___________________________________________________________________________________

- “It sounds like something had been readied in response to the recent equity rout,” said Mr Neo Wang, managing director for China research at Evercore ISI in New York.

- “The market was poor enough to warrant such elevated attention – China cannot afford to see A-shares sinking towards the Lunar New Year holidays,” he said, referring to domestically listed Chinese stocks and the upcoming mid-February break.

More than US$6 trillion has been wiped out from the market value of Chinese and Hong Kong stocks since a peak reached in 2021, underscoring the challenge that Beijing faces as it seeks to arrest a decline in investor confidence.

China weighs stock market rescue package backed by $378.2 billion

SHANGHAI – The Chinese authorities are considering a package of measures to stabilise the slumping stock market, according to people familiar with the matter, after earlier attempts to restore investor confidence fell short and prompted Premier Li Qiang to call for “forceful” steps.

Policymakers are seeking to mobilise about 2 trillion yuan (S$378.2 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilisation fund to buy shares onshore through the Hong Kong exchange link, said the people.

They have also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp or Central Huijin Investment, the people said.

Officials are weighing other options and may announce some of them as soon as this week if approved by the top leadership, the people said. The plans are still subject to change. The China Securities Regulatory Commission did not respond to a request for comment.

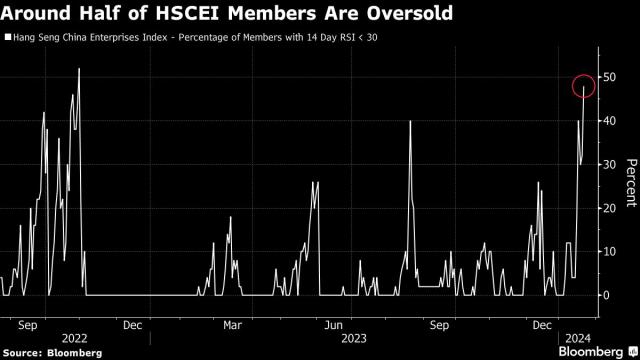

The deliberations underscore the elevated level of urgency among the Chinese authorities to stem a sell-off that sent the benchmark CSI 300 Index to a five-year low this week. Calming the nation’s retail investors, many of whom have been bruised by the protracted property downturn, is also seen as key to maintaining social stability.

Whether such measures will be enough to end the rout is far from certain. The property crisis, depressed consumer sentiment, tumbling foreign investment and diminished confidence among local businesses after years of volatile policymaking are exerting strong downward pressure on both the economy and financial markets.

Past efforts to shore up the stock market, most notably in 2015, proved insufficient at best and at times counterproductive. The authorities have also been reluctant to roll out major economic stimulus of the sort that many equity investors have called for. . .

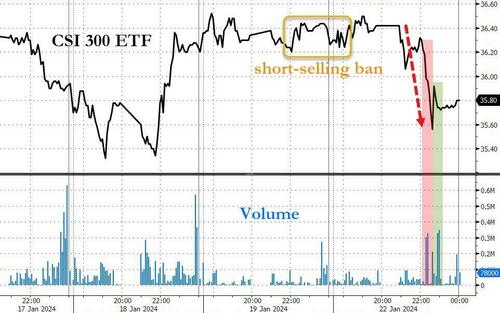

- China’s stock meltdown is adding pressure on so-called “snowball” derivatives, which are structured products that promise bond-like coupons as long as the underlying assets trade within a certain range.

- The CSI Smallcap 500 Index, a pricing reference for some of these products, slipped 4.7 per cent on Jan 22, taking it below an earlier estimated threshold that may trigger widespread losses on the snowballs.

Top stories News about stock market, China

___________________________________________________________________________________

.jpg)

No comments:

Post a Comment