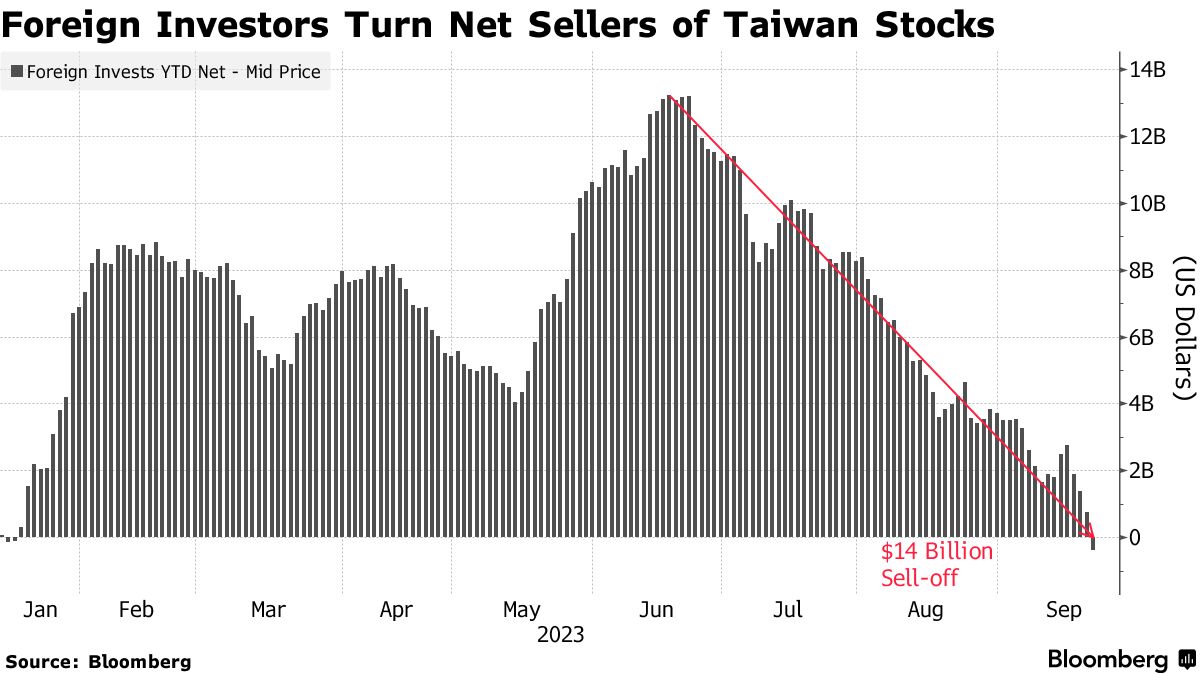

Overall, the tide has turned for foreign investors in Taiwan’s stock market, as the AI frenzy subsides. While this retreat presents challenges for the country’s financial stability, it also calls for a moment of caution for investors in the AI sector.

- FOREIGN investors are rapidly retreating from Taiwan’s stock market, turning net sellers for the year as an artificial intelligence (AI) frenzy cools.

- Overseas funds have sold near US$14 billion of Taiwanese equities on a net basis since mid-June, offsetting all inflows made earlier this year, according to data compiled by Bloomberg News.

Malaysia and Thailand are among those in Asia also experiencing outflows, while India continues to attract funds.

- The withdrawals came as this year’s stock rally, powered by AI optimism, lost momentum.

- Chipmaker Taiwan Semiconductor Manufacturing has fallen more than 11 per cent since a June high.

- Wall Street banks including Morgan Stanley have called for caution over the island’s AI stocks amid stretched valuation.

The sell-off has weighed on the Taiwanese dollar, which has depreciated more than 3 per cent this quarter, the worst performance in Asia for the current quarter.

Taiwan’s central bank said on Thursday (Sep 21) that the local currency has been under heavy pressure amid foreign outflows and withdrawal of dividends since early August. ------BLOOMBERG

Cooling AI boom drives US$14 billion outflow from Taiwan stocks

___________________________________________________________________________________

Most Read from Bloomberg Businessweek

__

No comments:

Post a Comment