta testing for Tongyi Qianwen, the company's AI-powered large language model.

Alibaba Cloud added that it will begin a partnership programme for Tongyi Qianwen, allowing select companies to retrain the model with their own intelligence to create industry-specific applications.

The seven companies comprising the program's initial stage include subdivisions of China National Petroleum Corp and China International Capital Corp.

(Reporting by Josh Horwitz in Shanghai, Liz Lee in Beijing and the Beijing Newsroom; Editing by Muralikumar Anantharaman and Kenneth Maxwell)

No comments:

Post a Comment