". . .Citing people who asked not to be identified, Bloomberg reported that policymakers are trying to marshal about two trillion yuan ($278 billion) primarily from Chinese state-owned enterprises’ offshore accounts to buy onshore stocks. They are also aiming to raise at least 300 billion yuan of local funds to invest through state-owned China Securities Finance Corp. or Central Hujiin, a unit of China’s sovereign fund. The Hang Seng Index broke a two-day losing streak to close up 2.6% to 15,353.98 on Tuesday as shares of companies like Alibaba, Tencent, and others soared. The iShares MSCI China exchange-traded fund rose 3.6% in early trading to $37.38, marking a reprieve from the slide it has taken so far this year. Chinese officials have intervened in the past, often indirectly, during market routs. And Chinese stocks have been under renewed pressure, with the MSCI down almost 12% just this year, a contrast to gains in the U.S. and elsewhere. The MSCI is approaching levels it hit in October 2022, before China eased the severe restrictions that devastated the economy during the pandemic, and closing in on lows hit during a global stock rout in October 2011. Investors have been disappointed that so far at least, Beijing has chosen not to step up stimulus measures even in response to disappointing economic data for December. Behind the losses, and that downbeat economic news, are a crisis in the property market that shows little sign of stabilizing, flagging confidence among householders, investors, and businesses, plus Beijing’s underwhelming response to all that. . ."

READ MORE

RELATED CONTENT TODAY ON THIS BLOG

$378.2B China Rescue Package...SNOWBALL DERIVATIVES

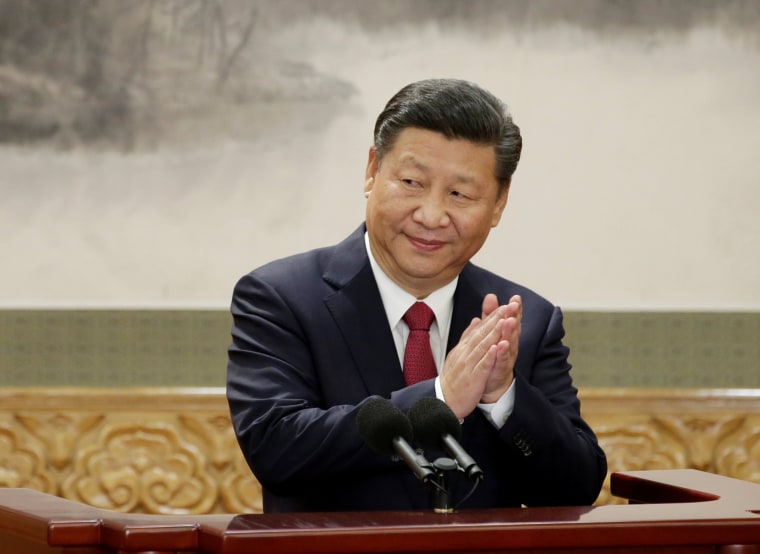

Confidence in China’s markets has been hurt over the past years by President Xi Jinping’s growing control over private enterprise, which has included a crackdown on the country’s tech giants.

International banks who were planning a massive expansion in the country are now tempering their ambitions to build platforms in the world’s second-largest economy.

.jpg)

No comments:

Post a Comment