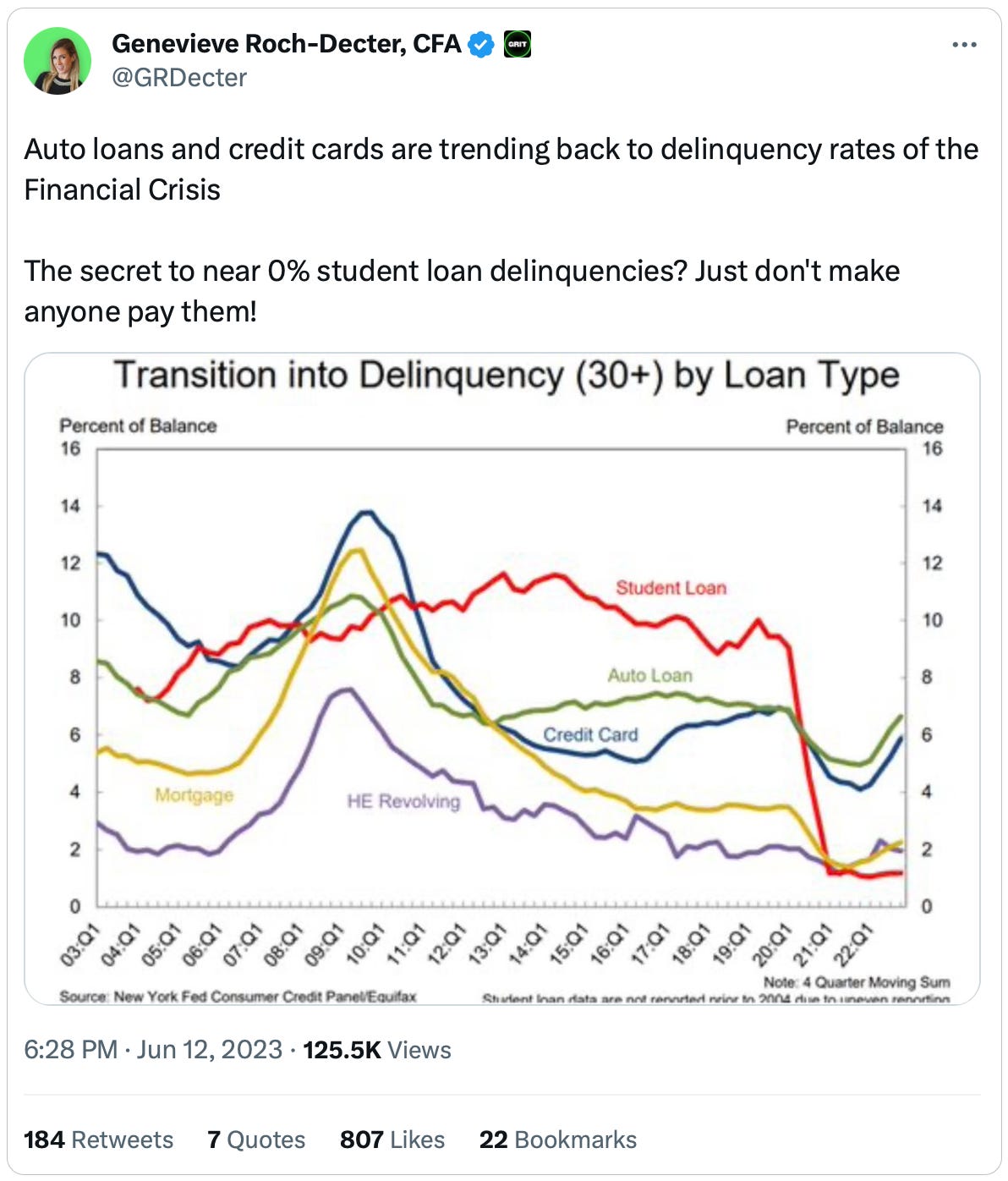

More than 80% of the latest debt build up had come from the developed world with the U.S., Japan, Britain and France registering the largest increases.

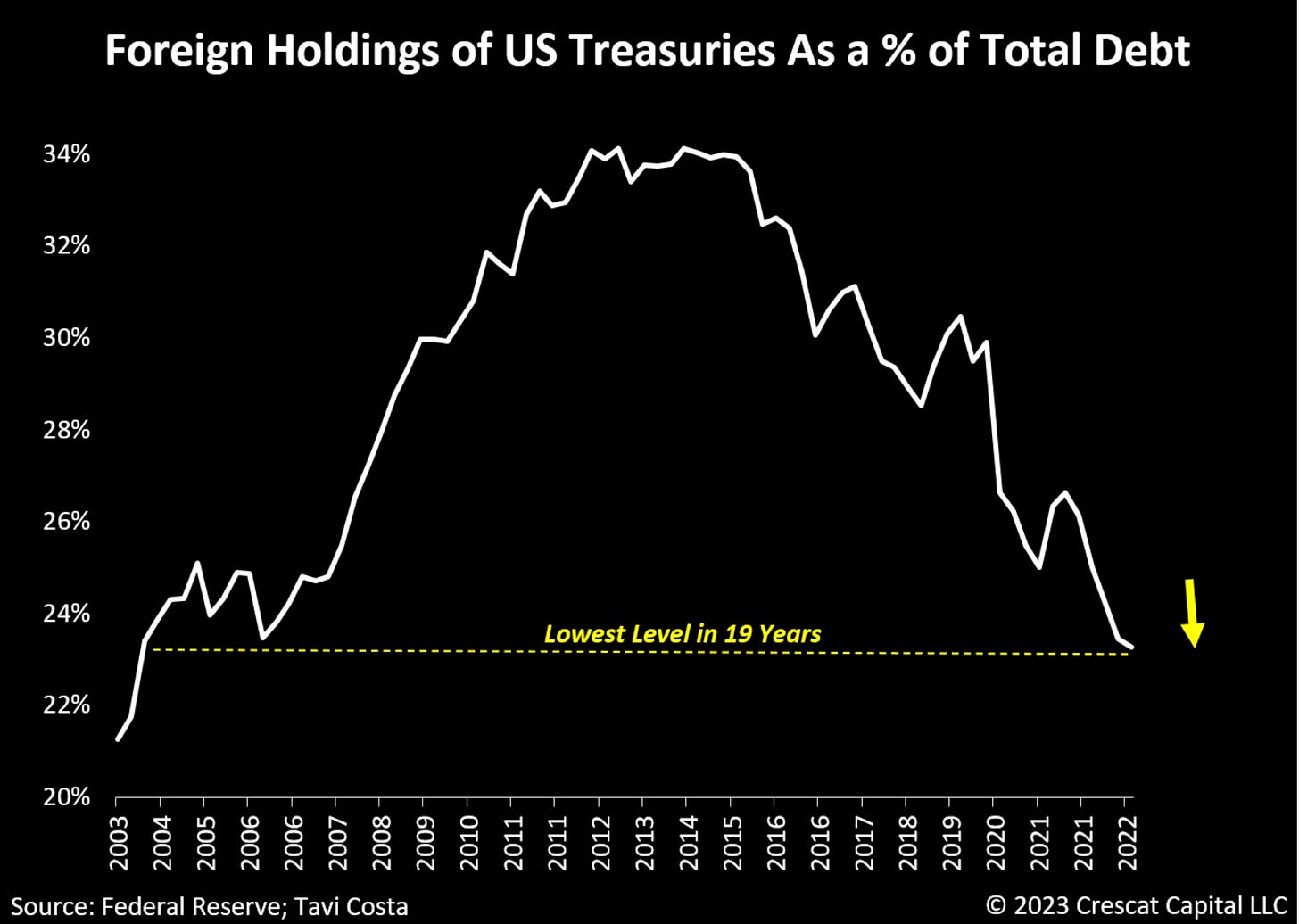

Usually, when there is geopolitical strife, money gushes into ultra-safe U.S. Treasury bonds, pushing interest rates downward. But since the Hamas attack on Israel three weeks ago, the opposite has happened.

Why it matters: Soaring rates, even in this moment of conflict, is a sign that bond markets are now being driven in significant part by the outlook for future U.S. government borrowing.

Global debt hits record $307 trillion, debt ratios climb -IIF

The world's richest economy is piling on more debt, with no end in sight as the stakes get higher.

Why it matters: The U.S. public debt surged during the pandemic and recently passed $34 trillion — a record even when accounting for inflation, according to recent data.

Go deeper (1 min. read)___________________________________________________________________________________

![OC] The U.S. National debt just crossed $33 Trillion for the first time : r/dataisbeautiful](https://preview.redd.it/the-u-s-national-debt-just-crossed-33-trillion-for-the-v0-hfp4y3s89npb1.png?auto=webp&s=2d2db77e130d6407c043efcdc901911b983ecd20)

/graphics.reuters.com/USA-ECONOMY/SENTIMENT-POLITICS/gkvlgqjzxpb/index.html_2.jpg)

No comments:

Post a Comment