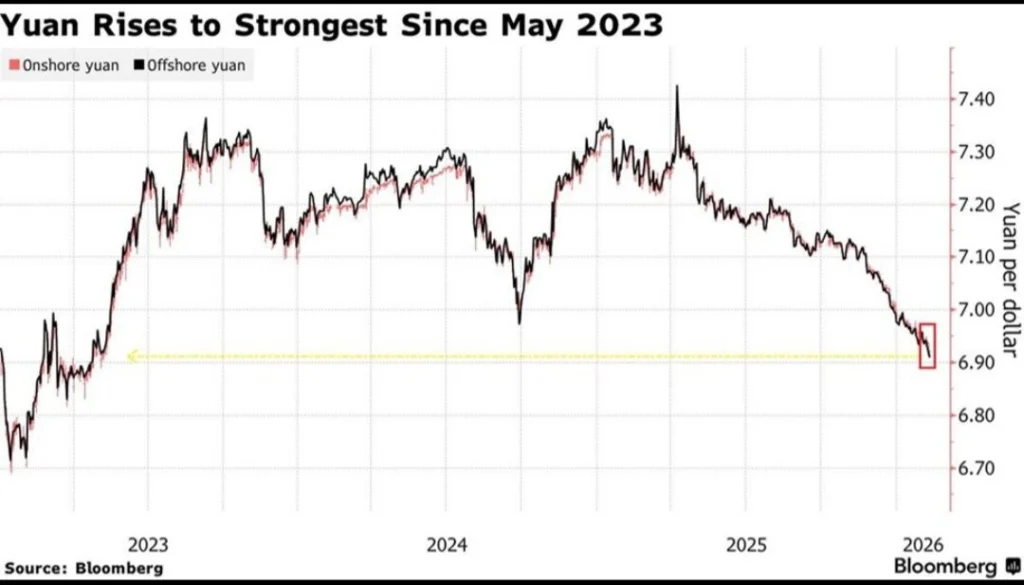

China lets yuan rise to strongest level in years as de-dollarization trend grows

China’s central bank sets the yuan’s midpoint rate at its strongest level since mid-2023, as jitters over the US dollar buoy the Chinese currency

Reading Time:2 minutes

Why you can trust SCMP

5

Listen

China’s central bank set the yuan’s daily fixing rate at its strongest level since mid-2023 on Wednesday, as the Chinese currency extended gains with investors increasingly rotating out of US dollar assets amid concerns over the Federal Reserve’s independence and U.S. debt sustainability.

- The People’s Bank of China set the yuan’s midpoint rate – also known as the daily fixing rate – at 6.9438 to the US dollar, which marked the strongest level in 33 months.

- The move followed months of steady appreciation in the yuan, with its offshore rate trading at 6.909 per US dollar as of early afternoon on Wednesday.

By contrast, the US dollar has remained under sustained pressure in recent months, with investor confidence sapped by persistent concerns over the Donald Trump administration’s policy volatility and interventions in the Federal Reserve, as well as the United States’ long-term fiscal sustainability.

Billionaire investor Ray Dalio, founder of the hedge fund Bridgewater Associates, has warned that the US is in stage five – or the “pre-breakdown phase” – of his six-stage “big cycle” that aims to chart the rise and fall of national and global orders.

- “We are sort of at the brink but not over the brink,” he said in an interview with Tucker Carlson released on Tuesday.

- “It’s before a period of great disorder when there can be a monetary breaking down of the system.”

This round of yuan appreciation is unlike any previous episode

As de-dollarisation gathers pace, investors are increasingly turning to alternatives such as gold and emerging markets, including China, in a bid to diversify away from US dollar assets.

- Europe’s largest asset manager, Amundi, is one of the institutional investors joining this trend.

- Last week, CEO Valerie Baudson said the firm would reduce its exposure to US dollar assets in the coming year and turn instead to European and emerging markets, the Financial Times reported.

- With Donald Trump having picked Kevin Warsh as his nominee to succeed the Federal Reserve chair, concerns over presidential interference in the central bank’s independence have remained firmly in global investors’ sights.

- At a hearing last week, US Treasury Secretary Scott Bessent said the central bank’s autonomy rested on public trust – trust he argued it had lost when it allowed inflation to soar to its highest level in decades from mid-2021.

RELATED

In

this video, we will understand the concept of De-dollarization. And why

many countries want to move away from doing international trade in

dollars. What are the reasons behind reducing dependency ...

No comments:

Post a Comment