Traders Brace for Volatility With US Debt Deal Elusive

- Dollar, Treasury futures will be closely monitored at open

- McCarthy says he plans to meet with Biden on Monday afternoon

Investors are girding for spikes in currency volatility and losses in equities as the US struggles to clinch a debt-limit deal.

House Speaker Kevin McCarthy said he and President Joe Biden will meet Monday afternoon, and negotiators will resume debt talks later Sunday. The Republican leader said he and Biden, who’s returning from the G-7 summit in Japan, had a “productive” call. “Time is of the essence,” McCarthy added. Treasury Secretary Janet Yellen said on NBC’s Meet the Press that the US is unlikely to reach mid-June and still be able to pay its bills.

Currency trading begins at 5 a.m. Sydney, while futures contracts for Treasuries and US stocks start three hours later.

The debt-ceiling debate has become an unwelcome sideshow for investors already dealing with the uncertainty surrounding the Federal Reserve’s next policy decision in June. Strategists at JPMorgan Chase & Co. and Morgan Stanley have warned that an impasse threatens the outlook for equity markets, while traders have also piled into swaps and options for major currencies to hedge their portfolios. European Central Bank President Christine Lagarde appealed to US politicians to resolve the standoff in a TV interview aired Sunday.

“Despite encouraging headlines, history suggests lawmakers will take things down to the wire, which will add to market volatility,” said Carol Kong, strategist at Commonwealth Bank of Australia in Sydney. “If, and once, an agreement is reached, focus will quickly shift back to economic data and the FOMC, which I think will lead to further modest dollar gains.”

The back-and-forth between lawmakers has Wall Street preparing for the worst, with executives in trading, corporate and consumer banking in the nation’s three biggest lenders trying to predict how the government’s failure to pay bills would cascade through markets. Some are looking back to 2011, when a similar episode led to massive price swings across asset classes.

Still, investors may be underprepared. Some 71% of respondents to a recent Bank of America survey expect a resolution before the so-called X-date, the point at which the government exhausts options to fund itself, though without necessarily entering a default.

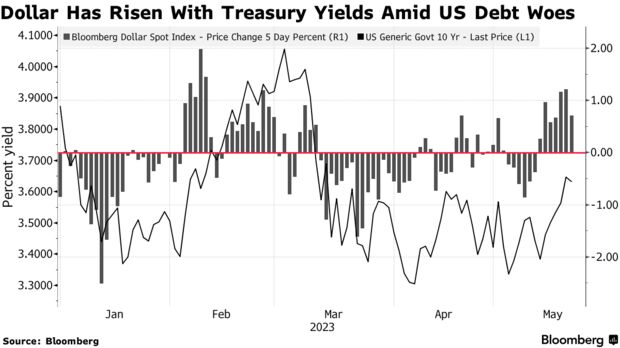

The S&P 500 Index rose last week on hopes that a resolution is close. A gauge of the dollar’s strength touched a two-month high, boosted by haven demand and stronger expectations for Fed hikes.

Yen, Stocks Bets

In addition to US assets, the yen, commodity currencies and emerging-market equities that are sensitive to swings in risk sentiment will also come under close scrutiny.

Goldman Sachs Group Inc. says the looming US debt ceiling is a “plausible catalyst” for hits to economic growth and stock markets.

“The EM template is fairly straightforward: large export markets, such as Korea, Mexico, and Taiwan, tend to underperform the most,” strategists including Caesar Maasry wrote in a note.

Investors are girding for spikes in currency volatility and losses in equities as the US struggles to clinch a debt-limit deal.

House Speaker Kevin McCarthy said he and President Joe Biden will meet Monday afternoon, and negotiators will resume debt talks later Sunday. The Republican leader said he and Biden, who’s returning from the G-7 summit in Japan, had a “productive” call. “Time is of the essence,” McCarthy added. Treasury Secretary Janet Yellen said on NBC’s Meet the Press that the US is unlikely to reach mid-June and still be able to pay its bills.

Currency trading begins at 5 a.m. Sydney, while futures contracts for Treasuries and US stocks start three hours later.

The debt-ceiling debate has become an unwelcome sideshow for investors already dealing with the uncertainty surrounding the Federal Reserve’s next policy decision in June. Strategists at JPMorgan Chase & Co. and Morgan Stanley have warned that an impasse threatens the outlook for equity markets, while traders have also piled into swaps and options for major currencies to hedge their portfolios. European Central Bank President Christine Lagarde appealed to US politicians to resolve the standoff in a TV interview aired Sunday.

“Despite encouraging headlines, history suggests lawmakers will take things down to the wire, which will add to market volatility,” said Carol Kong, strategist at Commonwealth Bank of Australia in Sydney. “If, and once, an agreement is reached, focus will quickly shift back to economic data and the FOMC, which I think will lead to further modest dollar gains.”

The back-and-forth between lawmakers has Wall Street preparing for the worst, with executives in trading, corporate and consumer banking in the nation’s three biggest lenders trying to predict how the government’s failure to pay bills would cascade through markets. Some are looking back to 2011, when a similar episode led to massive price swings across asset classes.

Still, investors may be underprepared. Some 71% of respondents to a recent Bank of America survey expect a resolution before the so-called X-date, the point at which the government exhausts options to fund itself, though without necessarily entering a default.

The S&P 500 Index rose last week on hopes that a resolution is close. A gauge of the dollar’s strength touched a two-month high, boosted by haven demand and stronger expectations for Fed hikes.

Yen, Stocks Bets

In addition to US assets, the yen, commodity currencies and emerging-market equities that are sensitive to swings in risk sentiment will also come under close scrutiny.

Goldman Sachs Group Inc. says the looming US debt ceiling is a “plausible catalyst” for hits to economic growth and stock markets.

“The EM template is fairly straightforward: large export markets, such as Korea, Mexico, and Taiwan, tend to underperform the most,” strategists including Caesar Maasry wrote in a note.

No comments:

Post a Comment